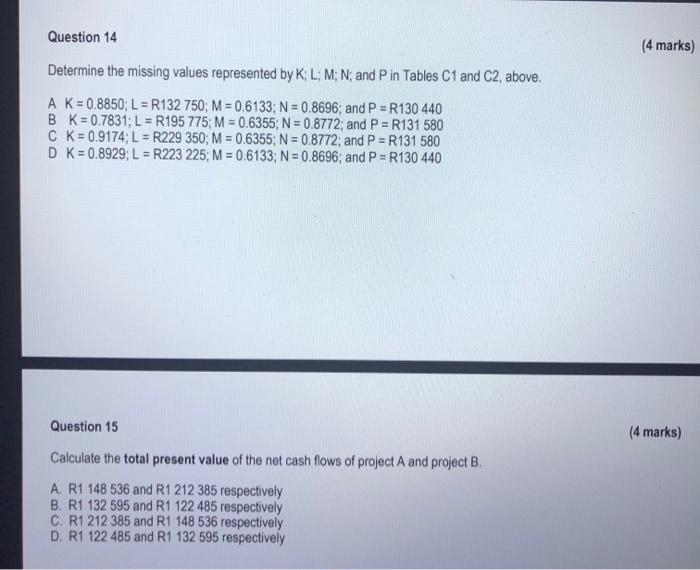

Question: Determine the missing values represented by K;L;M;N; and P in Tables C1 and C2, above. A K=0.8850;L=R132750;M=0.6133;N=0.8696; and P=R130440 B K=0.7831;L=R195775;M=0.6355;N=0.8772; and P=R131580 C K=0.9174;L=R229350;M=0.6355;N=0.8772;

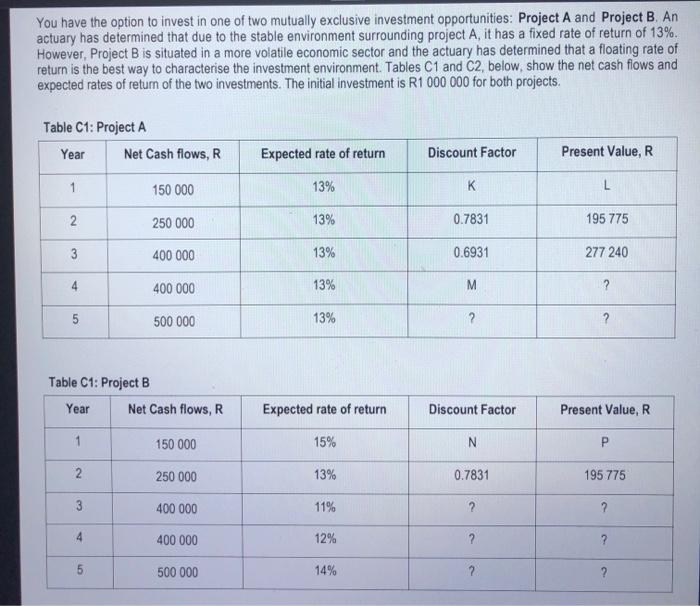

Determine the missing values represented by K;L;M;N; and P in Tables C1 and C2, above. A K=0.8850;L=R132750;M=0.6133;N=0.8696; and P=R130440 B K=0.7831;L=R195775;M=0.6355;N=0.8772; and P=R131580 C K=0.9174;L=R229350;M=0.6355;N=0.8772; and P=R131580 D K=0.8929;L=R223225;M=0.6133;N=0.8696; and P=R130440 Question 15 Calculate the total present value of the net cash flows of project A and project B. A. R1 148536 and R1 212385 respectively B. R1 132595 and R1 122485 respectively C. R1 212385 and R1 148536 respectively D. R1 122485 and R1 132595 respectively Question 16 (4 marks) As a rational investor, what decision would you make? A. Invest in project A only. B. Invest in project B only. C. Invest in both project A and project B. D. Invest in either project A or project B. You have the option to invest in one of two mutually exclusive investment opportunities: Project A and Project B. An actuary has determined that due to the stable environment surrounding project A, it has a fixed rate of return of 13%. However, Project B is situated in a more volatile economic sector and the actuary has determined that a floating rate of return is the best way to characterise the investment environment. Tables C1 and C2, below, show the net cash flows and expected rates of return of the two investments. The initial investment is R1 000000 for both projects. Takla CA. Drainet A Table C1: Proiect B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts