Question: Determine the maximum 30-year fixed-rate mortgage amount for which a couple could qualify if the rate is 6.19 percent. Assume they have other debt payments

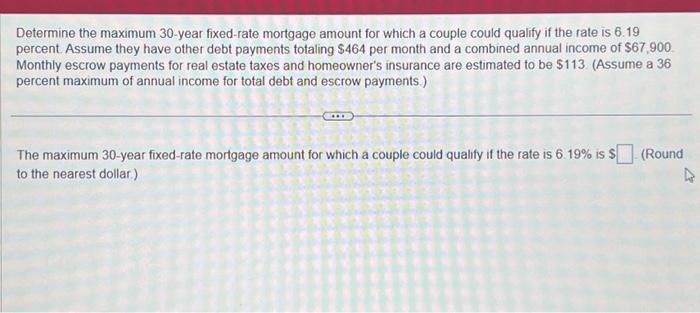

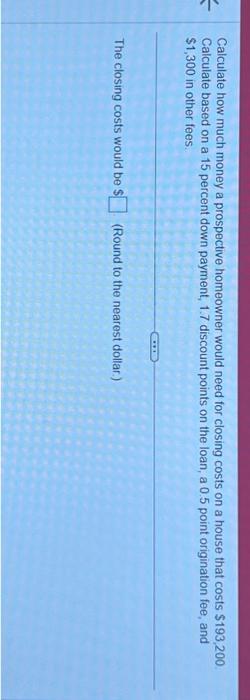

Determine the maximum 30-year fixed-rate mortgage amount for which a couple could qualify if the rate is 6.19 percent. Assume they have other debt payments totaling $464 per month and a combined annual income of $67,900 Monthly escrow payments for real estate taxes and homeowner's insurance are estimated to be $113. (Assume a 36 percent maximum of annual income for total debt and escrow payments.) The maximum 30-year fixed-rate mortgage amount for which a couple could qualify if the rate is 6.19% is $ (Round to the nearest dollar.) Calculate how much money a prospective homeowner would need for closing costs on a house that costs $193,200 Calculate based on a 15 percent down payment, 1.7 discount points on the loan, a 0.5 point origination fee, and $1,300 in other fees. The closing costs would be $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts