Question: Develop a report and relevant discussion/analysis for the ratios below: -return on equity -return on assets -financial leverage percentage (roe roa) -component percentage analysis

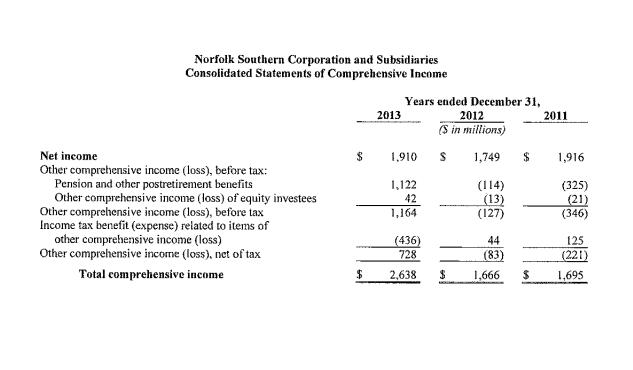

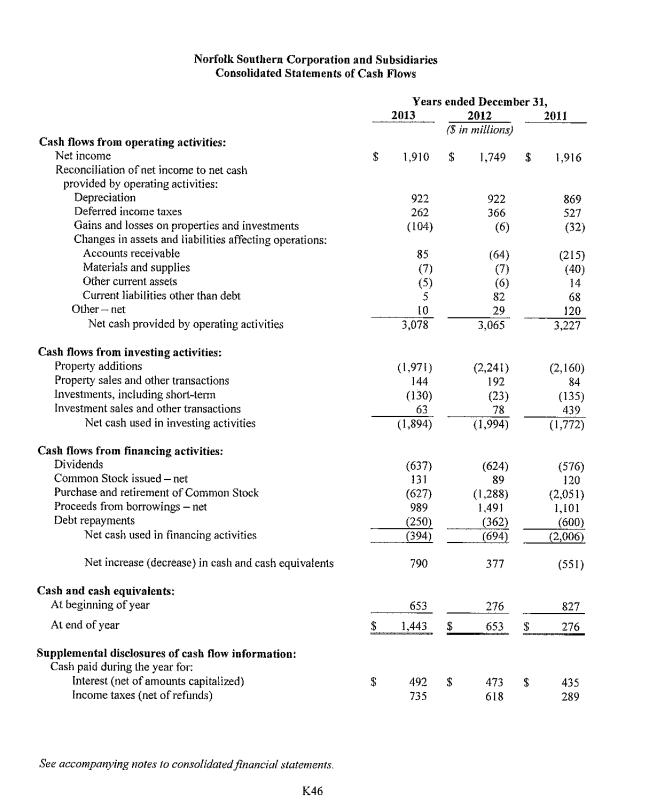

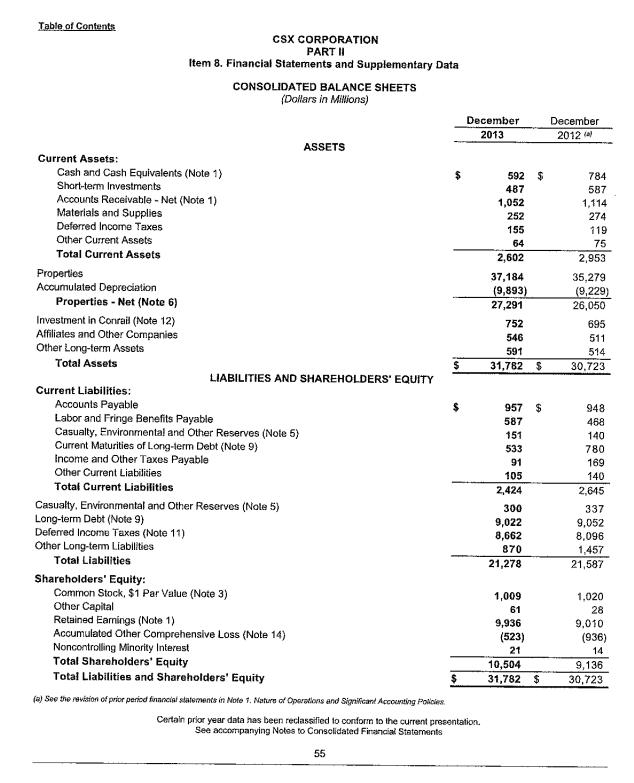

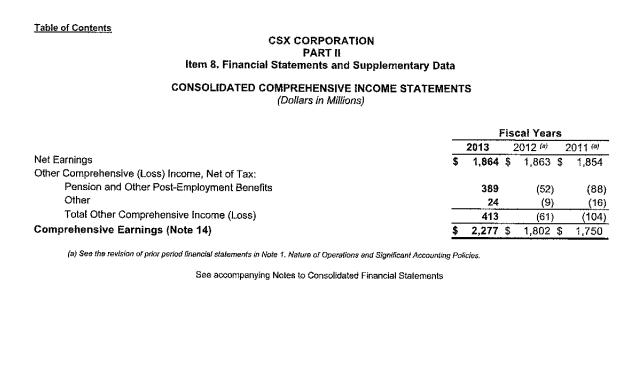

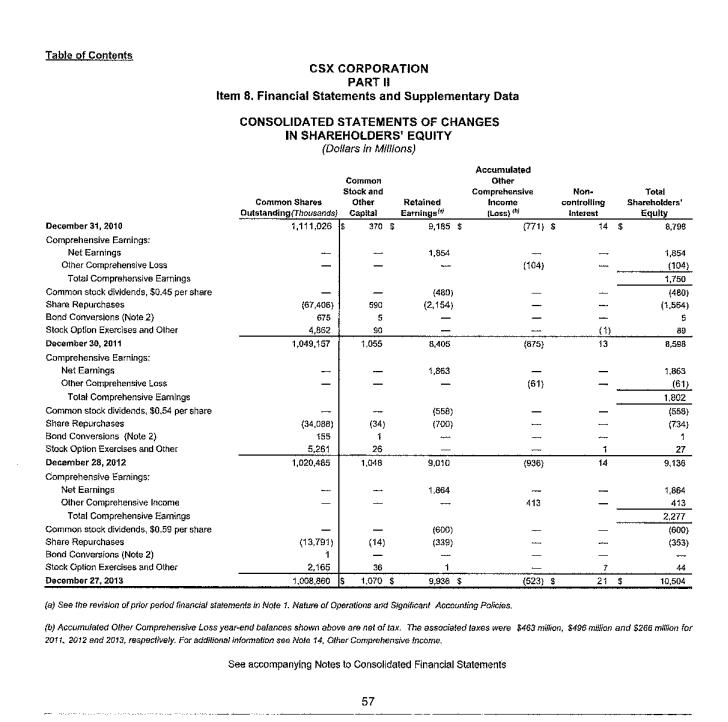

Develop a report and relevant discussion/analysis for the ratios below: -return on equity -return on assets -financial leverage percentage (roe – roa) -component percentage analysis of the income statements -current ratio for each ratio, need to find relevant information from the attached annual reports (csx and norfolk southern), calculate the ratios for the most recent year, report the ratios in the format required (see below), and write ratio analysis. for the ratio discussion, it needs to include supporting evidence/information from notes to financial statements and management discussions and analysis in the annual reports to provide more insights. (year) company1 __________ company 2 __________ i can provide the full annual reports for reference once a price is determined. deadline is march 25, 2015.

Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable - net Materials and supplies Deferred income taxes Other current assets Total current assets Investments Properties less accumulated depreciation of $10,387 and $9,922, respectively Other assets Total assets Norfolk Southern Corporation and Subsidiaries Consolidated Balance Sheets Liabilities and stockholders' equity Current liabilities: Accounts payable Short-term debt Income and other taxes Other current liabilities Current maturities of long-term debt Total current liabilities Long-term debt Other liabilities Deferred income taxes Total liabilities Stockholders' equity: Common Stock $1.00 per share par value, 1,350,000,000 shares authorized; outstanding 308,878,402 and 314,034,174 shares, respectively, net of treasury shares Additional paid-in capital Accumulated other comprehensive loss Retained income Total stockholders' equity Total liabilities and stockholders' equity See accompanying notes to consolidated financial statements. K45 $ $ $ $ At December 31, 2013 (8 in millions) 1,443 118 1,024 223 180 87 3,075 2,439 26,645 324 32,483 1,265 100 225 270 445 2,305 8,903 1,444 8,542 21,194 3.10 2,021 (381) 9,339 11,289 32,483 $ $ 2012 $ 653 15 1,109 216 167 82 2.242 2,300 25,736 64 30,342 1,362 200 206 263 50 2,081 8,432 2,237 7,832 20,582 315 1,911 (1,109) 8,643 9,760 $ 30,342

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Return on Equity Year CSX Norfolk Southern 2020 137 134 Return on Assets Year CSX Norfolk Southern 2020 88 89 Financial Leverage Percentage ROE ROA Ye... View full answer

Get step-by-step solutions from verified subject matter experts