Question: Development projects done by Standalone Products are subsidized by a government grant program. The program pays 35 percent of the total cost of the project

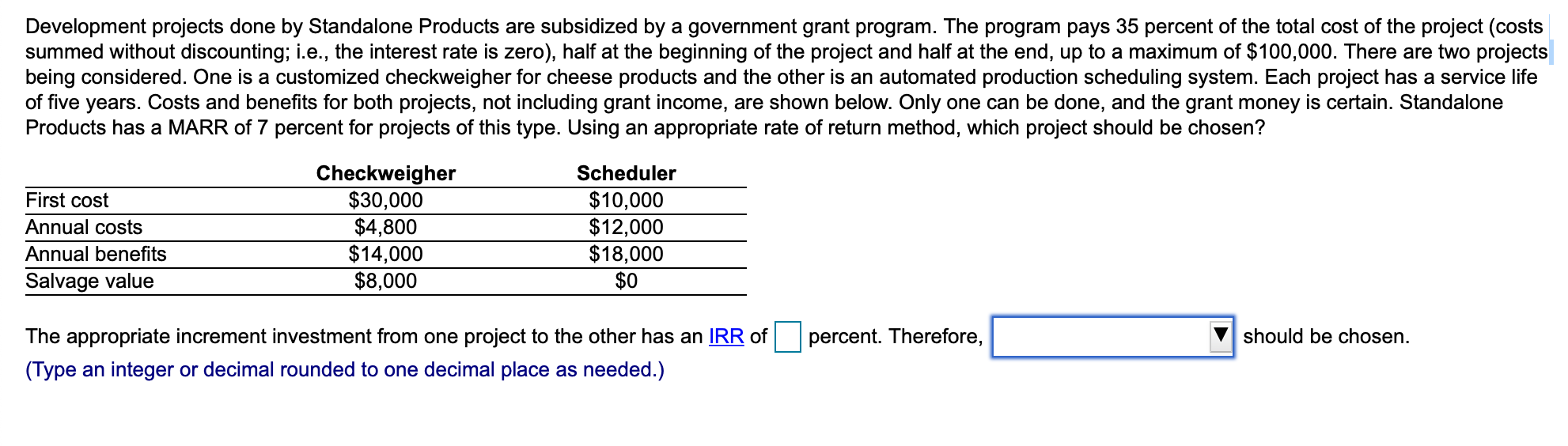

Development projects done by Standalone Products are subsidized by a government grant program. The program pays 35 percent of the total cost of the project (costs summed without discounting; i.e., the interest rate is zero), half at the beginning of the project and half at the end, up to a maximum of $100,000. There are two projects being considered. One is a customized checkweigher for cheese products and the other is an automated production scheduling system. Each project has a service life of five years. Costs and benefits for both projects, not including grant income, are shown below. Only one can be done, and the grant money is certain. Standalone Products has a MARR of 7 percent for projects of this type. Using an appropriate rate of return method, which project should be chosen?

Development projects done by Standalone Products are subsidized by a government grant program. The program pays 35 percent of the total cost of the project (costs summed without discounting; i.e., the interest rate is zero), half at the beginning of the project and half at the end, up to a maximum of $100,000. There are two projects being considered. One is a customized checkweigher for cheese products and the other is an automated production scheduling system. Each project has a service life of five years. Costs and benefits for both projects, not including grant income, are shown below. Only one can be done, and the grant money is certain. Standalone Products has a MARR of 7 percent for projects of this type. Using an appropriate rate of return method, which project should be chosen? First cost Annual costs Annual benefits Salvage value Checkweigher $30,000 $4,800 $14,000 $8,000 Scheduler $10,000 $12,000 $18,000 $0 percent. Therefore, should be chosen. The appropriate increment investment from one project to the other has an IRR of (Type an integer or decimal rounded to one decimal place as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts