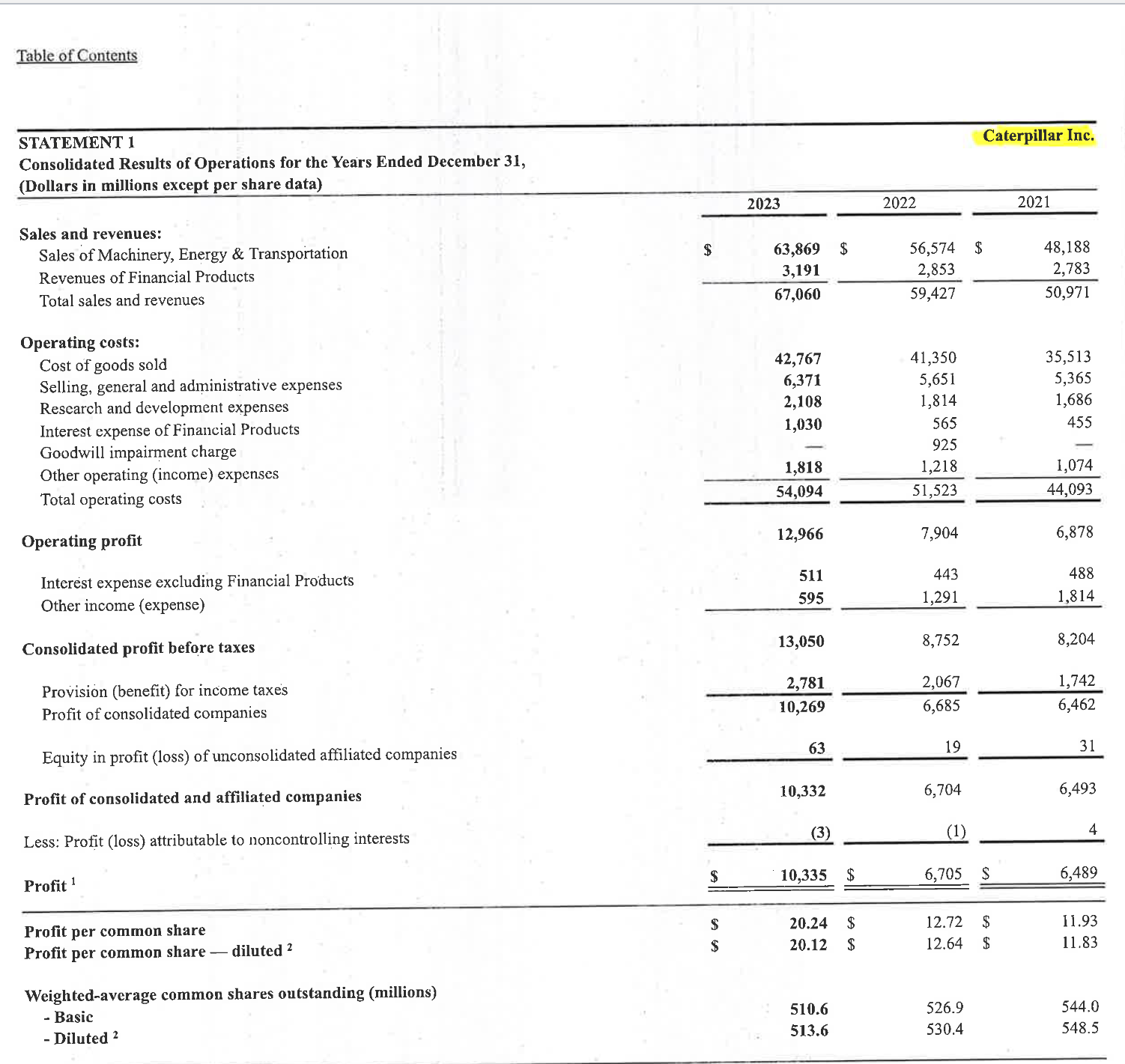

Question: Did CAT s operating profit margin improve in 2 0 2 3 ? Show your math. 2 . In 2 0 2 3 , how

Did CATs operating profit margin improve in Show your math.

In how much cash flow was generated by operating activities?

In did gross profit margin on sales of machinery increase or decrease? Show

your math. What factors do you think might have contributed to that change in

margin?

At the end of how many days sales of receivables trade and other did CAT

have. Show your math.

If the CFO was able to drive receivables days sales outstanding to would that

generate cash for the company, or absorb cash? Explain.

With respect to each of the following costs, indicate which would be expensed

immediately upon incurrence, versus those that would be capitalized to be

expensed at some later time

a Payment of corporate payroll

Expensed Capitalized

b Payment to a contractor for work expanding a CAT production facility

Expensed Capitalized

c Payment to purchase raw materials used to produce machinery for sale

Expensed Capitalized

d Payment of purchase price to acquire a small competitor

Expensed Capitalized

e Payment of rent for leased facilities

Expensed Capitalized

If CAT sold a piece of mining equipment out of inventory for cash, what would be

the accounting entries two debits, two credits

How much profit net income did CAT earn in

What was the profit per common share? How many shares of stock does

this imply were outstanding in Does that number directionally tie to the

number of shares outstanding as described on the balance sheet? Explain.

How much cash did CAT pay out in dividends in What does that indicate

that dividends per share received by CAT shareholders in were?

How much cash did CAT use in to repurchase common shares? What

would the expected benefit of this be to the shareholders just the concept, not

the math

What is the market value of CATs equity based on the current stock price?

What is CATs Enterprise Value or total company value based on the current

stock price? Show your math.

Drawing on your answer to # what proportions are debt and equity in CATs

capital structure based on the market value of equity, rather than balance sheet

value of equity

On that basis, do you view CATs capital structure as being more conservative

than was Massey Fergusons in text book chapter

What is the multiple of CATs Enterprise Value Cash Flow from

Operations? Show your math.

If this multiple were instead, would CATs stock represent a better value to

you as an investor considering buying the stock now all other things remaining

the same

Extra credit question: Referring to the attached CAT stock price chart and the

below blurb, what factors do you think might contribute to CAT having a higher

than average beta?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock