Question: Determine the inventory values CAT would report for the two most recent balance sheets if CAT had used the FIFO method instead of the LIFO

Determine the inventory values CAT would report for the two most recent balance sheets if CAT had used the FIFO method instead of the LIFO method. Include a table with your calculation

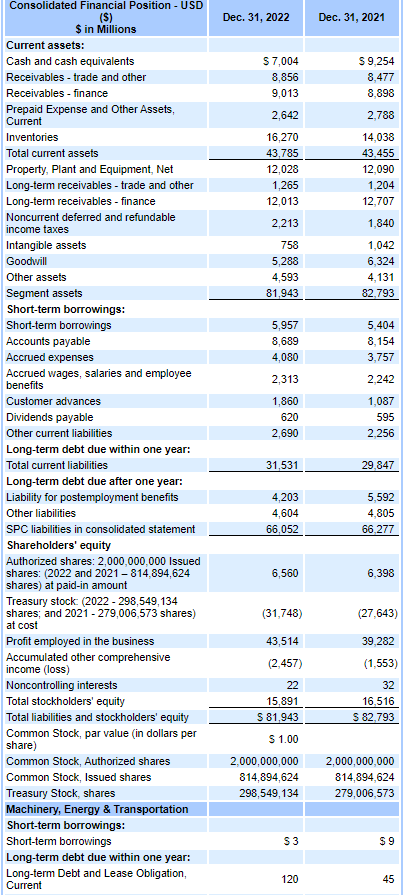

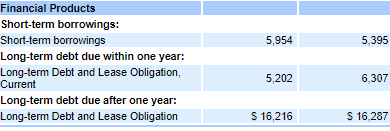

\begin{tabular}{|c|c|c|} \hline \begin{tabular}{c} Consolidated Financial Position - USD \\ (\$) \\ $ in Millions \end{tabular} & Dec. 31,2022 & Dec. 31, 2021 \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $7,004 & $9,254 \\ \hline Receivables - trade and other & 8,856 & 8,477 \\ \hline Receivables - finance & 9,013 & 8,898 \\ \hline \begin{tabular}{l} Prepaid Expense and Other Assets, \\ Current \end{tabular} & 2,642 & 2,788 \\ \hline Inventories & 16,270 & 14,038 \\ \hline Total current assets & 43,785 & 43,455 \\ \hline Property, Plant and Equipment, Net & 12,028 & 12,090 \\ \hline Long-term receivables - trade and other & 1,265 & 1,204 \\ \hline Long-term receivables - finance & 12,013 & 12,707 \\ \hline \begin{tabular}{l} Noncurrent deferred and refundable \\ income taxes \end{tabular} & 2,213 & 1,840 \\ \hline Intangible assets & 758 & 1,042 \\ \hline Goodwill & 5,288 & 6,324 \\ \hline Other assets & 4,593 & 4,131 \\ \hline Segment assets & 81,943 & 82,793 \\ \hline \multicolumn{3}{|l|}{ Short-term borrowings: } \\ \hline Short-term borrowings & 5,957 & 5,404 \\ \hline Accounts payable & 8,689 & 8,154 \\ \hline Accrued expenses & 4,080 & 3,757 \\ \hline \begin{tabular}{l} Accrued wages, salaries and employee \\ benefits \end{tabular} & 2,313 & 2,242 \\ \hline Customer advances & 1,860 & 1,087 \\ \hline Dividends payable & 620 & 595 \\ \hline Other current liabilities & 2,690 & 2,256 \\ \hline \multicolumn{3}{|l|}{ Long-term debt due within one year: } \\ \hline Total current liabilities & 31,531 & 29,847 \\ \hline \multicolumn{3}{|l|}{ Long-term debt due after one year: } \\ \hline Liability for postemployment benefits & 4,203 & 5,592 \\ \hline Other liabilities & 4,604 & 4,805 \\ \hline SPC liabilities in consolidated statement & 66,052 & 66,277 \\ \hline \multicolumn{3}{|l|}{ Shareholders' equity } \\ \hline \begin{tabular}{l} Authorized shares: 2,000,000,000 Issued \\ shares: ( 2022 and 2021814,894,624 \\ shares) at paid-in amount \end{tabular} & 6,560 & 6,398 \\ \hline \begin{tabular}{l} Treasury stock: (2022-298,549,134 \\ shares; and 2021279,006,573 shares) \\ at cost \end{tabular} & (31,748) & (27,643) \\ \hline Profit employed in the business & 43,514 & 39,282 \\ \hline \begin{tabular}{l} Accumulated other comprehensive \\ income (loss) \end{tabular} & (2,457) & (1,553) \\ \hline Noncontrolling interests & 22 & 32 \\ \hline Total stockholders' equity & 15,891 & 16,516 \\ \hline Total liabilities and stockholders' equity & $81,943 & $82,793 \\ \hline \begin{tabular}{l} Common Stock, par value (in dollars per \\ share) \end{tabular} & $1.00 & \\ \hline Common Stock, Authorized shares & 2,000,000,000 & 2,000,000,000 \\ \hline Common Stock, Issued shares & 814,894,624 & 814,894,624 \\ \hline Treasury Stock, shares & 298,549,134 & 279,006,573 \\ \hline \multicolumn{3}{|l|}{ Machinery, Energy \& Transportation } \\ \hline \multicolumn{3}{|l|}{ Short-term borrowings: } \\ \hline Short-term borrowings & $3 & $9 \\ \hline \multicolumn{3}{|l|}{ Long-term debt due within one year: } \\ \hline \begin{tabular}{l} Long-term Debt and Lease Obligation, \\ Current \end{tabular} & 120 & 45 \\ \hline \end{tabular} \begin{tabular}{l|r|r|} \begin{tabular}{l} Financial Products \\ Short-term borrowing: \end{tabular} & \\ Short-term borrowings \\ Long-term debt due within one year: \\ Long-term Debt and Lease Obligation, \\ Current \\ Long-term debt due after one year: \\ Long-term Debt and Lease Obligation \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts