Question: Devon Manufacturing is preparing its comprehensive budget for the first quarter of the upcoming year. The following data pertain to Devon Manufacturing's operations: View the

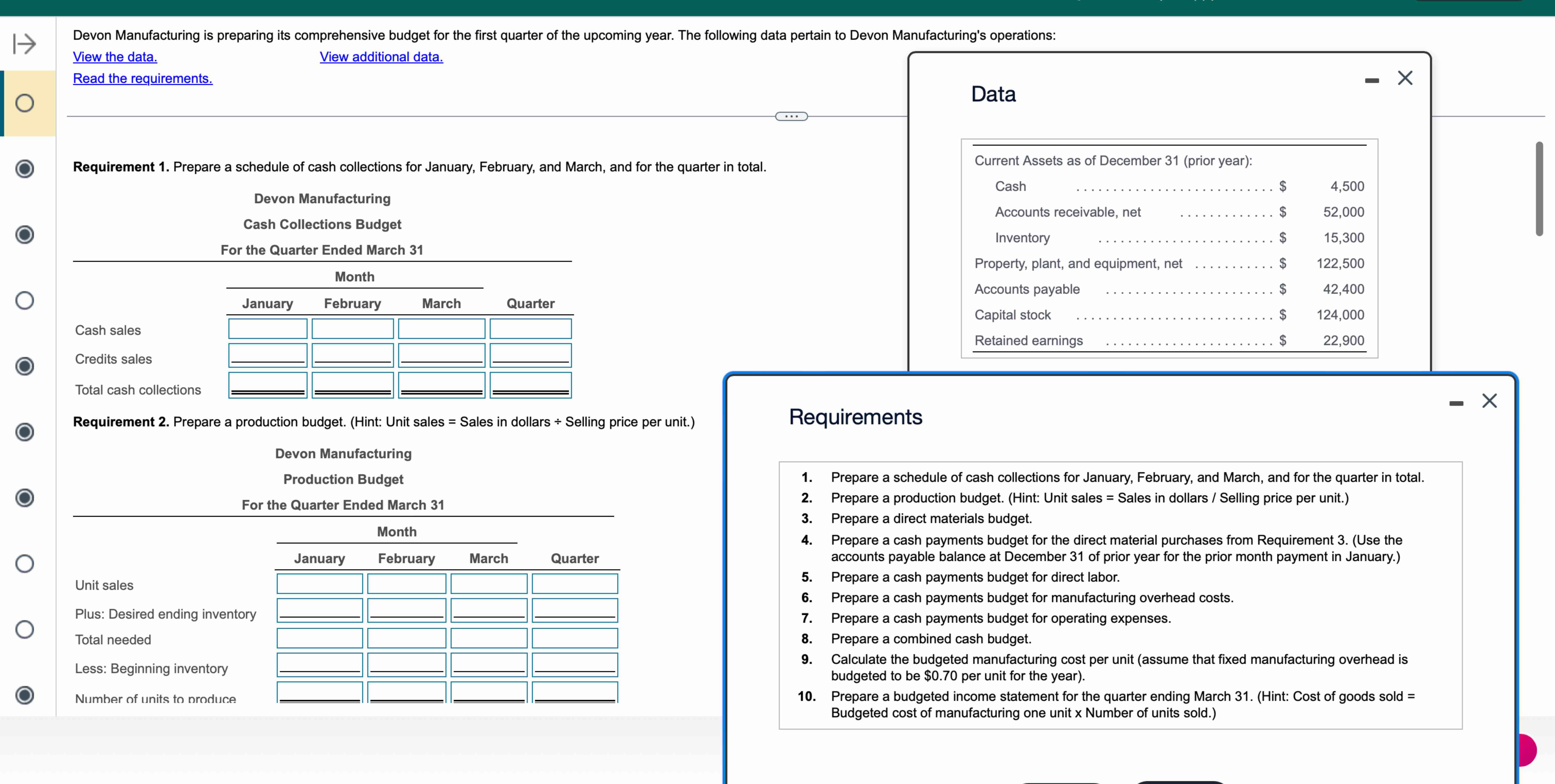

Devon Manufacturing is preparing its comprehensive budget for the first quarter of the upcoming year. The following data pertain to Devon Manufacturing's operations:

View the data.

Read the requirements.

Requirement Prepare a schedule of cash collections for January, February, and March, and for the quarter in total.

Devon Manufacturing

Cash Collections Budget

For the Quarter Ended March

Data

Requirements

Prepare a schedule of cash collections for January, February, and March, and for the quarter in total.

Prepare a production budget. Hint: Unit sales Sales in dollars Selling price per unit.

Prepare a direct materials budget.

Prepare a cash payments budget for the direct material purchases from Requirement Use the accounts payable balance at December of prior year for the prior month payment in January.

Prepare a cash payments budget for direct labor.

Prepare a cash payments budget for manufacturing overhead costs.

Prepare a cash payments budget for operating expenses.

Prepare a combined cash budget.

Calculate the budgeted manufacturing cost per unit assume that fixed manufacturing overhead is budgeted to be $ per unit for the year

Prepare a budgeted income statement for the quarter ending March Hint: Cost of goods sold Budgeted cost of manufacturing one unit x Number of units sold. Additional data

b Sales are cash and credit. All credit sales are collected in the month following the sale.

c Devon Manufacturing has a policy stating that each month's ending inventory of finished goods should be of the following month's sales in units inventory of direct materials should be of next month's production needs. the work is performed. The direct labor total cost for each of the upcoming three months is as follows:

are paid in the month in which they are incurred. and March's cash expenditure will be $

i Depreciation on the building and equipment for the general and administrative offices is budgeted to be $ for the entire quarter, which includes depreciation on new acquisitions. funds at the end of the quarter. The company would also pay the accumulated interest at the end of the quarter on the funds borrowed during the quarter.

k The company's income tax rate is projected to be of operating income less interest expense. The company pays $ cash at the end of February in estimated taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock