Question: develop the appropriate spreadsheet and discuss problems in here in value and his value to managers in making service decisions in addition discuss any qualitative

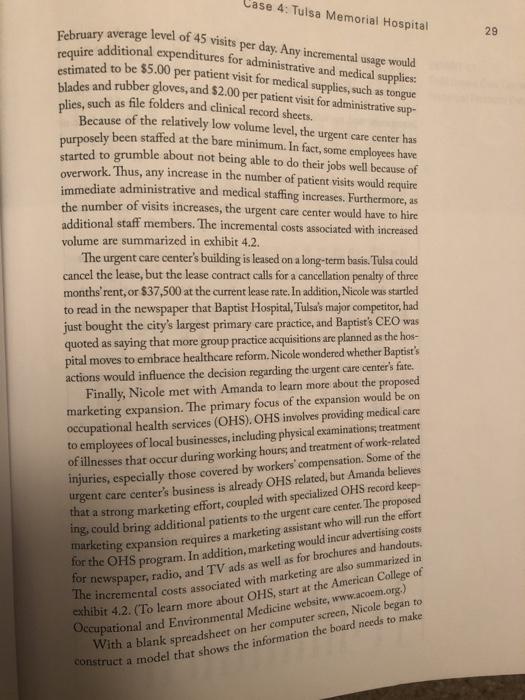

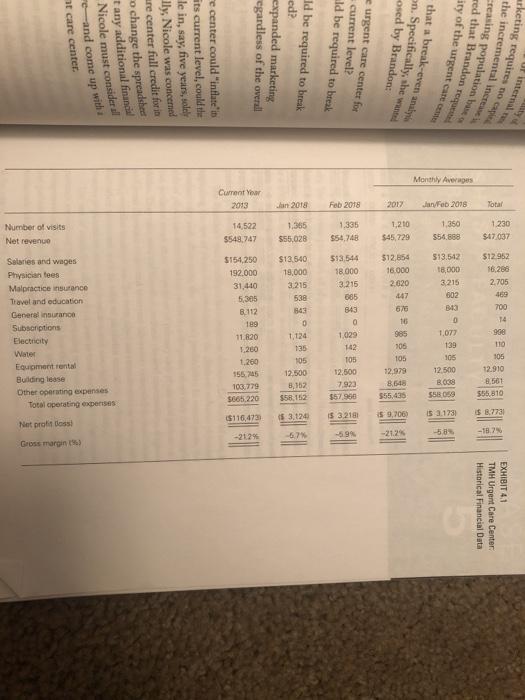

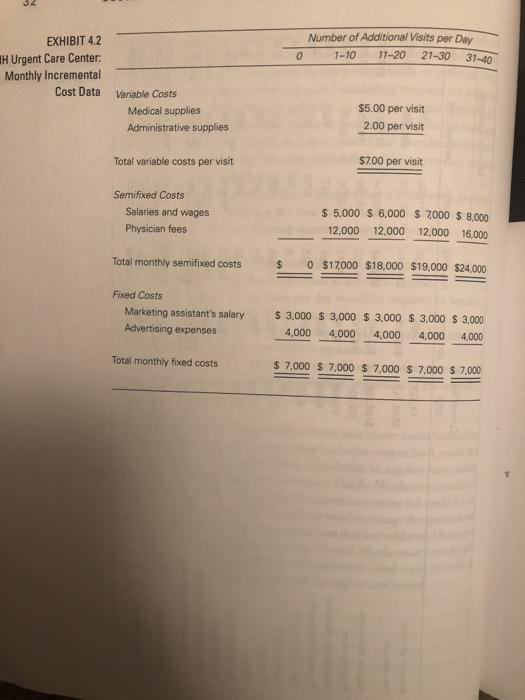

CA: TULSA MEMORIAL HOSPITAL BREAK-EVEN ANALYSIS 4 Tulsa MEMORIAL HOSPITAL (TMH), an acute care hospital with 300 beds and 160 staff physicians, is one of 75 hospitais owned and operated by Health Services of America, a for-profit, publicly owned company. Nine other acute care hospitals serve the same general population, but Tulsa historically has been highly profitable because of its well-appointed facilities, its fine medical staff, its reputation for quality care, and the amount of individual attention it gives to its patients. In addition, Tulsa operates an emergency department (ED) within the hospital complex and a stand-alone urgent care center located across the street from the area's major shopping mall, about two miles from the hospital. According to a Wall Street Journal article, urgent care centers are increas- ingly visited by patients who need immediate treatment for an illness, such as the flu or a sore throat, or an injury, such as a nail-gun wound. Urgent care centers are distinguished from similar types of ambulatory healthcare providers, such as EDs and retail clinics, by the scope of illnesses treated and the presence of on-site facilities. These centers help mitigate the problems of primary care physician shortages and already crowded (and typically very expensive) EDs. Urgent care centers, notes the Wall Street Journal article, are staffed by physicians, offer short wait times, and charge between $60 and $200 per procedure. Furthermore, no appointments are necessary, and evening and weekend hours are frequently available. Finally, many centers offer discounts to the uninsured, and for those with coverage, copayments are typically much less than for ED visits. Currently, about 9,000 urgent cure centers are in operation across the United States, including about 1,500 that are hospital affiliated. Foundation of ACHE, 2018 Reproduction without permission is prohibited 27 ages a Cases in The Urgent Care Association of America has established criteria for designation as a Certified Urgent Care Center. Currently, about half of the centers in the United States have this certification. According to MedLibrary org, "these criteria define scope of service, hours of operation, and staffing requirements. A qualifying facility must accept walk-in patients of all during all hours of operation. It should treat a 'broad-spectrum' of illnesses and injuries, and have the ability to perform minor procedures. An urgent care center must also have on-site diagnostic services, including phlebotomy and x-ray." (For more information on urgent care centers, see www.ucaoa. org.) In addition, urgent care centers can obtain accreditation through The Joint Commission as part of its ambulatory healthcare accreditation program. (For more information, see www.jointcommission.org.) Brandon Harley, Tulsa's chief executive officer, is concerned about the urgent care center's overall financial soundness. About ten years ago, several area hospitals jumped onto the urgent care center bandwagon, and within short time, 15 such centers were scattered around the city. Now, only 11 are left, and none of them appears to be a big moneymaker. Brandon wonders if Tulsa should continue to operate or close its urgent care center. The urgent care center currently handles a patient load of 45 visits per day, but it has the physical capacity to handle up to 85 visits a day. Brandon's decision is complicated by the fact that Amanda Daniels, Tulsa's marketing director, has been pushing to expand the marketing program for the urgent care center. She believes that an expanded marketing effort aimed at local businesses would bring in the number of new patients needed to make the urgent care center a financial winner. Brandon has asked Nicole Williams, Tulsa's chief financial officer, to analyze the options. In their meeting, Brandon stated that he visualizes three potential outcomes for the urgent care center: (1) close it, (2) continue to operate it without expanding marketing, or (3) continue to operate it with an expanded marketing effort. As a starting point, Nicole collected the most recent historical financial and operating data for the urgent care center, which are summarized in exhibit 4.1. In assessing the historical data, she noted that one competing center had recently (December 2017) closed its doors. Furthermore, a review of several years of financial data revealed that the urgent care center does not have a pronounced seasonal utilization pattern. Next, Nicole met several times with the urgent care center's administrative director. The primary purpose of the meetings was to estimate the additional costs that would have to be borne if volume rose above the current January Case 4: Tulsa Memorial Hospital 29 February average level of 45 visits per day. Any incremental usage would require additional expenditures for administrative and medical supplies estimated to be $5.00 per patient visit for medical supplies, such as tongue blades and rubber gloves, and $2.00 per patient visit for administrative sup- plies, such as file folders and clinical record sheets. Because of the relatively low volume level, the urgent care center has purposely been staffed at the bare minimum. In fact, some employees have started to grumble about not being able to do their jobs well because of overwork. Thus, any increase in the number of patient visits would require immediate administrative and medical staffing increases. Furthermore, as the number of visits increases, the urgent care center would have to hire additional staff members. The incremental costs associated with increased volume are summarized in exhibit 4.2. The urgent care center's building is leased on a long-term basis. Tulsa could cancel the lease, but the lease contract calls for a cancellation penalty of three months' rent, or $37,500 at the current lease rate. In addition, Nicole was started to read in the newspaper that Baptist Hospital, Tulsa's major competitor, had just bought the city's largest primary care practice, and Baptist's CEO was quoted as saying that more group practice acquisitions are planned as the hos- pital moves to embrace healthcare reform. Nicole wondered whether Baptist's actions would influence the decision regarding the urgent care center's fate. Finally, Nicole met with Amanda to learn more about the proposed marketing expansion. The primary focus of the expansion would be on occupational health services (OHS).OHS involves providing medical care to employees of local businesses, including physical examinations, treatment of illnesses that occur during working hours, and treatment of work-related injuries, especially those covered by workers' compensation. Some of the urgent care center's business is already OHS related, but Amanda believes that a strong marketing effort, coupled with specialized OHS record keep ing, could bring additional patients to the urgent care center. The proposed marketing expansion requires a marketing assistant who will run the effort for the OHS program. In addition, marketing would incur advertising costs for newspaper, radio, and TV ads as well as for brochures and handouts. The incremental costs associated with marketing are also summarized in exhibit 4.2. (To learn more about OHS, start at the American College of Occupational and Environmental Medicine website , www.acoem.org.) With a blank spreadsheet on her computer screen, Nicole began to construct a model that shows the information the board needs to make 30 Cases in Healthcare Finance a rational, financially sound decision. At first, Nicole planned to conduct a standard capital budgeting analysis that focused on the profitability of the urgent care center as measured by net present value or internal rate of return. But she realized that expanded marketing requires no capital investment and no valid data are available on the incremental increase in visits that would be generated by either an increasing population base or the expanded marketing. Finally, she remembered that Brandon requested that the analysis consider the inherent profitability of the urgent care center without the expanded marketing effort. With these points in mind, Nicole thought that a break-even analysis would be very useful in making the final decision. Specifically, she wanted to develop answers to the following questions posed by Brandon: What is the projected profitability of the urgent care center for the entire year if volume continues at its current level? How many additional visits per day would be required to break even without the expanded marketing? How many additional visits per day would be required to break even, assuming that marketing is expanded? How many additional daily visits would expanded marketing have to bring in to make it worthwhile, regardless of the overall profitability of the urgent care center? In addition, Nicole wondered if the urgent care center could "inflate" its way to profitability, that is, if volume remained at its current level, could the urgent care center be expected to become profitable in, say, five years, solely because of inflationary increases in revenues? Finally, Nicole was concerned about whether the analysis was giving the urgent care center full credit for its financial contributions to Tulsa. She did not want to change the spreadsheet at this late date, but she did want to make sure that any additional financial value was at least considered qualitatively. Overall, Nicole must consider all relevant factors--both quantitative and qualitative and come up recommendation regarding the future of the urgent care center. with a Ut Internal arketing requires no the incremental creasing population bu EXHIBIT 41 TMH Urgent Care Center Historical Financial Data req red that Brandon aty of the urgent cate ceno that a break-even analysis n. Specifically, she wanted Monthly Averages Jan Feb 2018 osed by Brandon: 16 2017 1.210 $45,729 $12.554 16.000 2620 447 676 986 904 SOL 626 urgent care center for current level? ald be required to break 0 1 1,336 $54,748 Feb 2018 $13,544 18.000 1.029 142 105 12.500 0 ld be required to break ed? expanded marketing regardless of the overall Jan 2018 1.365 $55,028 19,000 $12.540 538 3.215 349 1,124 135 105 e center could "inflate it its current level, could the le in, say, five years, solely lly, Nicole was concerned are center full credit for in o change the spreadsheet tany additional financial Nicole must consider al me and come up with t care center Number of visits Net revenue Salaries and wages Malpractice insurance Physiciantes Travel and education General insurance Totalcperating experies Other operating expenses Subscriptions Equiment rental Electricity Building lease Water Net profit loss Gross margin Number of Additional Visits per Day 1-10 11-20 21-30 0 31-40 EXHIBIT 4.2 Urgent Care Center: Monthly Incremental Cost Data Variable Costs Medical supplies Administrative supplies $5.00 per visit 2.00 per visit Total variable costs per visit $7.00 per visit Semifixed Costs Salaries and wages Physician fees $ 5.000 $ 6,000 $ 7000 $ 8,000 12,000 12.000 12,000 16,000 Total monthly semifixed costs $ 0 $17,000 $18,000 $19,000 $24,000 Fixed Costs Marketing assistant's salary Advertising expenses $ 3,000 S 3,000 s 3,000 S 3,000 $3,000 4,000 4,000 4,000 4,000 4,000 Total monthly fixed costs $ 7,000 $ 7.000 $ 7,000 $ 7,000 $ 7.000 CA: TULSA MEMORIAL HOSPITAL BREAK-EVEN ANALYSIS 4 Tulsa MEMORIAL HOSPITAL (TMH), an acute care hospital with 300 beds and 160 staff physicians, is one of 75 hospitais owned and operated by Health Services of America, a for-profit, publicly owned company. Nine other acute care hospitals serve the same general population, but Tulsa historically has been highly profitable because of its well-appointed facilities, its fine medical staff, its reputation for quality care, and the amount of individual attention it gives to its patients. In addition, Tulsa operates an emergency department (ED) within the hospital complex and a stand-alone urgent care center located across the street from the area's major shopping mall, about two miles from the hospital. According to a Wall Street Journal article, urgent care centers are increas- ingly visited by patients who need immediate treatment for an illness, such as the flu or a sore throat, or an injury, such as a nail-gun wound. Urgent care centers are distinguished from similar types of ambulatory healthcare providers, such as EDs and retail clinics, by the scope of illnesses treated and the presence of on-site facilities. These centers help mitigate the problems of primary care physician shortages and already crowded (and typically very expensive) EDs. Urgent care centers, notes the Wall Street Journal article, are staffed by physicians, offer short wait times, and charge between $60 and $200 per procedure. Furthermore, no appointments are necessary, and evening and weekend hours are frequently available. Finally, many centers offer discounts to the uninsured, and for those with coverage, copayments are typically much less than for ED visits. Currently, about 9,000 urgent cure centers are in operation across the United States, including about 1,500 that are hospital affiliated. Foundation of ACHE, 2018 Reproduction without permission is prohibited 27 ages a Cases in The Urgent Care Association of America has established criteria for designation as a Certified Urgent Care Center. Currently, about half of the centers in the United States have this certification. According to MedLibrary org, "these criteria define scope of service, hours of operation, and staffing requirements. A qualifying facility must accept walk-in patients of all during all hours of operation. It should treat a 'broad-spectrum' of illnesses and injuries, and have the ability to perform minor procedures. An urgent care center must also have on-site diagnostic services, including phlebotomy and x-ray." (For more information on urgent care centers, see www.ucaoa. org.) In addition, urgent care centers can obtain accreditation through The Joint Commission as part of its ambulatory healthcare accreditation program. (For more information, see www.jointcommission.org.) Brandon Harley, Tulsa's chief executive officer, is concerned about the urgent care center's overall financial soundness. About ten years ago, several area hospitals jumped onto the urgent care center bandwagon, and within short time, 15 such centers were scattered around the city. Now, only 11 are left, and none of them appears to be a big moneymaker. Brandon wonders if Tulsa should continue to operate or close its urgent care center. The urgent care center currently handles a patient load of 45 visits per day, but it has the physical capacity to handle up to 85 visits a day. Brandon's decision is complicated by the fact that Amanda Daniels, Tulsa's marketing director, has been pushing to expand the marketing program for the urgent care center. She believes that an expanded marketing effort aimed at local businesses would bring in the number of new patients needed to make the urgent care center a financial winner. Brandon has asked Nicole Williams, Tulsa's chief financial officer, to analyze the options. In their meeting, Brandon stated that he visualizes three potential outcomes for the urgent care center: (1) close it, (2) continue to operate it without expanding marketing, or (3) continue to operate it with an expanded marketing effort. As a starting point, Nicole collected the most recent historical financial and operating data for the urgent care center, which are summarized in exhibit 4.1. In assessing the historical data, she noted that one competing center had recently (December 2017) closed its doors. Furthermore, a review of several years of financial data revealed that the urgent care center does not have a pronounced seasonal utilization pattern. Next, Nicole met several times with the urgent care center's administrative director. The primary purpose of the meetings was to estimate the additional costs that would have to be borne if volume rose above the current January Case 4: Tulsa Memorial Hospital 29 February average level of 45 visits per day. Any incremental usage would require additional expenditures for administrative and medical supplies estimated to be $5.00 per patient visit for medical supplies, such as tongue blades and rubber gloves, and $2.00 per patient visit for administrative sup- plies, such as file folders and clinical record sheets. Because of the relatively low volume level, the urgent care center has purposely been staffed at the bare minimum. In fact, some employees have started to grumble about not being able to do their jobs well because of overwork. Thus, any increase in the number of patient visits would require immediate administrative and medical staffing increases. Furthermore, as the number of visits increases, the urgent care center would have to hire additional staff members. The incremental costs associated with increased volume are summarized in exhibit 4.2. The urgent care center's building is leased on a long-term basis. Tulsa could cancel the lease, but the lease contract calls for a cancellation penalty of three months' rent, or $37,500 at the current lease rate. In addition, Nicole was started to read in the newspaper that Baptist Hospital, Tulsa's major competitor, had just bought the city's largest primary care practice, and Baptist's CEO was quoted as saying that more group practice acquisitions are planned as the hos- pital moves to embrace healthcare reform. Nicole wondered whether Baptist's actions would influence the decision regarding the urgent care center's fate. Finally, Nicole met with Amanda to learn more about the proposed marketing expansion. The primary focus of the expansion would be on occupational health services (OHS).OHS involves providing medical care to employees of local businesses, including physical examinations, treatment of illnesses that occur during working hours, and treatment of work-related injuries, especially those covered by workers' compensation. Some of the urgent care center's business is already OHS related, but Amanda believes that a strong marketing effort, coupled with specialized OHS record keep ing, could bring additional patients to the urgent care center. The proposed marketing expansion requires a marketing assistant who will run the effort for the OHS program. In addition, marketing would incur advertising costs for newspaper, radio, and TV ads as well as for brochures and handouts. The incremental costs associated with marketing are also summarized in exhibit 4.2. (To learn more about OHS, start at the American College of Occupational and Environmental Medicine website , www.acoem.org.) With a blank spreadsheet on her computer screen, Nicole began to construct a model that shows the information the board needs to make 30 Cases in Healthcare Finance a rational, financially sound decision. At first, Nicole planned to conduct a standard capital budgeting analysis that focused on the profitability of the urgent care center as measured by net present value or internal rate of return. But she realized that expanded marketing requires no capital investment and no valid data are available on the incremental increase in visits that would be generated by either an increasing population base or the expanded marketing. Finally, she remembered that Brandon requested that the analysis consider the inherent profitability of the urgent care center without the expanded marketing effort. With these points in mind, Nicole thought that a break-even analysis would be very useful in making the final decision. Specifically, she wanted to develop answers to the following questions posed by Brandon: What is the projected profitability of the urgent care center for the entire year if volume continues at its current level? How many additional visits per day would be required to break even without the expanded marketing? How many additional visits per day would be required to break even, assuming that marketing is expanded? How many additional daily visits would expanded marketing have to bring in to make it worthwhile, regardless of the overall profitability of the urgent care center? In addition, Nicole wondered if the urgent care center could "inflate" its way to profitability, that is, if volume remained at its current level, could the urgent care center be expected to become profitable in, say, five years, solely because of inflationary increases in revenues? Finally, Nicole was concerned about whether the analysis was giving the urgent care center full credit for its financial contributions to Tulsa. She did not want to change the spreadsheet at this late date, but she did want to make sure that any additional financial value was at least considered qualitatively. Overall, Nicole must consider all relevant factors--both quantitative and qualitative and come up recommendation regarding the future of the urgent care center. with a Ut Internal arketing requires no the incremental creasing population bu EXHIBIT 41 TMH Urgent Care Center Historical Financial Data req red that Brandon aty of the urgent cate ceno that a break-even analysis n. Specifically, she wanted Monthly Averages Jan Feb 2018 osed by Brandon: 16 2017 1.210 $45,729 $12.554 16.000 2620 447 676 986 904 SOL 626 urgent care center for current level? ald be required to break 0 1 1,336 $54,748 Feb 2018 $13,544 18.000 1.029 142 105 12.500 0 ld be required to break ed? expanded marketing regardless of the overall Jan 2018 1.365 $55,028 19,000 $12.540 538 3.215 349 1,124 135 105 e center could "inflate it its current level, could the le in, say, five years, solely lly, Nicole was concerned are center full credit for in o change the spreadsheet tany additional financial Nicole must consider al me and come up with t care center Number of visits Net revenue Salaries and wages Malpractice insurance Physiciantes Travel and education General insurance Totalcperating experies Other operating expenses Subscriptions Equiment rental Electricity Building lease Water Net profit loss Gross margin Number of Additional Visits per Day 1-10 11-20 21-30 0 31-40 EXHIBIT 4.2 Urgent Care Center: Monthly Incremental Cost Data Variable Costs Medical supplies Administrative supplies $5.00 per visit 2.00 per visit Total variable costs per visit $7.00 per visit Semifixed Costs Salaries and wages Physician fees $ 5.000 $ 6,000 $ 7000 $ 8,000 12,000 12.000 12,000 16,000 Total monthly semifixed costs $ 0 $17,000 $18,000 $19,000 $24,000 Fixed Costs Marketing assistant's salary Advertising expenses $ 3,000 S 3,000 s 3,000 S 3,000 $3,000 4,000 4,000 4,000 4,000 4,000 Total monthly fixed costs $ 7,000 $ 7.000 $ 7,000 $ 7,000 $ 7.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts