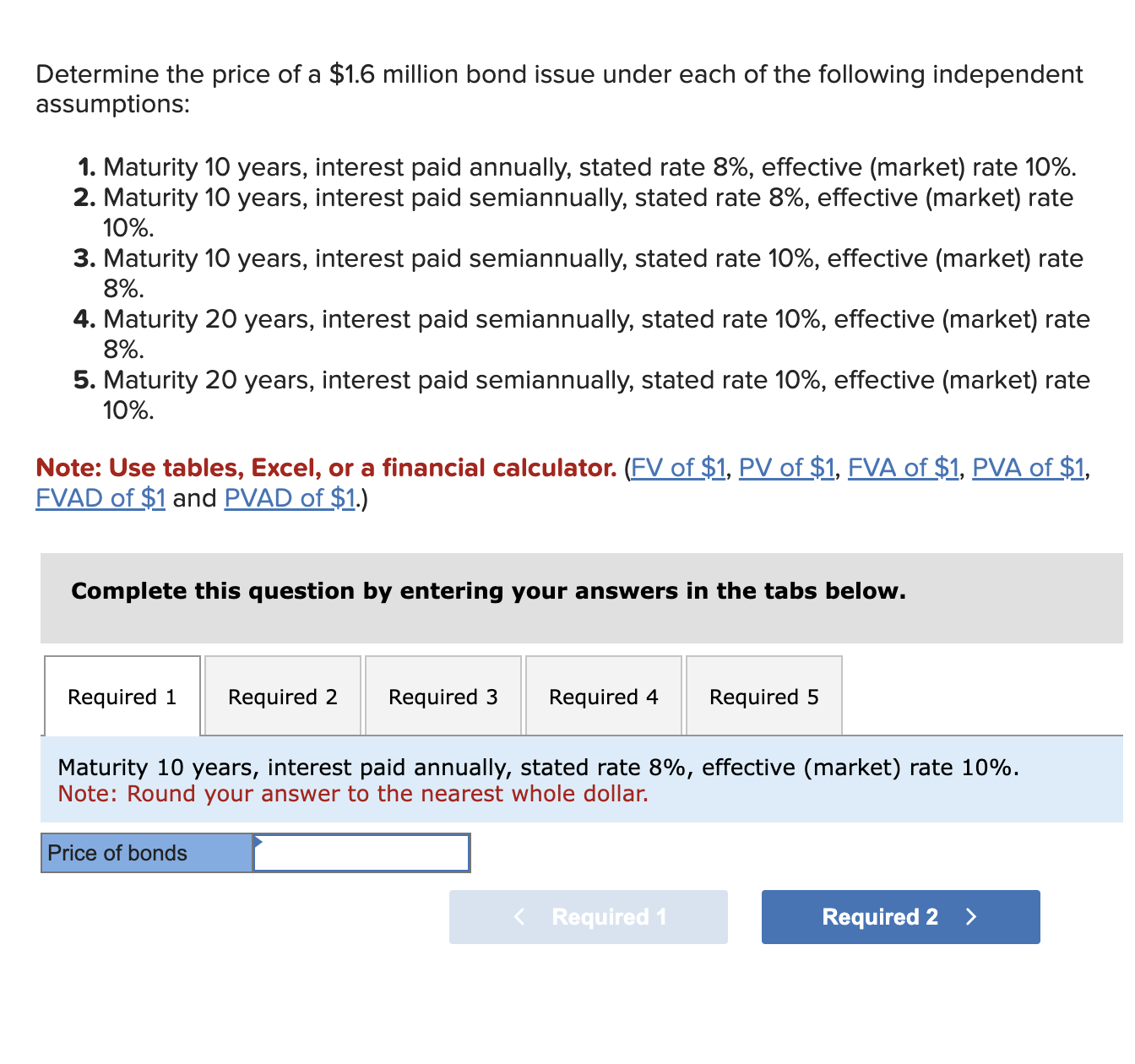

Determine the price of a $1.6 million bond issue under each of the following independent assumptions:...

Fantastic news! We've Found the answer you've been seeking!

Question:

Related Book For

Basic Technical Mathematics

ISBN: 9780137529896

12th Edition

Authors: Allyn J. Washington, Richard Evans

Posted Date: