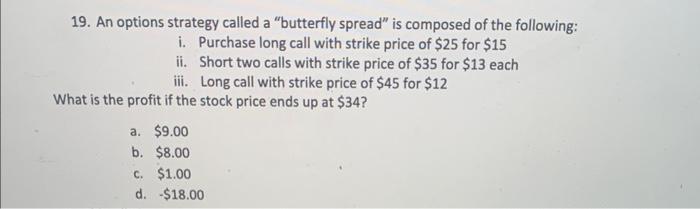

Question: 19. An options strategy called a butterfly spread is composed of the following: i. Purchase long call with strike price of $25 for $15

19. An options strategy called a "butterfly spread" is composed of the following: i. Purchase long call with strike price of $25 for $15 ii. Short two calls with strike price of $35 for $13 each Long call with strike price of $45 for $12 iii. What is the profit if the stock price ends up at $34? a. $9.00 b. $8.00 c. $1.00 d. -$18.00

Step by Step Solution

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Particulars Long call 25 short call 35 Long call 45 Total ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635dcf56bd538_179057.pdf

180 KBs PDF File

635dcf56bd538_179057.docx

120 KBs Word File