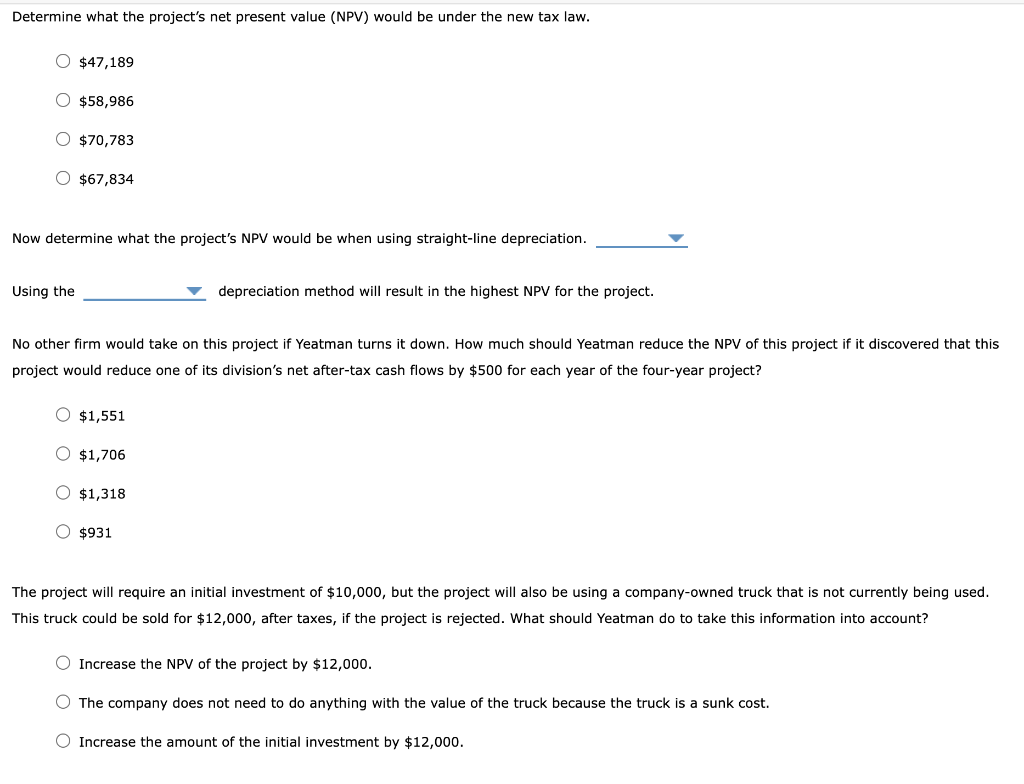

Question: Determine what the project's net present value (NPV) would be under the new tax law. $47,189 $58,986 $70,783 $67,834 Now determine what the project's NPV

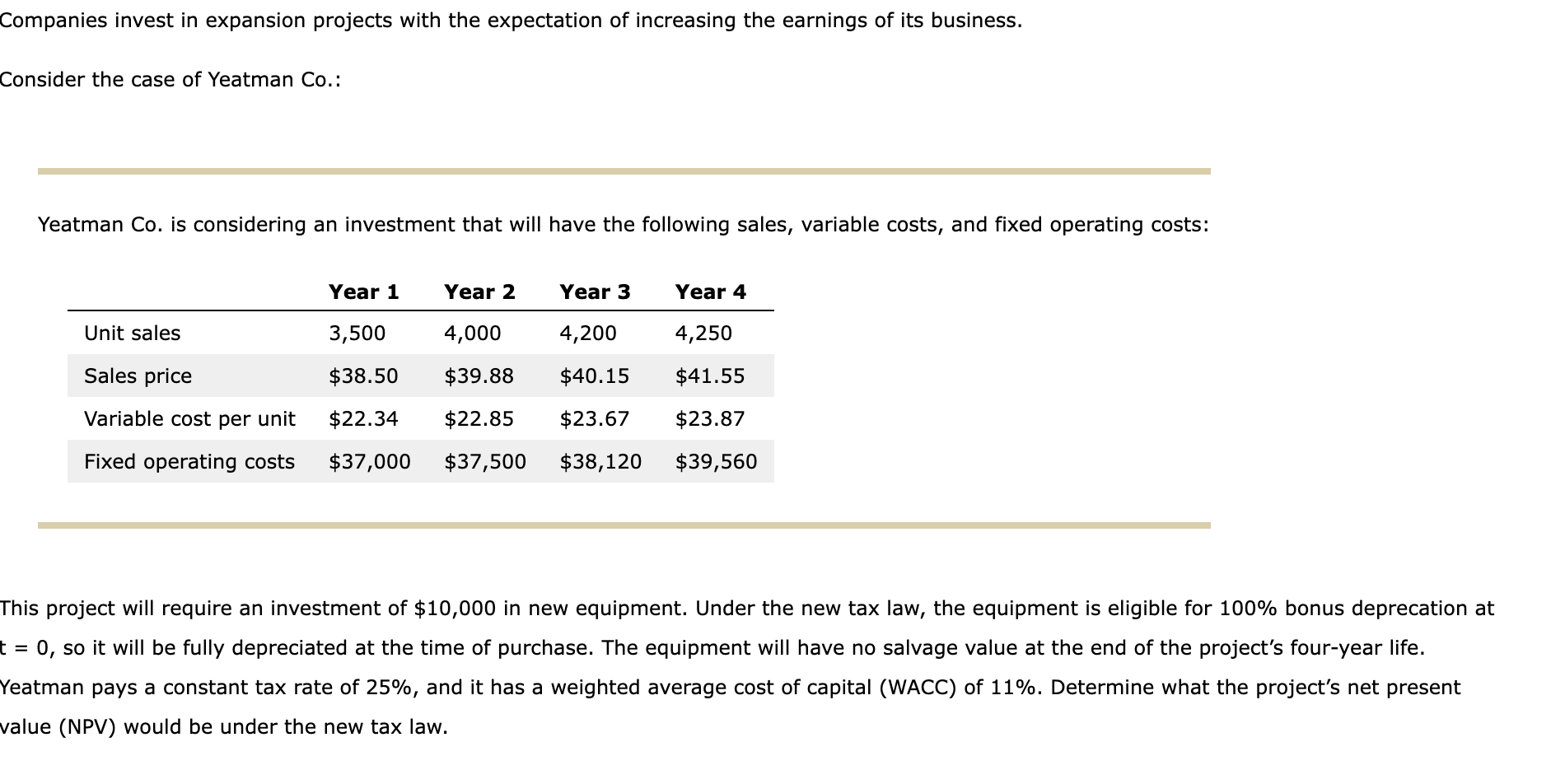

Determine what the project's net present value (NPV) would be under the new tax law. $47,189 $58,986 $70,783 $67,834 Now determine what the project's NPV would be when using straight-line depreciation. Using the depreciation method will result in the highest NPV for the project. project would reduce one of its division's net after-tax cash flows by $500 for each year of the four-year project? $1,551 $1,706 $1,318 $931 The project will require an initial investment of $10,000, but the project will also be using a company-owned truck that is neen This truck could be sold for $12,000, after taxes, if the project is rejected. What should Yeatman do to take in into account? Increase the NPV of the project by $12,000. The company does not need to do anything with the value of the truck because the truck is a sunk cost. Increase the amount of the initial investment by $12,000. Companies invest in expansion projects with the expectation of increasing the earnings of its business. Consider the case of Yeatman Co.: Yeatman Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: Yeatman pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the projects value (NPV) would be under the new tax law

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts