Question: did I do (E) and (F) correctly??? b) Compute the bid-ask spread for the two pairs (2) NZD/JPY and USD/JPY (Ask Bid) / Ask NZD/JPY

did I do (E) and (F) correctly???

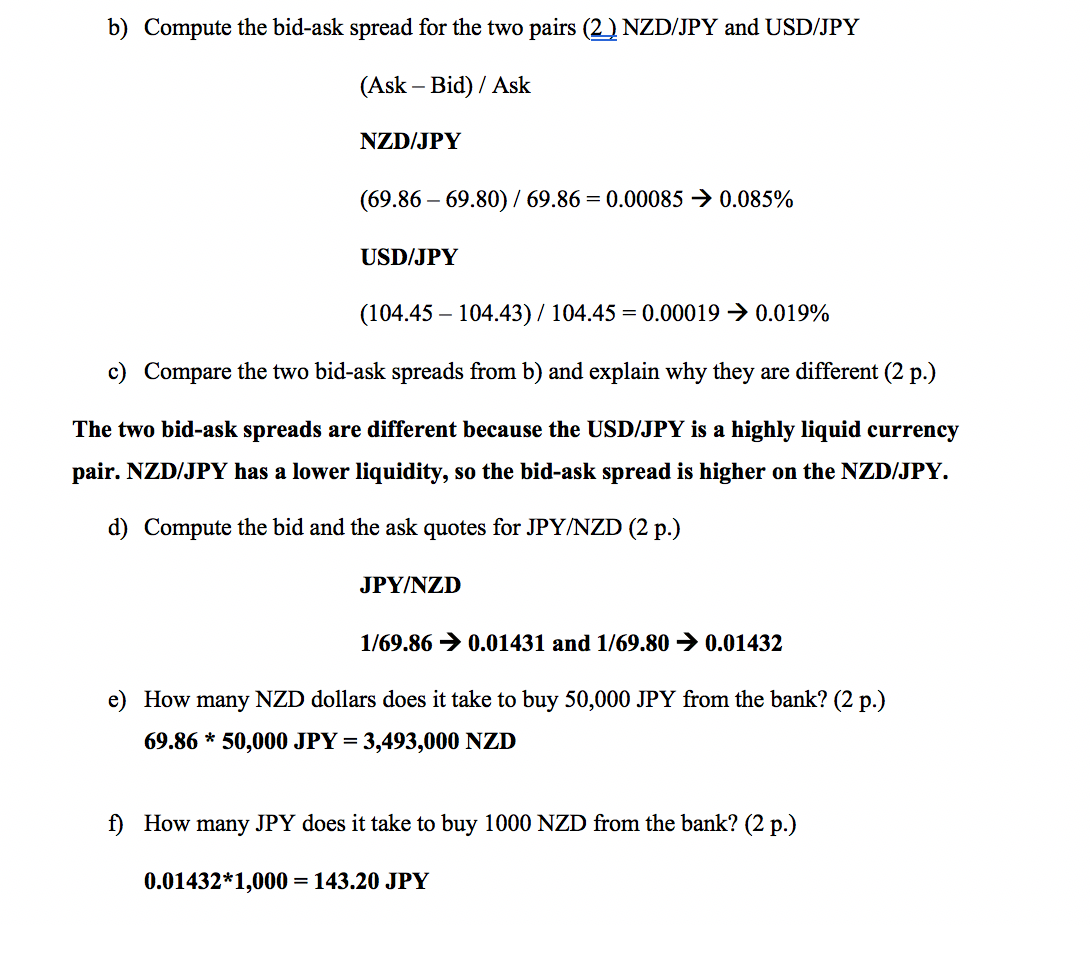

b) Compute the bid-ask spread for the two pairs (2) NZD/JPY and USD/JPY (Ask Bid) / Ask NZD/JPY (69.86 - 69.80) / 69.86 = 0.00085 0.085% USD/JPY (104.45 104.43) / 104.45 = 0.00019 0.019% c) Compare the two bid-ask spreads from b) and explain why they are different (2 p.) The two bid-ask spreads are different because the USD/JPY is a highly liquid currency pair. NZD/JPY has a lower liquidity, so the bid-ask spread is higher on the NZD/JPY. d) Compute the bid and the ask quotes for JPY/NZD (2 p.) JPY/NZD 1/69.86 0.01431 and 1/69.80 0.01432 How many NZD dollars does it take to buy 50,000 JPY from the bank? (2 p.) 69.86 * 50,000 JPY = 3,493,000 NZD f) How many JPY does it take to buy 1000 NZD from the bank? (2 p.) 0.01432*1,000 = 143.20 JPY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts