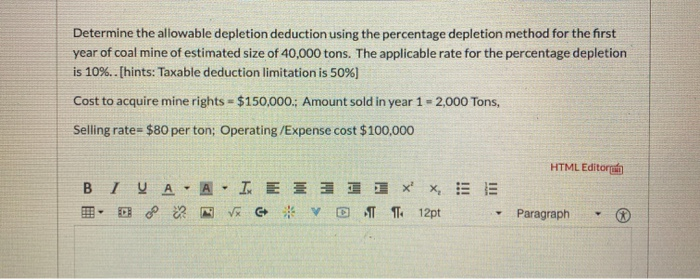

Question: Determine the allowable depletion deduction using the percentage depletion method for the first year of coal mine of estimated size of 40,000 tons. The applicable

Determine the allowable depletion deduction using the percentage depletion method for the first year of coal mine of estimated size of 40,000 tons. The applicable rate for the percentage depletion is 10%.. (hints: Taxable deduction limitation is 50%) Cost to acquire mine rights = $150,000.: Amount sold in year 1 - 2,000 Tons, Selling rate= $80 per ton; Operating/Expense cost $100,000 HTML Editoria BI V AA- IX E 3 1 1 XX, DEE SO G V T 12pt - Paragraph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts