Question: Devon signed a 20-year note payable on January 1, 2018. The note requires annual principal payments plus interest. The entry to record the annual payment

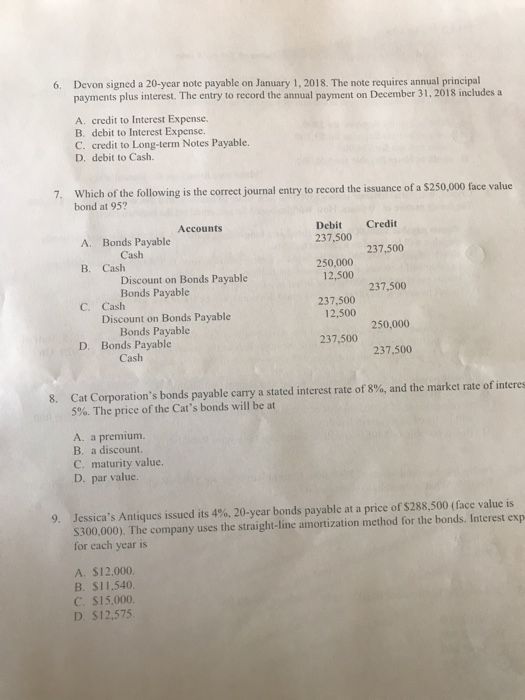

Devon signed a 20-year note payable on January 1, 2018. The note requires annual principal payments plus interest. The entry to record the annual payment on December 31, 2018 includes a 6. A. credit to Interest Expense. B. debit to Interest Expense. C. credit to Long-term Notes Payable. D. debit to Cash. 7. Which of the following is the correct journal entry to record the issuance of a $250,000 face value bond at 95? Accounts Debit Credit A. Bonds Payable 237,500 Cash 237,500 B. Cash 250,000 12,500 Discount on Bonds Payable Bonds Payable 237,500 C. Cash 237,500 12,500 Discount on Bonds Payable Bonds Payable 250,000 D. Bonds Payable 237,500 Cash 237,500 Cat Corporation's bondspayable carry a stated interest rate of 8%, and the market rate of interes 5%. The price of the Cat's bonds will be at 8 A. a premium. B. a discount. C. maturity value. D. par value. Jessica's Antiques issued its 4%, 20-year bonds payable at a price of $288,500 (face value is S300.000). The company uses the straight-line amortization method for the bonds. Interest exp for each year is 9, A. $12,000 B. $11,540 C. S15,000. D. S12,575

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts