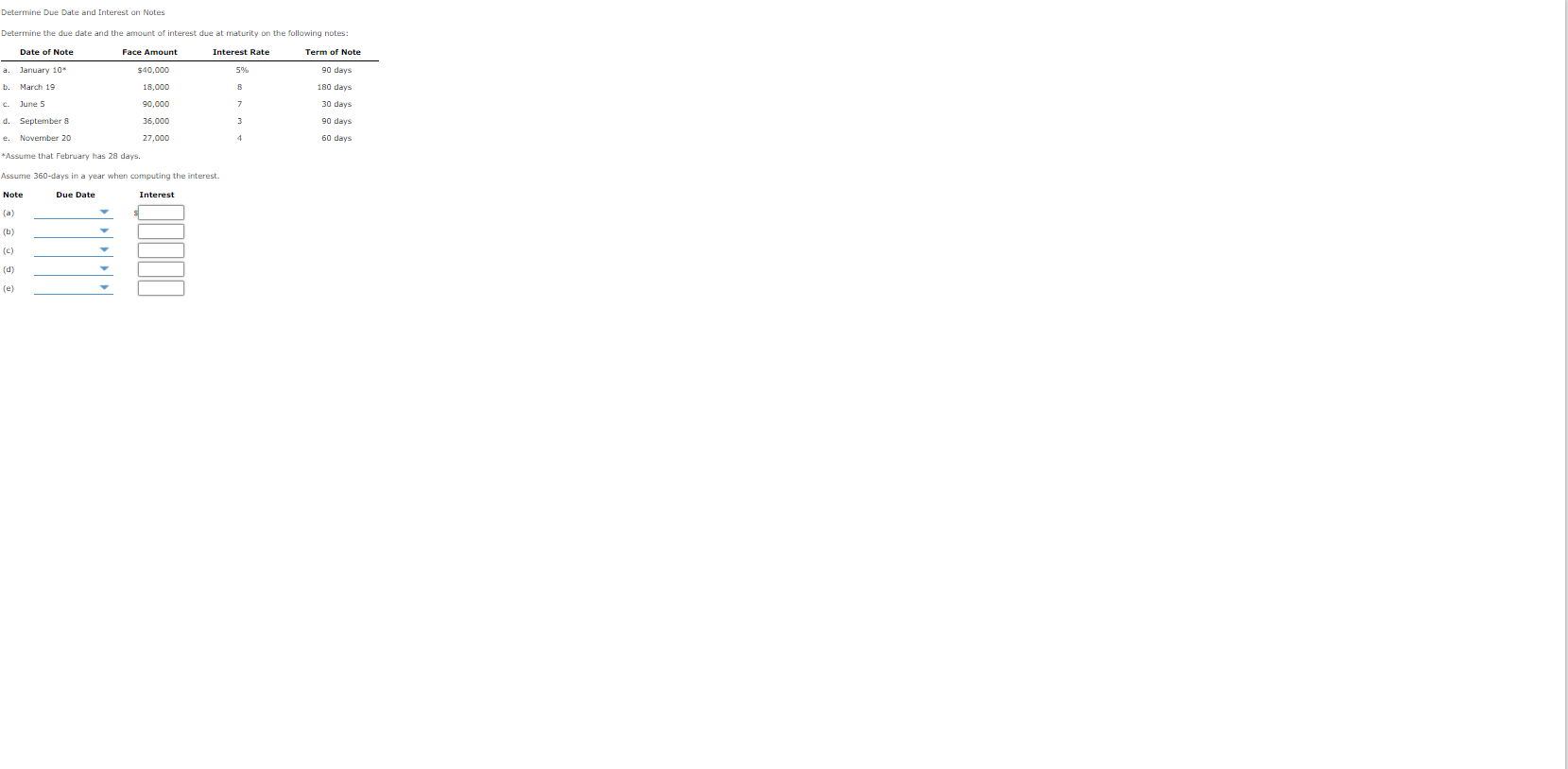

Question: Determine Due Date and Interest on Notes Determine the due date and the amount of interest due at maturity on the following notes: Date of

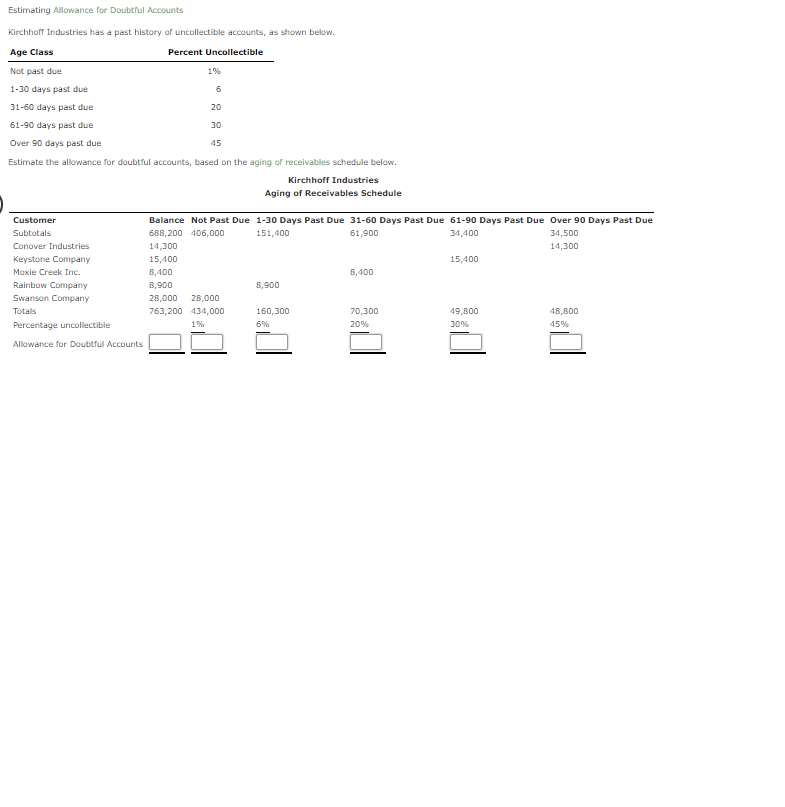

Determine Due Date and Interest on Notes Determine the due date and the amount of interest due at maturity on the following notes: Date of Note Face Amount Interest Rate Term Note a. January 10 $40,000 59 90 days b. March 19 18,000 B 90,000 June 5 d. September 8 e. November 20 180 days 30 days 90 days 60 days 36.000 27,000 4 *Assume that February has 28 days. Assume 360 days in a year when computing the interest. Note Due Date Interest (c) TUTTI (d) Estimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible accounts, as shown below. Age Class Percent Uncollectible 1% Not past due 1-30 days past due 6 20 31-60 days past due 61-90 days past due Over 90 days past due 30 45 Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below. Kirchhoff Industries Aging of Receivables Schedule Customer Subtotals Conover Industries Keystone Company Moxie Creek Inc. Rainbow Company Swanson Company Totals Percentage uncollectible Allowance for Doubtful Accounts Balance Not Past Due 1-30 Days Past Due 31-60 Days Past Due 61-90 Days Past Due Over 90 Days Past Due 688,200 406,000 151,400 61,900 34,400 34,500 14,300 14,300 15,400 15,400 8,400 8,400 8,900 8,900 28,000 28,000 763,200 434,000 160,300 70,300 49,800 48,800 1% 6% 20% 30% 45%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts