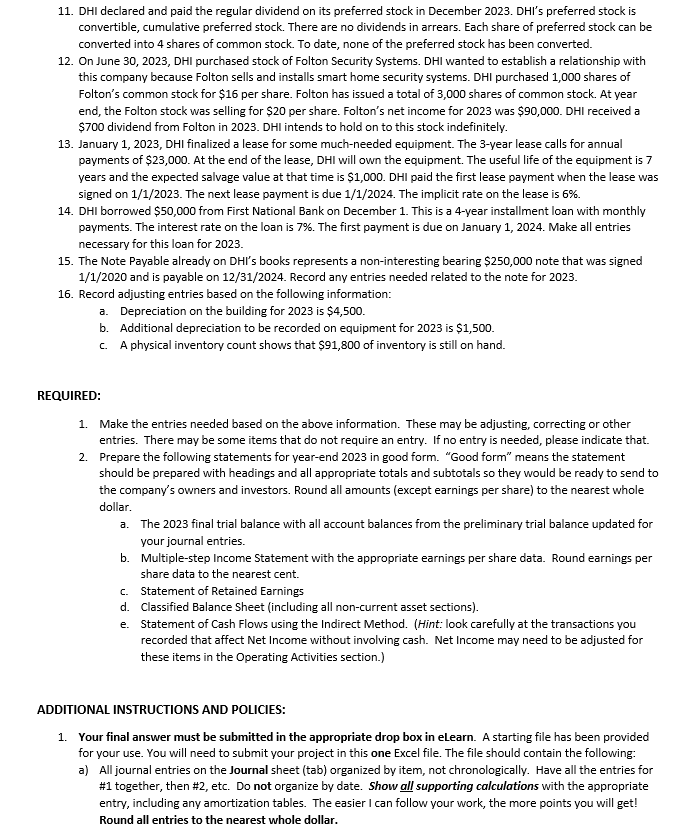

Question: DHI declared and paid the regular dividend on its preferred stock in December 2 0 2 3 . DHI's preferred stock is convertible, cumulative preferred

DHI declared and paid the regular dividend on its preferred stock in December DHI's preferred stock is

convertible, cumulative preferred stock. There are no dividends in arrears. Each share of preferred stock can be

converted into shares of common stock. To date, none of the preferred stock has been converted.

On June DHI purchased stock of Folton Security Systems. DHI wanted to establish a relationship with

this company because Folton sells and installs smart home security systems. DHI purchased shares of

Folton's common stock for $ per share. Folton has issued a total of shares of common stock. At year

end, the Folton stock was selling for $ per share. Folton's net income for was $ DHI received a

$ dividend from Folton in DHI intends to hold on to this stock indefinitely.

January DHI finalized a lease for some muchneeded equipment. The year lease calls for annual

payments of $ At the end of the lease, DHI will own the equipment. The useful life of the equipment is

years and the expected salvage value at that time is $ DHI paid the first lease payment when the lease was

signed on The next lease payment is due The implicit rate on the lease is

DHI borrowed $ from First National Bank on December This is a year installment loan with monthly

payments. The interest rate on the loan is The first payment is due on January Make all entries

necessary for this loan for

The Note Payable already on DHI s books represents a noninteresting bearing $ note that was signed

and is payable on Record any entries needed related to the note for

Record adjusting entries based on the following information:

a Depreciation on the building for is $

b Additional depreciation to be recorded on equipment for is $

c A physical inventory count shows that $ of inventory is still on hand.

REQUIRED:

Make the entries needed based on the above information. These may be adjusting, correcting or other

entries. There may be some items that do not require an entry. If no entry is needed, please indicate that.

Prepare the following statements for yearend in good form. "Good form" means the statement

should be prepared with headings and all appropriate totals and subtotals so they would be ready to send to

the company's owners and investors. Round all amounts except earnings per share to the nearest whole

dollar.

a The final trial balance with all account balances from the preliminary trial balance updated for

your journal entries.

b Multiplestep Income Statement with the appropriate earnings per share data. Round earnings per

share data to the nearest cent.

c Statement of Retained Earnings

d Classified Balance Sheet including all noncurrent asset sections

e Statement of Cash Flows using the Indirect Method. Hint: look carefully at the transactions you

recorded that affect Net Income without involving cash. Net Income may need to be adjusted for

these items in the Operating Activities section.

ADDITIONAL INSTRUCTIONS AND POLICIES:

Your final answer must be submitted in the appropriate drop box in elearn. A starting file has been provided

for your use. You will need to submit your project in this one Excel file. The file should contain the following:

a All journal entries on the Journal sheet tab organized by item, not chronologically. Have all the entries for

# together, then # etc. Do not organize by date. Show all supporting calculations with the appropriate

entry, including any amortization tables. The easier I can follow your work, the more points you will get!

Round all entries to the nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock