Question: Determining target leverage. A firm has an operating profit margin of 4% in a realistic worst case, and it is considered a moderately vulnerable business,

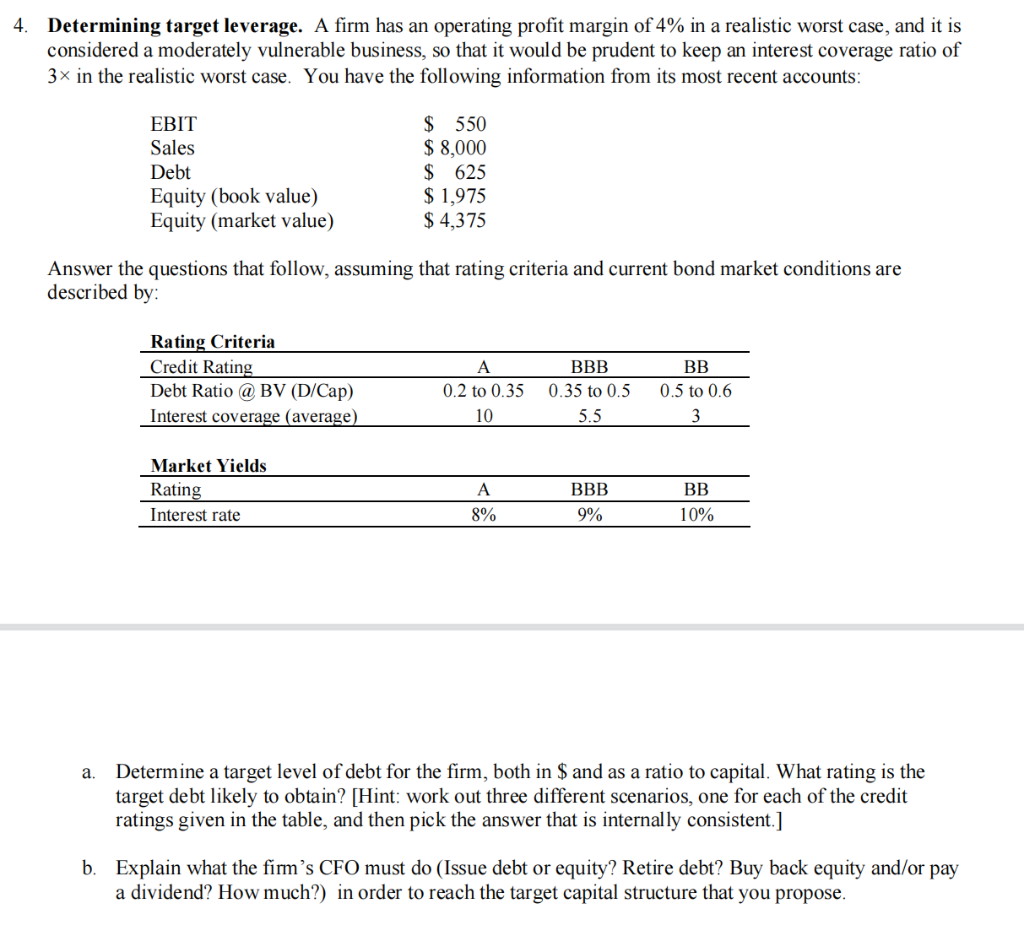

Determining target leverage. A firm has an operating profit margin of 4% in a realistic worst case, and it is considered a moderately vulnerable business, so that it would be prudent to keep an interest coverage ratio of 3 in the realistic worst case. You have the following information from its most recent accounts: Answer the questions that follow, assuming that rating criteria and current bond market conditions are described by: a. Determine a target level of debt for the firm, both in $ and as a ratio to capital. What rating is the target debt likely to obtain? [Hint: work out three different scenarios, one for each of the credit ratings given in the table, and then pick the answer that is internally consistent.] b. Explain what the firm's CFO must do (Issue debt or equity? Retire debt? Buy back equity and/or pay a dividend? How much?) in order to reach the target capital structure that you propose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts