Question: Determining the break-even point and preparing a contribution margin income statement Ritchie Manufacturing Company makes a product that it sells for $150 per unit. The

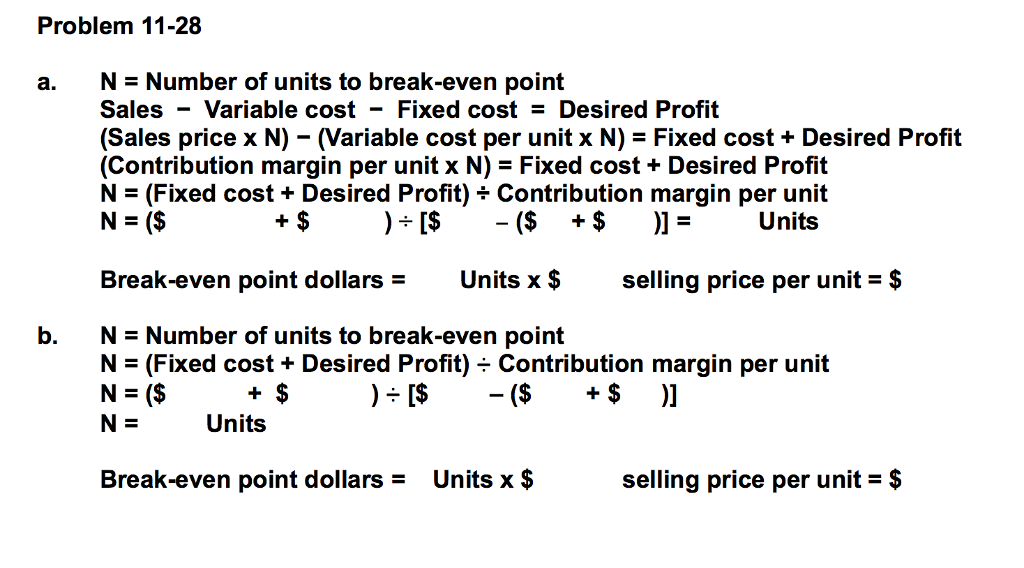

Determining the break-even point and preparing a contribution margin income statement Ritchie Manufacturing Company makes a product that it sells for $150 per unit. The company incurs variable manufacturing costs of $60 per unit. Variable selling expenses are $18 per unit, annual fixed manufacturing costs are $480,000, and fixed selling and administrative costs are $240,000 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method.

b. Use the contribution margin per unit approach.

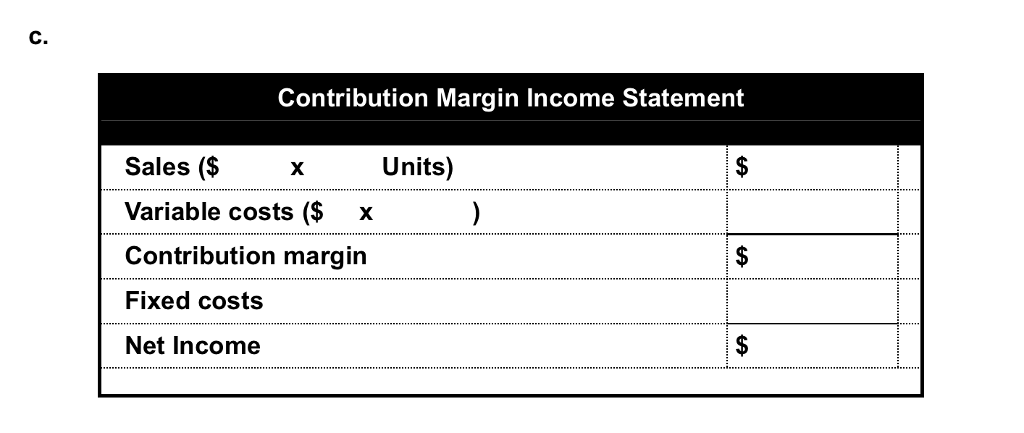

c. Confirm your results by preparing a contribution margin income statement for the break-even sales volume

PLEASE FILL OUT SOLUTIONS SIMILAR TO THE EXAMPLES BELOW

Problem 11-28 N = Number of units to break-even point Sales - Variable cost Fixed cost = Desired Profit (Sales price x N) - (Variable cost per unit x N) = Fixed cost + Desired Profit (Contribution margin per unit x N) = Fixed cost + Desired Profit N = (Fixed cost + Desired Profit) + Contribution margin per unit N = ($ + $ ) + [$ -($ + $ )] = Units Break-even point dollars = Units x $ selling price per unit = $ N = Number of units to break-even point N = (Fixed cost + Desired Profit) + Contribution margin per unit N = ($ + $ ) + [$ -$ +$ )]. N= Units Break-even point dollars = Units x $ selling price per unit = $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts