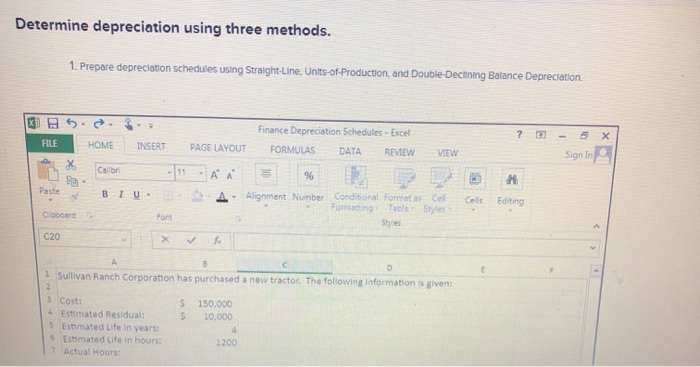

Question: Determine depreciation using three methods. 1. Prepare depreciation schedules using Straight-Line, Units-of-Production, and Double Declining Balance Depreciation ? X - Sign In FILE HOME INSERT

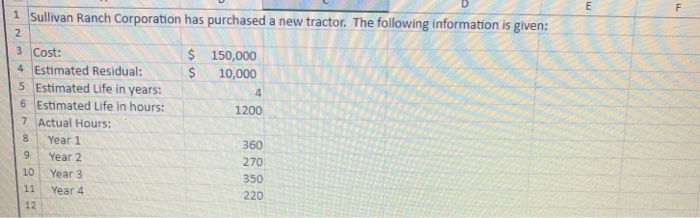

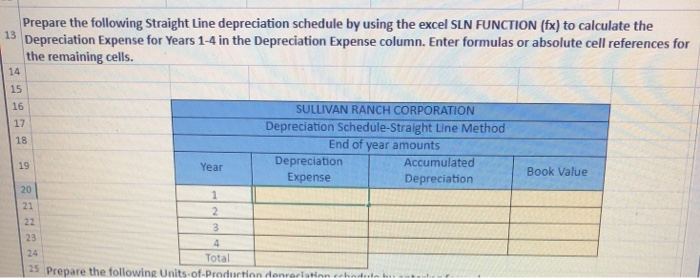

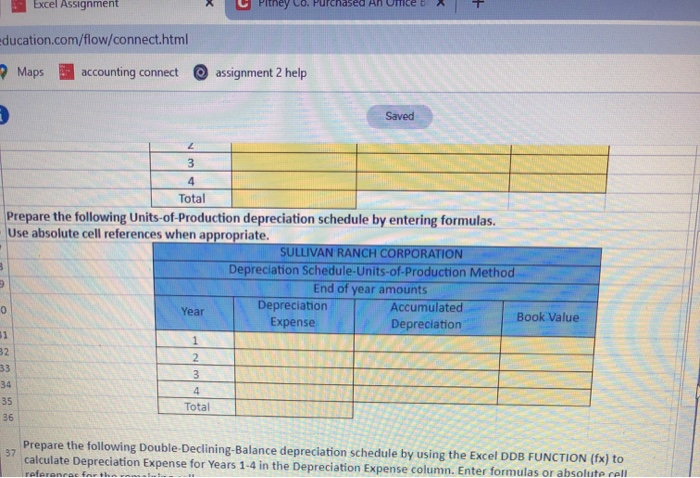

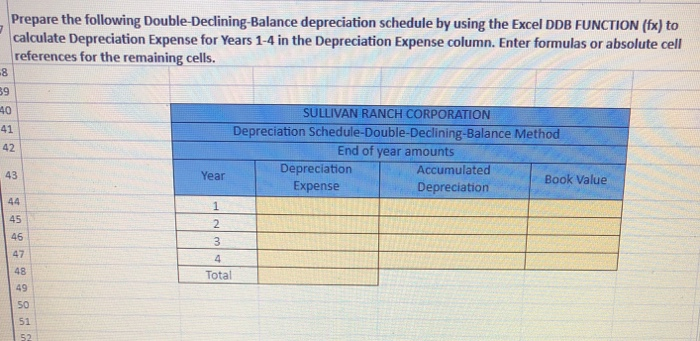

Determine depreciation using three methods. 1. Prepare depreciation schedules using Straight-Line, Units-of-Production, and Double Declining Balance Depreciation ? X - Sign In FILE HOME INSERT Finance Depreciation Schedules - Excel FORMULAS DATA REVIEW PAGE LAYOUT VIEW Paste BIU. S A Alignment Number Conditional Format cel Cell Eating board Styes C20 1 Sullivan Ranch Corporation has purchased a new tractor. The following information is given $ $ 150.000 10,000 3 Cost: 4 Estimated Residual: Estimated Life in years: 5 Estimated ufe in hours: 17 Actual Hours: 1200 1 Sullivan Ranch Corporation has purchased a new tractor. The following information is given: $ $ 150,000 10,000 1200 3 Cost: 4 Estimated Residual: 5 Estimated Life in years: 6 Estimated Life in hours: 7 Actual Hours: 8 Year 1 9 Year 2 10 Year 3 11 Year 4 12 Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION (fx) to calculate the 15 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. SULLIVAN RANCH CORPORATION Depreciation Schedule-Straight Line Method End of year amounts Depreciation Accumulated Expense Depreciation Year Book Value Total 25 Prepare the following units of Production de relation te Excel Assignment they co rurchased An United A/ T ducation.com/flow/connect.html Maps accounting connect assignment 2 help Saved 3 Total Prepare the following Units-of-Production depreciation schedule by entering formulas. Use absolute cell references when appropriate. SULLIVAN RANCH CORPORATION Depreciation Schedule-Units-of-Production Method End of year amounts Year Depreciation Accumulated Expense Book Value Depreciation 4 Total Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (fx) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute call Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (Ex) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. SULLIVAN RANCH CORPORATION Depreciation Schedule-Double-Declining-Balance Method End of year amounts Depreciation Accumulated Book Value Expense Depreciation Year Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts