Question: Developing Project Evaluation worksheet New/Expansion project example: Phasel: Net Initial Outlay Determining the Installed Cost (IC) / Total depreciable asset (TDA) IC TDA will be

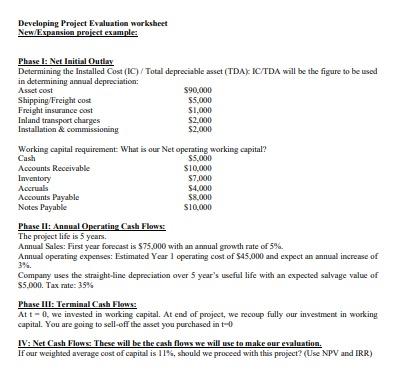

Developing Project Evaluation worksheet New/Expansion project example: Phasel: Net Initial Outlay Determining the Installed Cost (IC) / Total depreciable asset (TDA) IC TDA will be the figure to be used in determining annual depreciation: Asset cost $90,000 Shipping Freight cost $5,000 Freight insurance cost $1,000 Inland transport charges $2.000 Installation & commissioning $2.000 Working capital requirement: What is our Net operating working capital? Cash 55.000 Accounts Receivable $10,000 Inventory $7.000 Accruals $4.000 Accounts Payable $8.000 Notes Payable $10.000 Phase II: Annual Operating Cash Flows: The project life is 5 years. Annual Sales: First year forecast is $75.000 with an annual growth rate of 5%. Annual operating expenses: Estimated Year 1 operating cost of $45,000 and expect an annual increase of Company uses the straight-line depreciation over 5 year's useful life with an expected salvage value of $5.000. Tax rate: 35% Phase IIT: Terminal Cash Flows: Att - Q. we invested in working capital. At end of project, we recoup fully our investment in working capital. You are going to sell-off the asset you purchased into IV: Net Cash Flows. These will be the cash flows we will use to make our evaluation. If our weighted average cost of capital is 11%, should we proceed with this project? (Use NPV and IRR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts