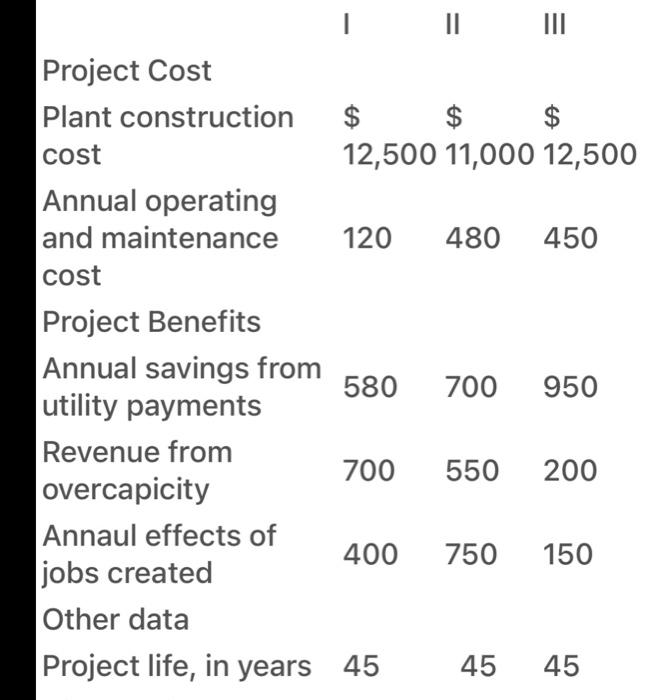

Question: determine which project should be selected based on incremental benefit cost ratio analysis. B/C=B-D/C II III Project Cost Plant construction $ $ cost 12,500 11,000

II III Project Cost Plant construction $ $ cost 12,500 11,000 12,500 Annual operating and maintenance 120 480 450 cost Project Benefits Annual savings from 580 700 950 utility payments Revenue from 700 550 200 overcapicity Annaul effects of 400 750 150 jobs created Other data Project life, in years 45 45 45 3. A Midwestern industrial state is considering the construction and operation of facilities to provide electricity to several state-owned properties. Electricity will be provided via two coal-burning power plants and a distribution network wired to the properties targeted for conversion. A group studying the proposal has identified the general cost and benefits for two competing design and these are listed below ($). The life of both projects is 45 years and the MARR to be used is 8%. II III Project Cost Plant construction $ $ cost 12,500 11,000 12,500 Annual operating and maintenance 120 480 450 cost Project Benefits Annual savings from 580 700 950 utility payments Revenue from 700 550 200 overcapicity Annaul effects of 400 750 150 jobs created Other data Project life, in years 45 45 45 3. A Midwestern industrial state is considering the construction and operation of facilities to provide electricity to several state-owned properties. Electricity will be provided via two coal-burning power plants and a distribution network wired to the properties targeted for conversion. A group studying the proposal has identified the general cost and benefits for two competing design and these are listed below ($). The life of both projects is 45 years and the MARR to be used is 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts