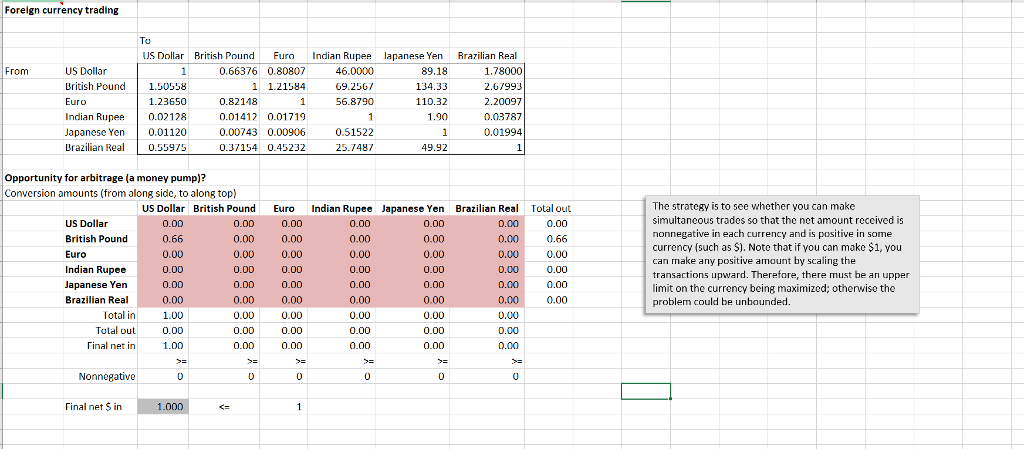

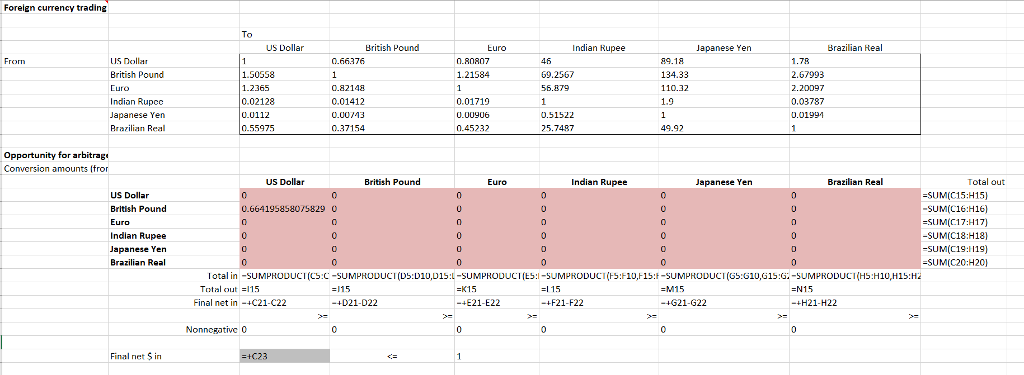

Question: . Develop an LP model to determine whether there are any arbitrage opportunities with the spot currency rates given in the file. Note that an

. Develop an LP model to determine whether there are any arbitrage opportunities with the spot currency rates given in the file. Note that an arbitrage opportunity could involve several currencies. If there is an arbitrage opportunity, your model should specify the exact set of transactions to achieve it.

This is what I have so far, I have to use the Solver add in to find the answer, but It is not coming up with a viable answer. I feel like my formulas may be off.

Forelgn currency trading US Dollar British PoundFuro Indian Rup lapanse Yen Rrazilian Real 89.18 134.33 110.32 From US Dollar Uritish Pound 1.50558 0.66376 0.80807 1 1.21584 0.82118 0.01412 0.01719 0.00743 0.00906 0.37154 0.45232 46.0000 69.2567 56.8790 1.78000 2.67993 2.20097 0.03787 0.01994 1.23650 Indian Rupee 0.02128 Japanese Yen0.01120 BrazilianRea0.55975 0.51522 25.7487 49.92 Opportunity for arbitrage (a money pump)? Conversion amounts (from along side, to along top) US Dollar British Pound Euro Indian Rupee Japanese Yen Brazilian ReTotal out 0.00 0.66 0.00 0.00 0.00 0.00 The stratesy is to see whether you can make simultaneous trades so that the net amount received is nonnegative in each currency and is positive in some currency (such as S). Note that if you can make $1, you can make any positive amount by scaling the transactions up limit on the currency being maximized; otherwise the problem could be unbounded. 0.00 0.00 US Dollar British Pound Euro Indian Rupee 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 ward. Therefore, there must be an upper 0.00 Brazilian Real Total in Totat0.00 Final net in Nonnegative 0 Final net $in 1.000 Forelgn currency trading US Dollar British PoundFuro Indian Rup lapanse Yen Rrazilian Real 89.18 134.33 110.32 From US Dollar Uritish Pound 1.50558 0.66376 0.80807 1 1.21584 0.82118 0.01412 0.01719 0.00743 0.00906 0.37154 0.45232 46.0000 69.2567 56.8790 1.78000 2.67993 2.20097 0.03787 0.01994 1.23650 Indian Rupee 0.02128 Japanese Yen0.01120 BrazilianRea0.55975 0.51522 25.7487 49.92 Opportunity for arbitrage (a money pump)? Conversion amounts (from along side, to along top) US Dollar British Pound Euro Indian Rupee Japanese Yen Brazilian ReTotal out 0.00 0.66 0.00 0.00 0.00 0.00 The stratesy is to see whether you can make simultaneous trades so that the net amount received is nonnegative in each currency and is positive in some currency (such as S). Note that if you can make $1, you can make any positive amount by scaling the transactions up limit on the currency being maximized; otherwise the problem could be unbounded. 0.00 0.00 US Dollar British Pound Euro Indian Rupee 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 ward. Therefore, there must be an upper 0.00 Brazilian Real Total in Totat0.00 Final net in Nonnegative 0 Final net $in 1.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts