Question: Determining the optimal capital structure Understanding the optimal capital structure Review this situation: Transworld Consortium Corp. is trying to identify its optimal capital structure. Transworld

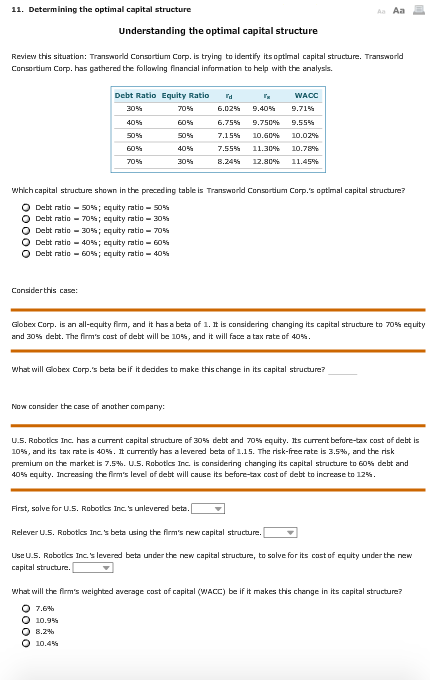

Determining the optimal capital structure Understanding the optimal capital structure Review this situation: Transworld Consortium Corp. is trying to identify its optimal capital structure. Transworld Consortium Corp. has gathered the following financial information to help with the analysis. Which capital structure shown in the preceding table is Transworld Consortium Corp.'s optimal capital structure? Debt ratio = 50%: equity ratio = 50% Debt ratio = 70%: equity ratio = 30% Debt ratio = 30%: equity ratio = 70% Debt ratio = 40%: equity ratio = 60% Debt ratio = 60%: equity ratio 40% Consider this case: Globex Corp. is an all-equity firm, and it has a beta of 1. It is considering changing its capital structure to 70% equity and 30% debt. The firm's cost of debt will be 10%, and it will face a tax rate of 40%. What will Globex Corp.'s beta brief it decides to make this change in its capital structure? Now consider the case of another company: U.S. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 10%, and its tax rate is 40%. It currently has a levered beta of 1.15. The risk-free rate is 3.5%, and the risk premium on the market is 7.5%. U.S. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-tax cost of debt to increase to 12%. First, solve for U.S. Robotics Inc.'s unlevered beta. Relever U.S. Robotics Inc.'s beta using the firm's new capital structure. Use U.S Robotics Inc.'s levered beta under the new capital structure, to solve for its cost of equity under the new capital structure. What will the firm's weighted average cost of capital (MACC) be if it makes this change in its capital structure? 7.6% 10.9% 8.2% 10.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts