Question: Determine what the project's ROE will be if its EBIT is -$55, 000. When calculating the tax effects, assume that Sombra Corp. as a whole

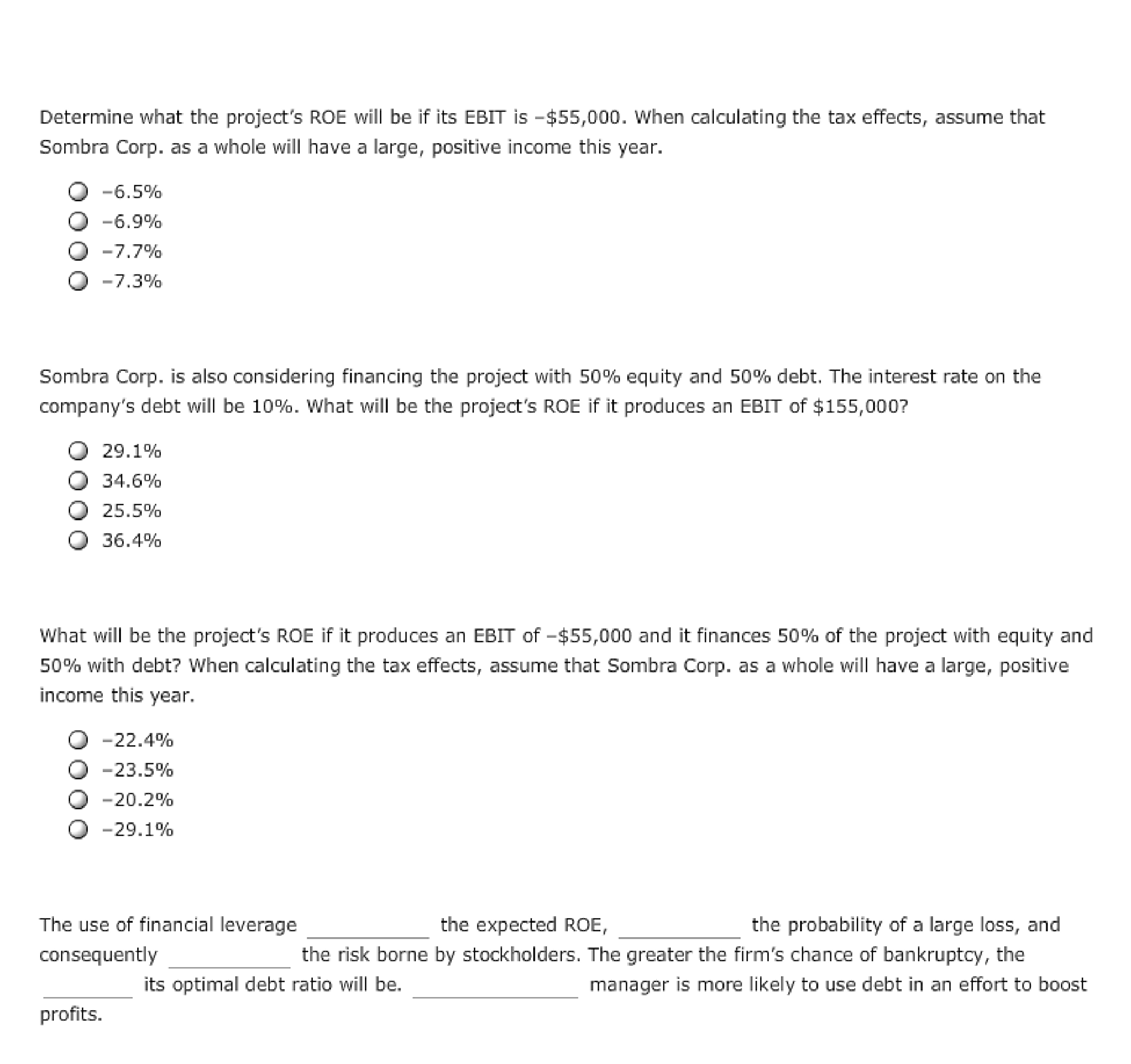

Determine what the project's ROE will be if its EBIT is -$55, 000. When calculating the tax effects, assume that Sombra Corp. as a whole will have a large, positive income this year. -6.5% -6.9% -7.7% -7.3% Sombra Corp. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company's debt will be 10%. What will be the project's ROE if it produces an EBIT of $155, 000? 29.1% 34.6% 25.5% 36.4% What will be the project's ROE if it produces an EBIT of -$55, 000 and it finances 50% of the project with equity and 50% with debt? When calculating the tax effects, assume that Sombra Corp. as a whole will have a large, positive income this year. -22.4% -23.5% -20.2% -29.1% The use of financial leverage the expected ROE, the probability of a large loss, and consequently the risk borne by stockholders. The greater the firm's chance of bankruptcy, the its optimal debt ratio will be manager is more likely to use debt in an effort to boost profits. Determine what the project's ROE will be if its EBIT is -$55, 000. When calculating the tax effects, assume that Sombra Corp. as a whole will have a large, positive income this year. -6.5% -6.9% -7.7% -7.3% Sombra Corp. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company's debt will be 10%. What will be the project's ROE if it produces an EBIT of $155, 000? 29.1% 34.6% 25.5% 36.4% What will be the project's ROE if it produces an EBIT of -$55, 000 and it finances 50% of the project with equity and 50% with debt? When calculating the tax effects, assume that Sombra Corp. as a whole will have a large, positive income this year. -22.4% -23.5% -20.2% -29.1% The use of financial leverage the expected ROE, the probability of a large loss, and consequently the risk borne by stockholders. The greater the firm's chance of bankruptcy, the its optimal debt ratio will be manager is more likely to use debt in an effort to boost profits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts