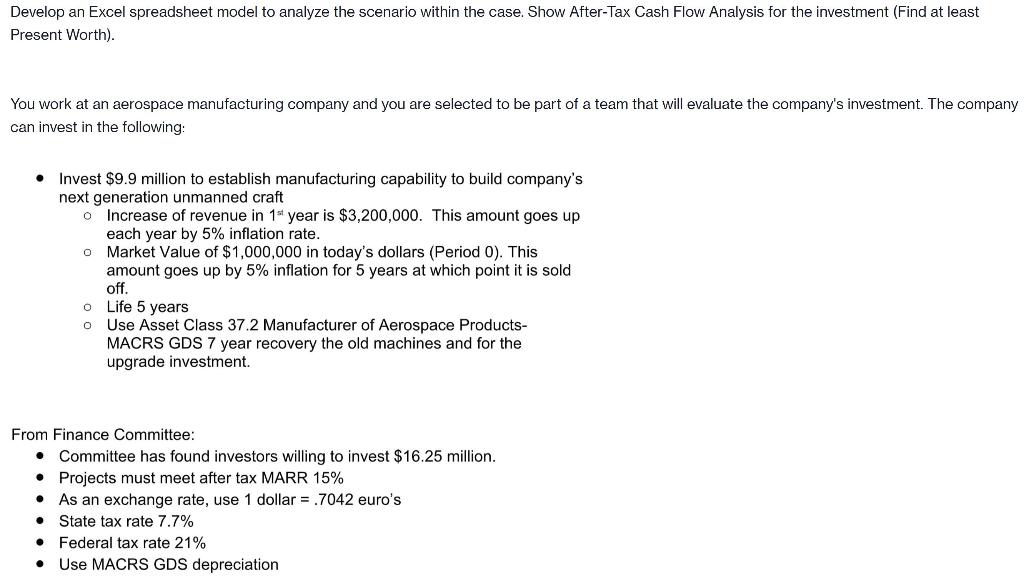

Question: Develop an Excel spreadsheet model to analyze the scenario within the case. Show After-Tax Cash Flow Analysis for the investment (Find at least Present Worth).

Develop an Excel spreadsheet model to analyze the scenario within the case. Show After-Tax Cash Flow Analysis for the investment (Find at least Present Worth). You work at an aerospace manufacturing company and you are selected to be part of a team that will evaluate the company's investment. The company can invest in the following: . Invest $9.9 million to establish manufacturing capability to build company's next generation unmanned craft o Increase of revenue in 18 year is $3,200,000. This amount goes up each year by 5% inflation rate. Market Value of $1,000,000 in today's dollars (Period 0). This amount goes up by 5% inflation for 5 years at which point it is sold off. Life 5 years Use Asset Class 37.2 Manufacturer of Aerospace Products- MACRS GDS 7 year recovery the old machines and for the upgrade investment. O o From Finance Committee: Committee has found investors willing to invest $16.25 million. Projects must meet after tax MARR 15% As an exchange rate, use 1 dollar = .7042 euro's State tax rate 7.7% Federal tax rate 21% Use MACRS GDS depreciation . Develop an Excel spreadsheet model to analyze the scenario within the case. Show After-Tax Cash Flow Analysis for the investment (Find at least Present Worth). You work at an aerospace manufacturing company and you are selected to be part of a team that will evaluate the company's investment. The company can invest in the following: . Invest $9.9 million to establish manufacturing capability to build company's next generation unmanned craft o Increase of revenue in 18 year is $3,200,000. This amount goes up each year by 5% inflation rate. Market Value of $1,000,000 in today's dollars (Period 0). This amount goes up by 5% inflation for 5 years at which point it is sold off. Life 5 years Use Asset Class 37.2 Manufacturer of Aerospace Products- MACRS GDS 7 year recovery the old machines and for the upgrade investment. O o From Finance Committee: Committee has found investors willing to invest $16.25 million. Projects must meet after tax MARR 15% As an exchange rate, use 1 dollar = .7042 euro's State tax rate 7.7% Federal tax rate 21% Use MACRS GDS depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts