Question: Determine the ending inventory under a perpetual inventory system using (1) FIFO, (2) moving-average cost, and (3) LIFO. I don't use excel so if you

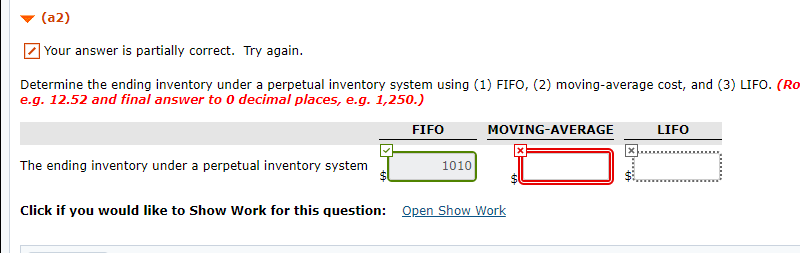

Determine the ending inventory under a perpetual inventory system using (1) FIFO, (2) moving-average cost, and (3) LIFO.

I don't use excel so if you could please show how you got the answers, that would be awesome!

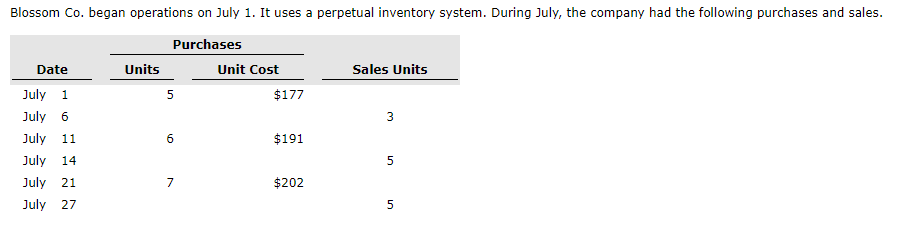

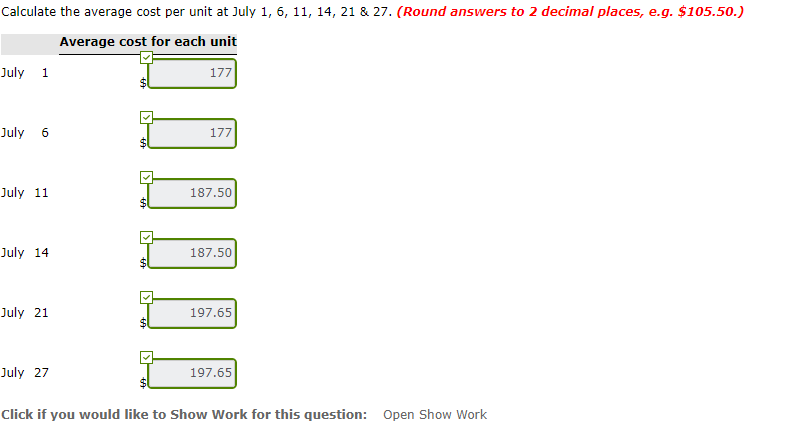

Blossom Co. began operations on July 1. It uses a perpetual inventory system. During July, the company had the following purchases and sales. Date Purchases Units Unit Cost 5 $177 Sales Units 6 $191 July 1 July 6 July 11 July 14 July 21 July 27 5 7 $202 5 Calculate the average cost per unit at July 1, 6, 11, 14, 21 & 27. (Round answers to 2 decimal places, e.g. $105.50.) Average cost for each unit July 1 177 July 6 177 July 11 187.50 July 14 187.50 July 21 197.65 July 27 197.65 Click if you would like to Show Work for this question: Open Show Work (a2) Your answer is partially correct. Try again. Determine the ending inventory under a perpetual inventory system using (1) FIFO, (2) moving average cost, and (3) LIFO. (Ro e.g. 12.52 and final answer to 0 decimal places, e.g. 1,250.) FIFO MOVING-AVERAGE LIFO The ending inventory under a perpetual inventory system 1010 Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts