Question: Determining Net Income from Net Cash Flow from Operating Activities Curwen Inc. reported net cash flow from operating activities of $182,200 on its statement of

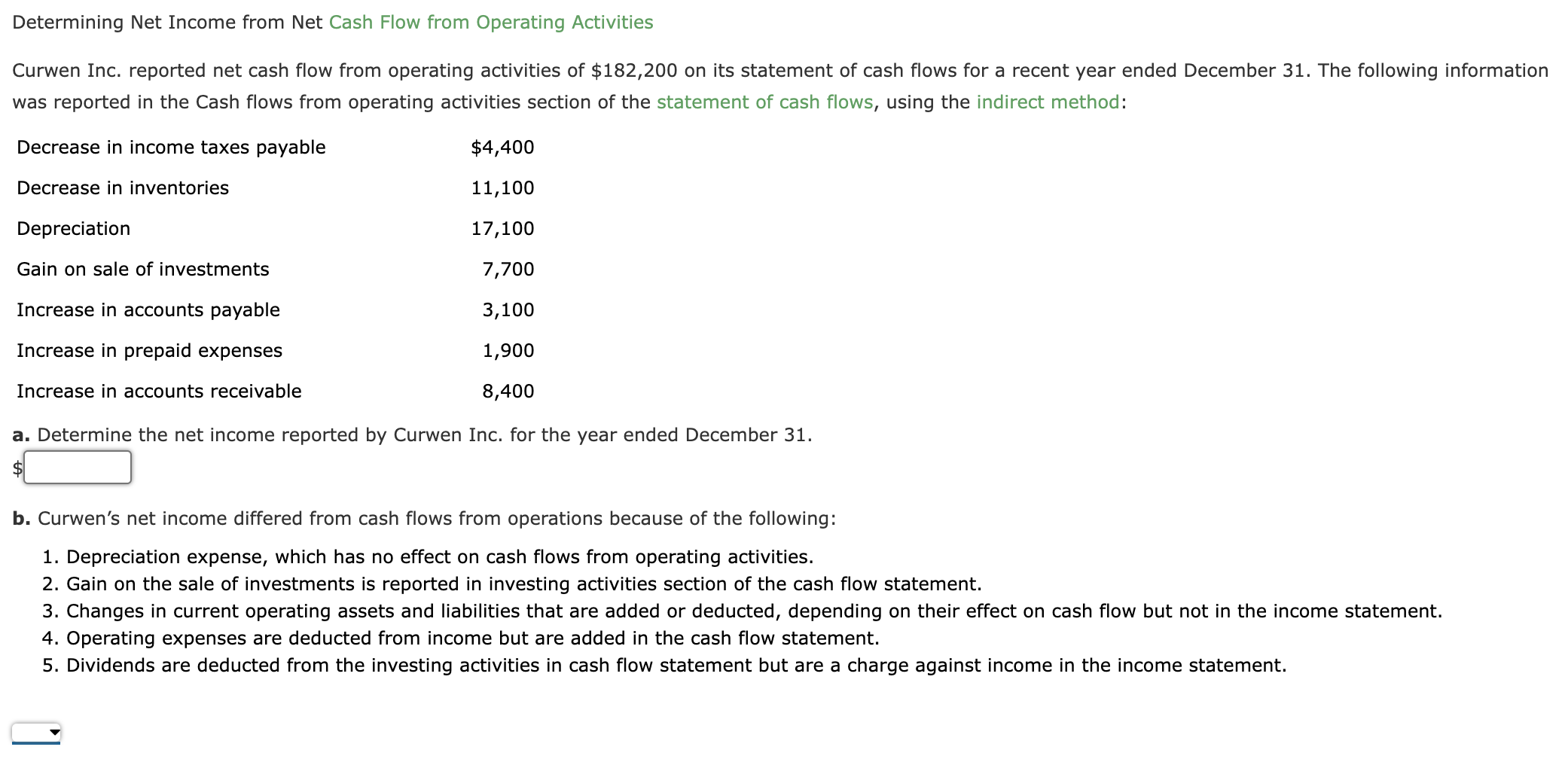

Determining Net Income from Net Cash Flow from Operating Activities

Curwen Inc. reported net cash flow from operating activities of $182,200 on its statement of cash flows for a recent year ended December 31. The following information was reported in the Cash flows from operating activities section of the statement of cash flows, using the indirect method:

| Decrease in income taxes payable | $4,400 |

| Decrease in inventories | 11,100 |

| Depreciation | 17,100 |

| Gain on sale of investments | 7,700 |

| Increase in accounts payable | 3,100 |

| Increase in prepaid expenses | 1,900 |

| Increase in accounts receivable | 8,400 |

a. Determine the net income reported by Curwen Inc. for the year ended December 31. $fill in the blank 1

b. Curwens net income differed from cash flows from operations because of the following:

- Depreciation expense, which has no effect on cash flows from operating activities.

- Gain on the sale of investments is reported in investing activities section of the cash flow statement.

- Changes in current operating assets and liabilities that are added or deducted, depending on their effect on cash flow but not in the income statement.

- Operating expenses are deducted from income but are added in the cash flow statement.

- Dividends are deducted from the investing activities in cash flow statement but are a charge against income in the income statement.

1, 2 and 31, 4 and 51, 3 and 5

Determining Net Income from Net Cash Flow from Operating Activities Curwen Inc. reported net cash flow from operating activities of $182,200 on its statement of cash flows for a recent year ended December 31. The following information was reported in the Cash flows from operating activities section of the statement of cash flows, using the indirect method: Decrease in income taxes payable $4,400 11,100 Decrease in inventories Depreciation 17,100 Gain on sale of investments 7,700 Increase in accounts payable 3,100 Increase in prepaid expenses 1,900 8,400 Increase in accounts receivable a. Determine the net income reported by Curwen Inc. for the year ended December 31. b. Curwen's net income differed from cash flows from operations because of the following: 1. Depreciation expense, which has no effect on cash flows from operating activities. 2. Gain on the sale of investments is reported in investing activities section of the cash flow statement. 3. Changes in current operating assets and liabilities that are added or deducted, depending on their effect on cash flow but not in the income statement. 4. Operating expenses are deducted from income but are added in the cash flow statement. 5. Dividends are deducted from the investing activities in cash flow statement but are a charge against income in the income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts