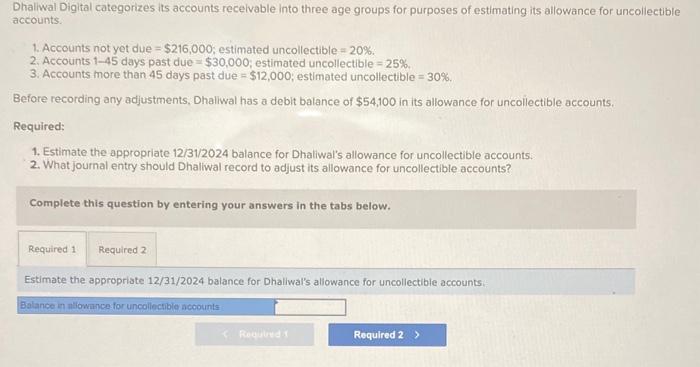

Question: Dhaliwal Digital categorizes its accounts recelvable into three age groups for purposes of estimating its allowance for uncollectible accounts. 1. Accounts not yet due =$216,000;

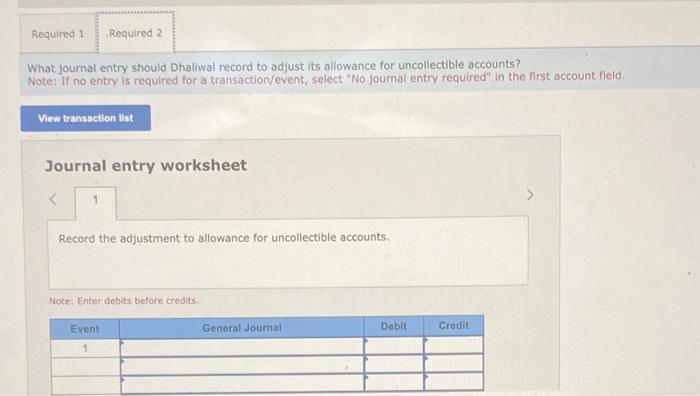

Dhaliwal Digital categorizes its accounts recelvable into three age groups for purposes of estimating its allowance for uncollectible accounts. 1. Accounts not yet due =$216,000; estimated uncollectible =20%. 2. Accounts 145 days past due =$30,000; estimated uncollectible =25%. 3. Accounts more than 45 days past due =$12,000; estimated uncollectible =30%. Before recording any adjustments, Dhaliwal has a debit balance of $54,100 in its allowance for uncollectible accounts. Required: 1. Estimate the appropriate 12/31/2024 balance for Dhaliwal's allowance for uncollectible accounts: 2. What journal entry should Dhallwal record to adjust its allowance for uncollectible accounts? Complete this question by entering your answers in the tabs below. Estimate the appropriste 12/31/2024 balance for Dhallwal's allowance for uncollectible accounts.: What journal entry should Dhaliwal record to adjust its allowance for uncollectible accounts? Note: If no entry is required for a transaction/event, select "No journal entry required". in the first account fleid. Journal entry worksheet Record the adjustment to allowance for uncollectible accounts. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts