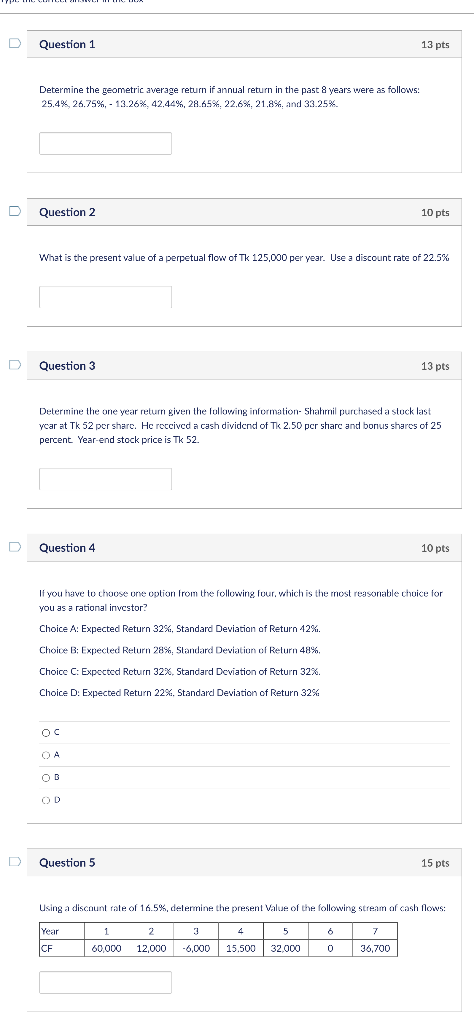

Question: Determine the geometric average return if annual return in the past 8 years were as follows: 25.4%,26.75%,13.26%,42.44%,28.65%,22.6%,21.8%, and 33.25% Question 2 10 pts What is

Determine the geometric average return if annual return in the past 8 years were as follows: 25.4%,26.75%,13.26%,42.44%,28.65%,22.6%,21.8%, and 33.25% Question 2 10 pts What is the present value of a perpetual flow of Tk 125,000 per year. Use a discount rate of 22.5% Question 3 13pts Determine the one year return given the fullowing information- Shahmil purchased a stock last year at Tk 52 per share. He reccived a cash dividend of Tk2.50 per sharc and bonus shares of 25 percent Year-end stock price is Tk52. Question 4 10 pts If you have to thoose one option Irom the following four, which is the most reasonable choice for you as a rational investor? Choice A: Expected Return 32\%, Standard Deviation of Return 42%. Choive B; Expected Return 28\%, 5tandard Deviation of Relurn 48%. Choice C: Experted Return 32%, Standard Deviation of Return 32%. Choice D: Expected Return 22\%, Standard Deviation of Return 32\% A B D Question 5 15 pts Using a discount fale of 16.5%, delermine the present Value of the following stream af cash fows: Determine the geometric average return if annual return in the past 8 years were as follows: 25.4%,26.75%,13.26%,42.44%,28.65%,22.6%,21.8%, and 33.25% Question 2 10 pts What is the present value of a perpetual flow of Tk 125,000 per year. Use a discount rate of 22.5% Question 3 13pts Determine the one year return given the fullowing information- Shahmil purchased a stock last year at Tk 52 per share. He reccived a cash dividend of Tk2.50 per sharc and bonus shares of 25 percent Year-end stock price is Tk52. Question 4 10 pts If you have to thoose one option Irom the following four, which is the most reasonable choice for you as a rational investor? Choice A: Expected Return 32\%, Standard Deviation of Return 42%. Choive B; Expected Return 28\%, 5tandard Deviation of Relurn 48%. Choice C: Experted Return 32%, Standard Deviation of Return 32%. Choice D: Expected Return 22\%, Standard Deviation of Return 32\% A B D Question 5 15 pts Using a discount fale of 16.5%, delermine the present Value of the following stream af cash fows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts