Question: Develop a spreadsheet model to determine how much a person or a couple can afford to spend on a house. Lender guidelines suggest that the

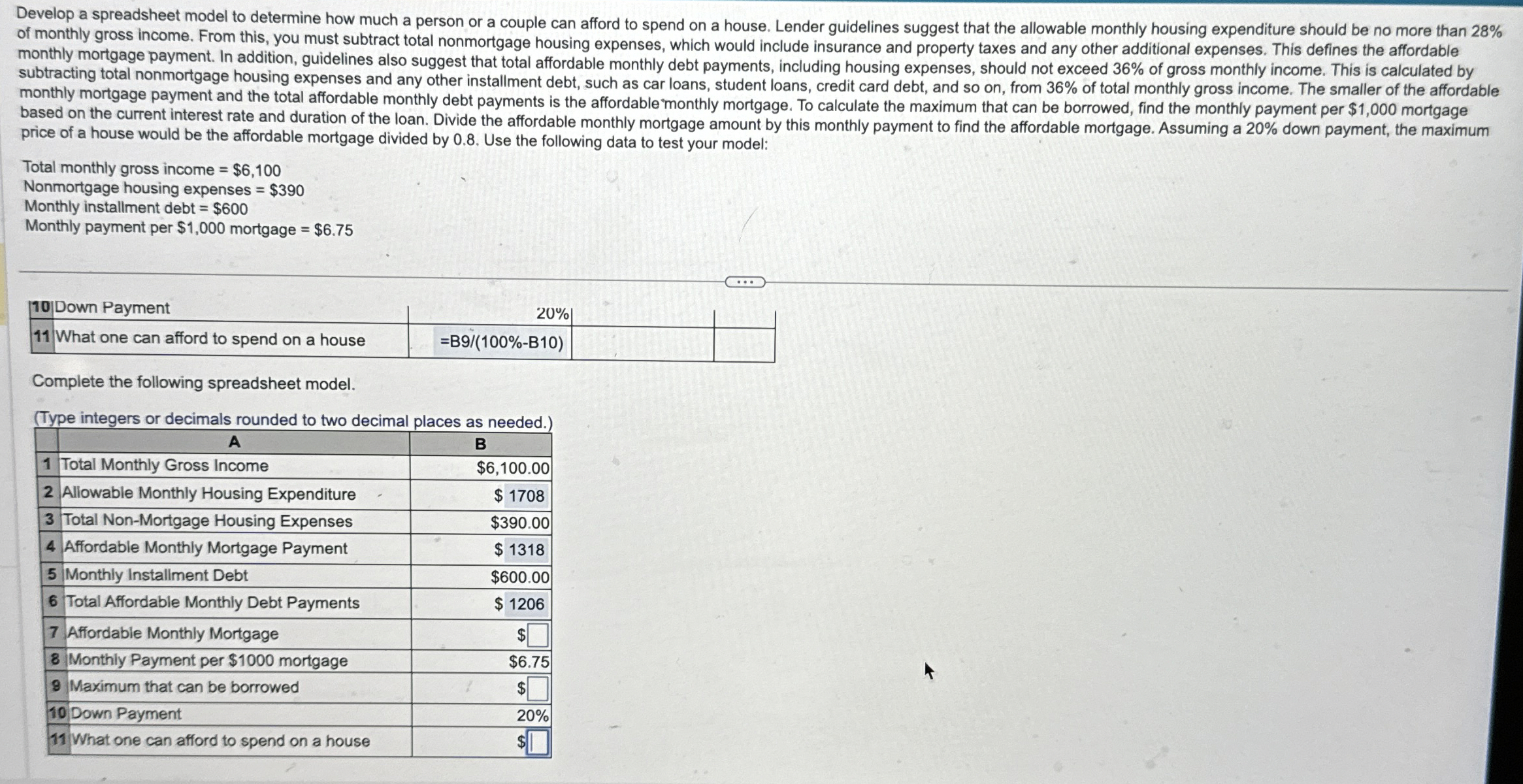

Develop a spreadsheet model to determine how much a person or a couple can afford to spend on a house. Lender guidelines suggest that the allowable monthly housing expenditure should be no more than of monthly gross income. From this, you must subtract total nonmortgage housing expenses, which would include insurance and property taxes and any other additional expenses. This defines the affordable monthly mortgage payment. In addition, guidelines also suggest that total affordable monthly debt payments, including housing expenses, should not exceed of gross monthly income. This is calculated by subtracting total nonmortgage housing expenses and any other installment debt, such as car loans, student loans, credit card debt, and so on from of total monthly gross income. The smaller of the affordable monthly mortgage payment and the total affordable monthly debt payments is the affordable monthly mortgage. To calculate the maximum that can be borrowed, find the monthly payment per $ mortgage based on the current interest rate and duration of the loan. Divide the affordable monthly mortgage amount by this monthly payment to find the affordable mortgage. Assuming a down payment, the maximum price of a house would be the affordable mortgage divided by Use the following data to test your model:

Total monthly gross income $

Nonmortgage housing expenses $

Monthly installment debt $

Monthly payment per $ mortgage $

table Down Payment, What one can afford to spend on a house,

Complete the following spreadsheet model.

Type integers or decimals rounded to two decimal places as needed.

tableABTotal Monthly Gross Income,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock