Question: Develop Window Help Safari File Edit View History Bookmarks mathxl.com ... FIN 310 Spring 2020 Save Homework: Chapter 10 Homework Score: 0 of 1 pt

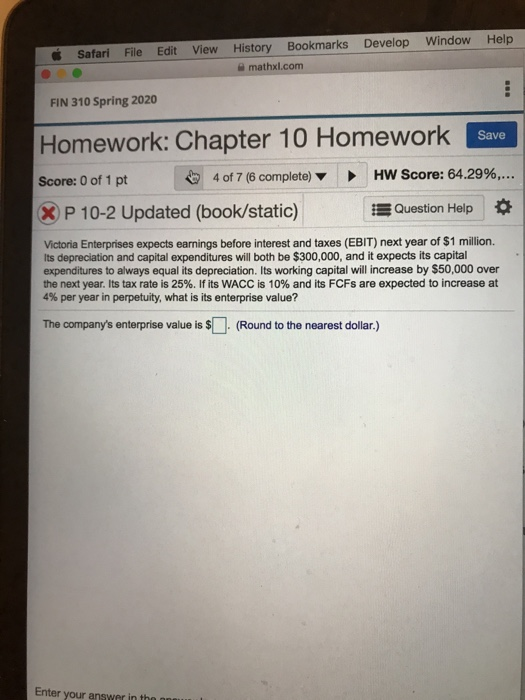

Develop Window Help Safari File Edit View History Bookmarks mathxl.com ... FIN 310 Spring 2020 Save Homework: Chapter 10 Homework Score: 0 of 1 pt 4 of 7 (6 complete) HW Score: 64.29%.... XP 10-2 Updated (book/static) Question Help Victoria Enterprises expects earnings before interest and taxes (EBIT) next year of $1 million. Its depreciation and capital expenditures will both be $300,000, and it expects its capital expenditures to always equal its depreciation. Its working capital will increase by $50,000 over the next year. Its tax rate is 25%. If its WACC is 10% and its FCFs are expected to increase at 4% per year in perpetuity, what is its enterprise value? The company's enterprise value is $. (Round to the nearest dollar.) Enter your answer in the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts