Question: did i do these 2 question correctly give me an answer so i understand thank you!! Question 1 This question consists of TEN(10) multiple-choice questions.

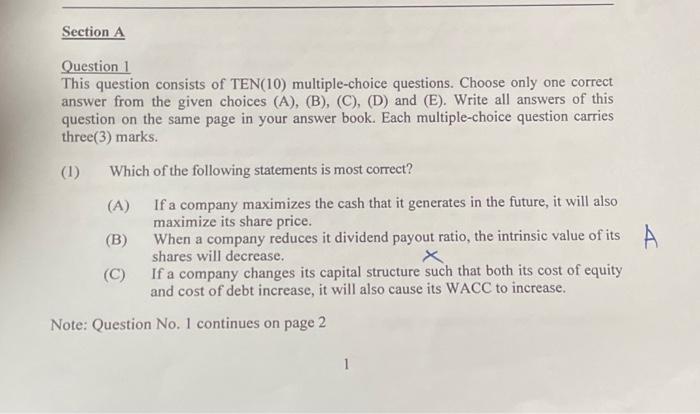

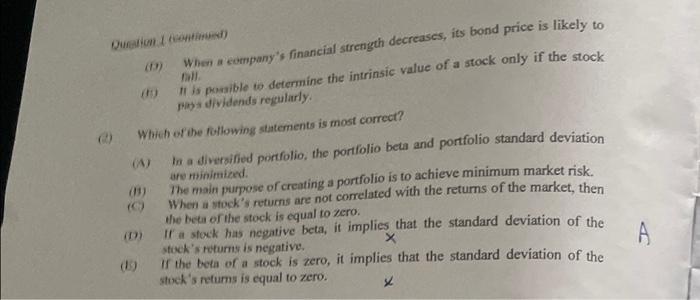

Question 1 This question consists of TEN(10) multiple-choice questions. Choose only one correct answer from the given choices (A), (B), (C), (D) and (E). Write all answers of this question on the same page in your answer book. Each multiple-choice question carries three(3) marks. (1) Which of the following statements is most correct? (A) If a company maximizes the cash that it generates in the future, it will also maximize its share price. (B) When a company reduces it dividend payout ratio, the intrinsic value of its shares will decrease. (C) If a company changes its capital structure such that both its cost of equity and cost of debt increase, it will also cause its WACC to increase. Note: Question No. 1 continues on page 2 Qufarion ( Riditimind) (13) When a company's financial strength decreases, its bond price is likely to liil. (11) II is posable to determine the intrinsic value of a stock only if the stock rass dividends regularly. (i) Which of the following statements is most correct? (A) In a diversified porffolio, the portfolio beta and portfolio standard deviation are minimized. (11) The main purpose of creating a portfolio is to achieve minimum market risk. (C) When a stock's returns are not correlated with the returns of the market, then the beta of the stock is equal to zero. (17) If a sfock has negative beta, it implies that the standard deviation of the stock's returns is negative. (b) If the beta of a stock is zero, it implies that the standard deviation of the stuch's returns is equal to zero. x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts