Question: Develop Your Business Language Match the terms listed with the definitions. Some tetms will not be used. 1. An individual or business is responsible to

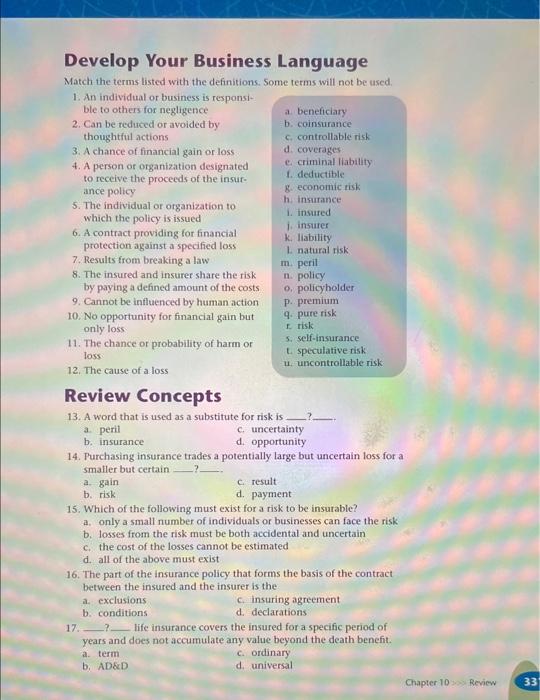

Develop Your Business Language Match the terms listed with the definitions. Some tetms will not be used. 1. An individual or business is responsible to others for negligence a. beneficiary 2. Can be reduced or avoided by b. coinsurance thoughtful actions c. controllable risk 3. A chance of financial gain or loss: d. coverages 4. A person or organization designated c. criminal liability to receive the proceeds of the insur- f. deductible: ance policy g. economic risk 5. The individual or organization to h. insurance which the policy is issued 1. insured 6. A contract providing for financial 1. insturer k. liability. protection against a specified loss 1. natural risk 7. Results from breaking a law im. peril 8. The insured and insurer share the risk ii. policy by paying a defined amount of the costs O. policyholder 9. Cannot be influenced by human action p. premium 10. No opportunity for financial gain but 9. pure tisk only loss f. risk 11. The chance or probability of harm or 5. self-insurance loss: t. speculative risk 4. uncontrollable risk 12. The cause of a loss Review Concepts 13. A word that is used as a substitute for risk is a. peril c. uncertainty b. insurance d. opportunity 14. Purchasing insurance trades a potentially large but uncertain loss for a smafler but certain a. gain c. result b. risk d. payment 15. Which of the following must exist for a risk to be insurable? a. only a small number of individuals or businesses can face the risk b. losses from the risk must be both accidental and uncertain c. the cost of the losses cannot be estimated d. all of the above must exist 16. The part of the insurance policy that forms the bisis of the contract between the insured and the insurer is the a. exclusions c. insuring agreement b. conditions d. declarations 17. __ ? life insurance covers the insured for a specific period of years and does not accumulate any value beyond the death benefit. a. term c. ordinary b. ADECD d. universal Develop Your Business Language Match the terms listed with the definitions. Some tetms will not be used. 1. An individual or business is responsible to others for negligence a. beneficiary 2. Can be reduced or avoided by b. coinsurance thoughtful actions c. controllable risk 3. A chance of financial gain or loss: d. coverages 4. A person or organization designated c. criminal liability to receive the proceeds of the insur- f. deductible: ance policy g. economic risk 5. The individual or organization to h. insurance which the policy is issued 1. insured 6. A contract providing for financial 1. insturer k. liability. protection against a specified loss 1. natural risk 7. Results from breaking a law im. peril 8. The insured and insurer share the risk ii. policy by paying a defined amount of the costs O. policyholder 9. Cannot be influenced by human action p. premium 10. No opportunity for financial gain but 9. pure tisk only loss f. risk 11. The chance or probability of harm or 5. self-insurance loss: t. speculative risk 4. uncontrollable risk 12. The cause of a loss Review Concepts 13. A word that is used as a substitute for risk is a. peril c. uncertainty b. insurance d. opportunity 14. Purchasing insurance trades a potentially large but uncertain loss for a smafler but certain a. gain c. result b. risk d. payment 15. Which of the following must exist for a risk to be insurable? a. only a small number of individuals or businesses can face the risk b. losses from the risk must be both accidental and uncertain c. the cost of the losses cannot be estimated d. all of the above must exist 16. The part of the insurance policy that forms the bisis of the contract between the insured and the insurer is the a. exclusions c. insuring agreement b. conditions d. declarations 17. __ ? life insurance covers the insured for a specific period of years and does not accumulate any value beyond the death benefit. a. term c. ordinary b. ADECD d. universal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts