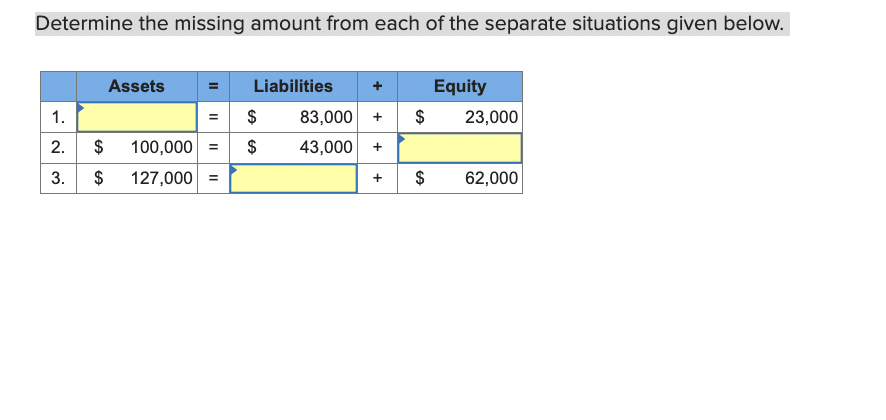

Question: Determine the missing amount from each of the separate situations given below. Required information [The following information applies to the questions displayed below.] On December

![below. Required information [The following information applies to the questions displayed below.]](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66daad41619eb_23266daad40bc722.jpg)

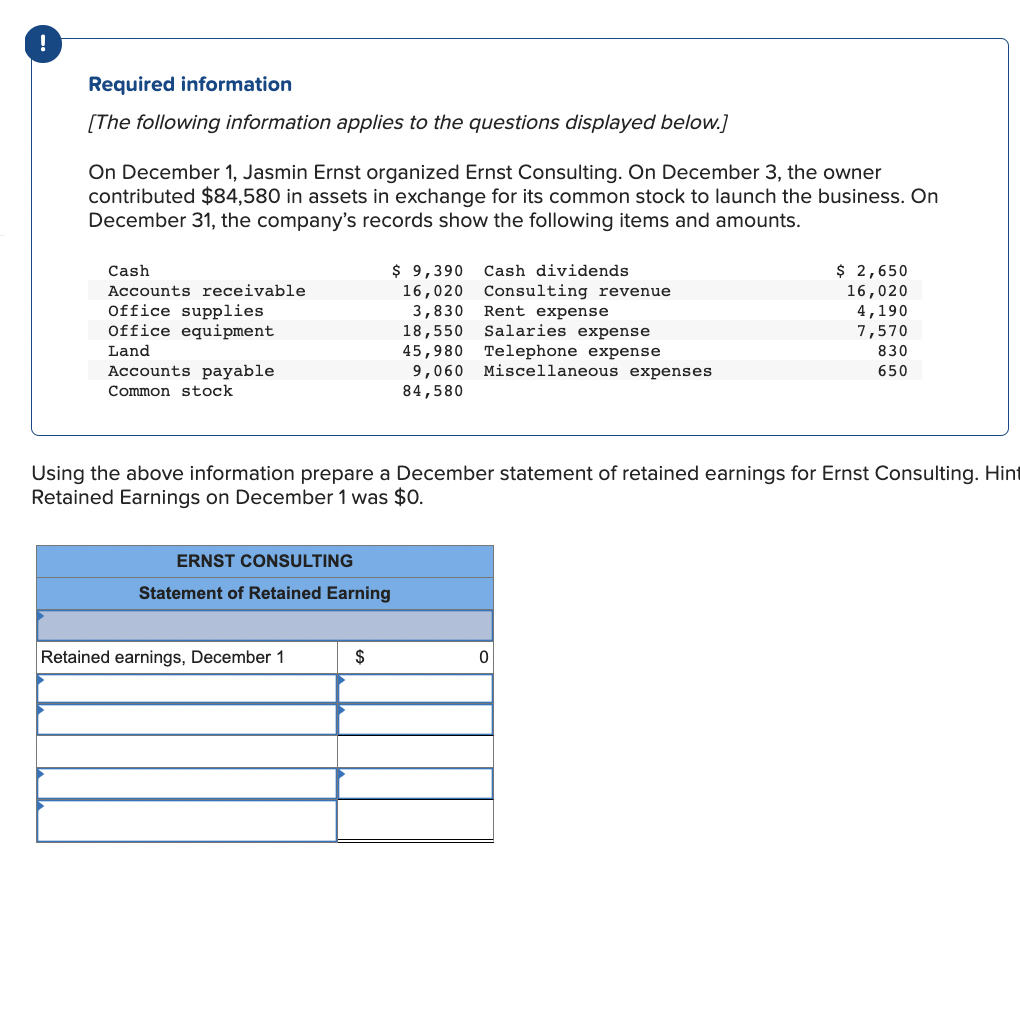

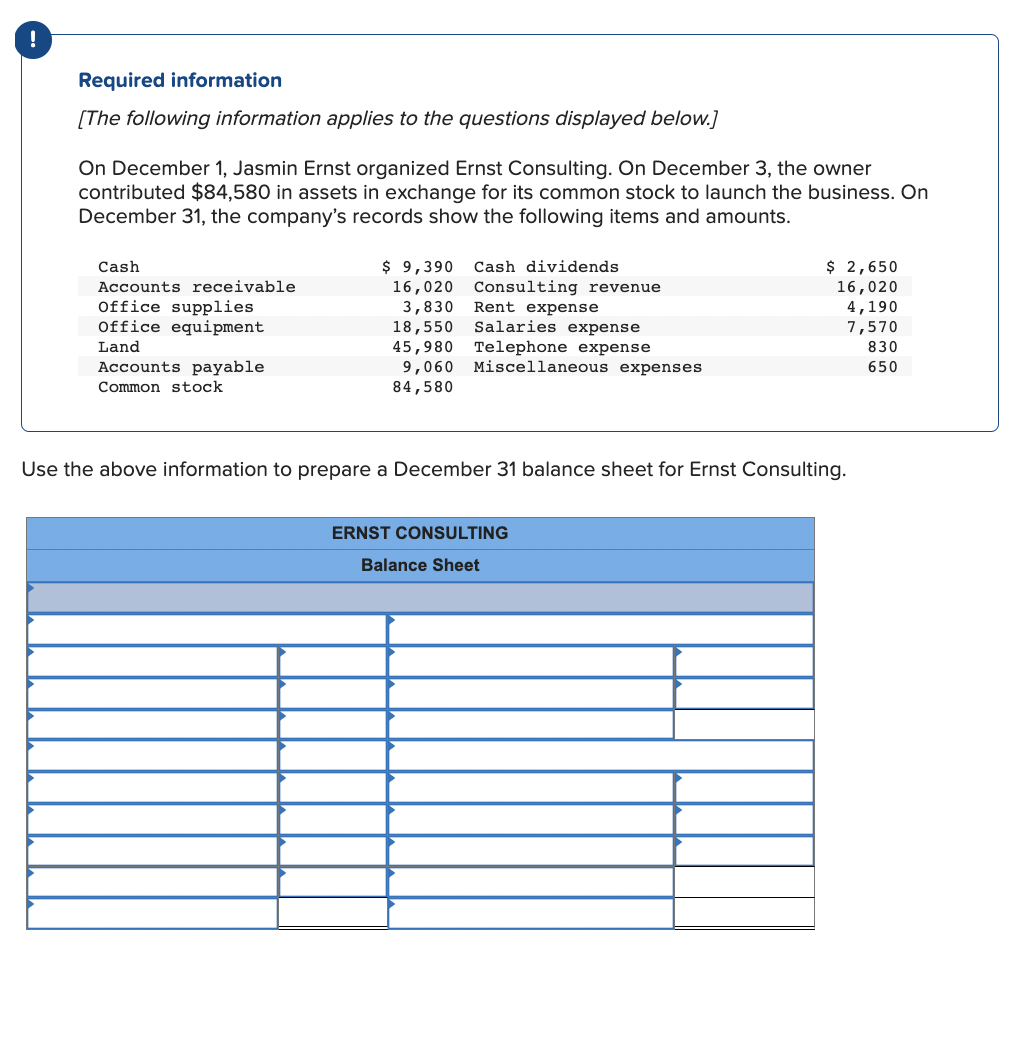

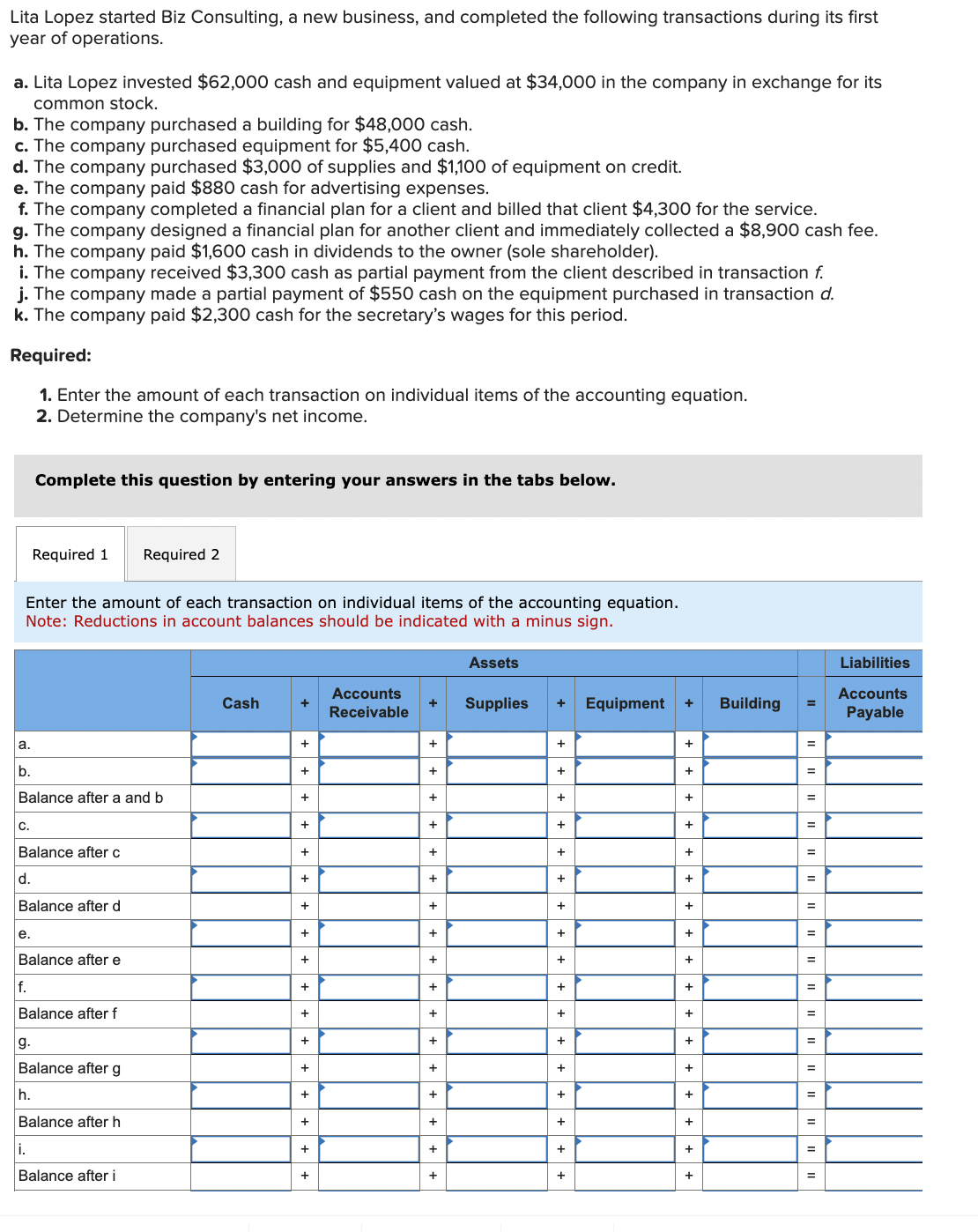

Determine the missing amount from each of the separate situations given below. Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,580 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Use the above information to prepare a December 31 balance sheet for Ernst Consulting. Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,580 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Using the above information prepare a December income statement for the business. Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,580 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Jsing the above information prepare a December statement of retained earnings for Ernst Consulting. Hir Retained Earnings on December 1 was $0. Lita Lopez started Biz Consulting, a new business, and completed the following transactions during its first year of operations. a. Lita Lopez invested $62,000 cash and equipment valued at $34,000 in the company in exchange for its common stock. b. The company purchased a building for $48,000 cash. c. The company purchased equipment for $5,400 cash. d. The company purchased $3,000 of supplies and $1,100 of equipment on credit. e. The company paid $880 cash for advertising expenses. f. The company completed a financial plan for a client and billed that client $4,300 for the service. g. The company designed a financial plan for another client and immediately collected a $8,900 cash fee. h. The company paid $1,600 cash in dividends to the owner (sole shareholder). i. The company received $3,300 cash as partial payment from the client described in transaction f. j. The company made a partial payment of $550 cash on the equipment purchased in transaction d. k. The company paid $2,300 cash for the secretary's wages for this period. Required: 1. Enter the amount of each transaction on individual items of the accounting equation. 2. Determine the company's net income. Complete this question by entering your answers in the tabs below. Enter the amount of each transaction on individual items of the accounting equation. Note: Reductions in account balances should be indicated with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts