Question: Did I do these correctly? If not, can you help me answer them? In January 1,2024 , White Water issues $580,000 of 5% bonds, due

Did I do these correctly? If not, can you help me answer them?

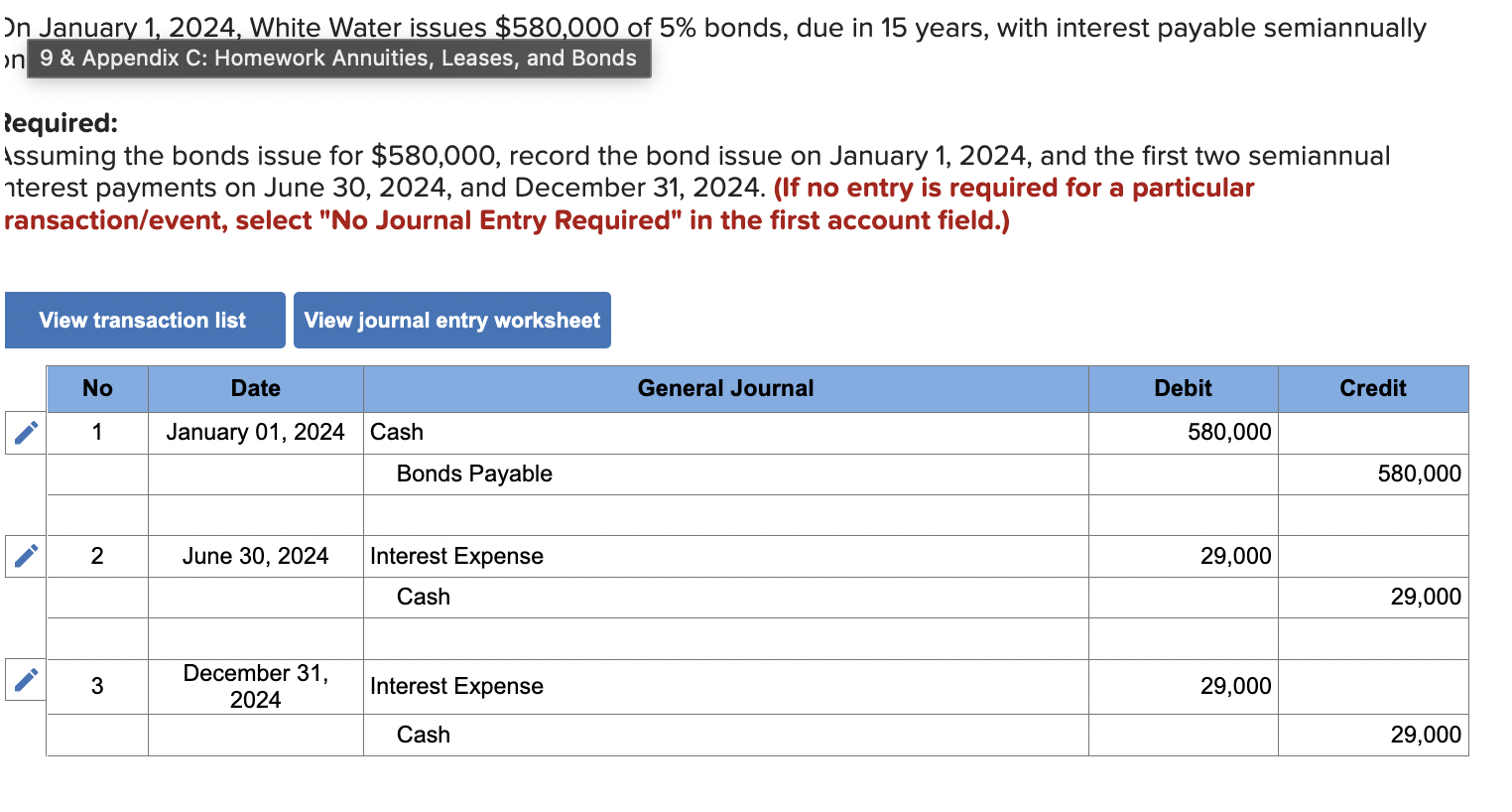

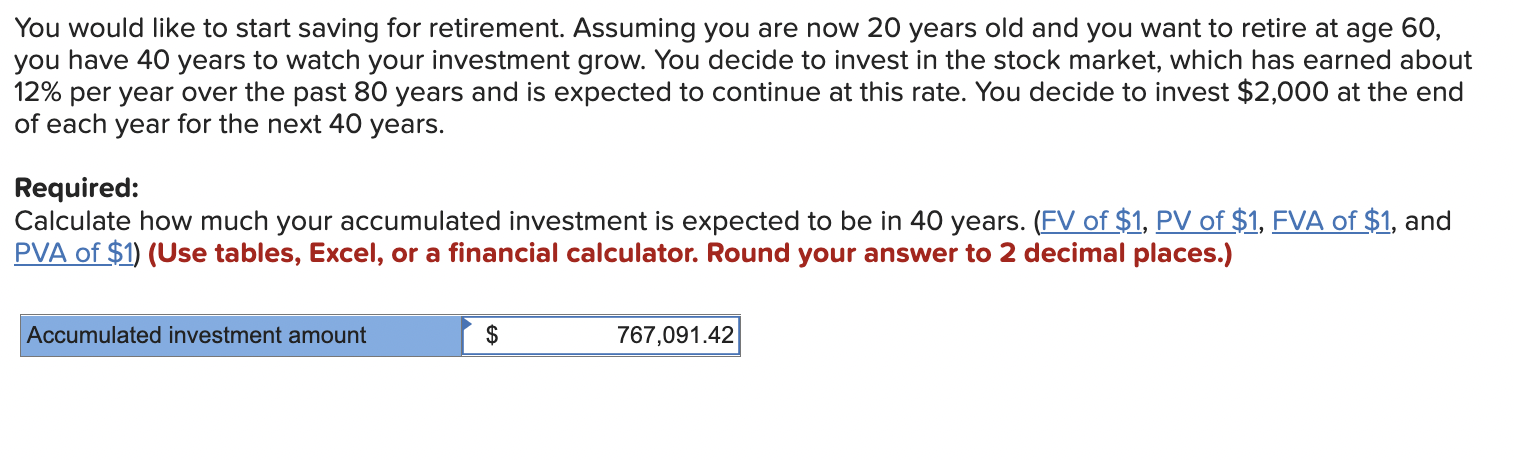

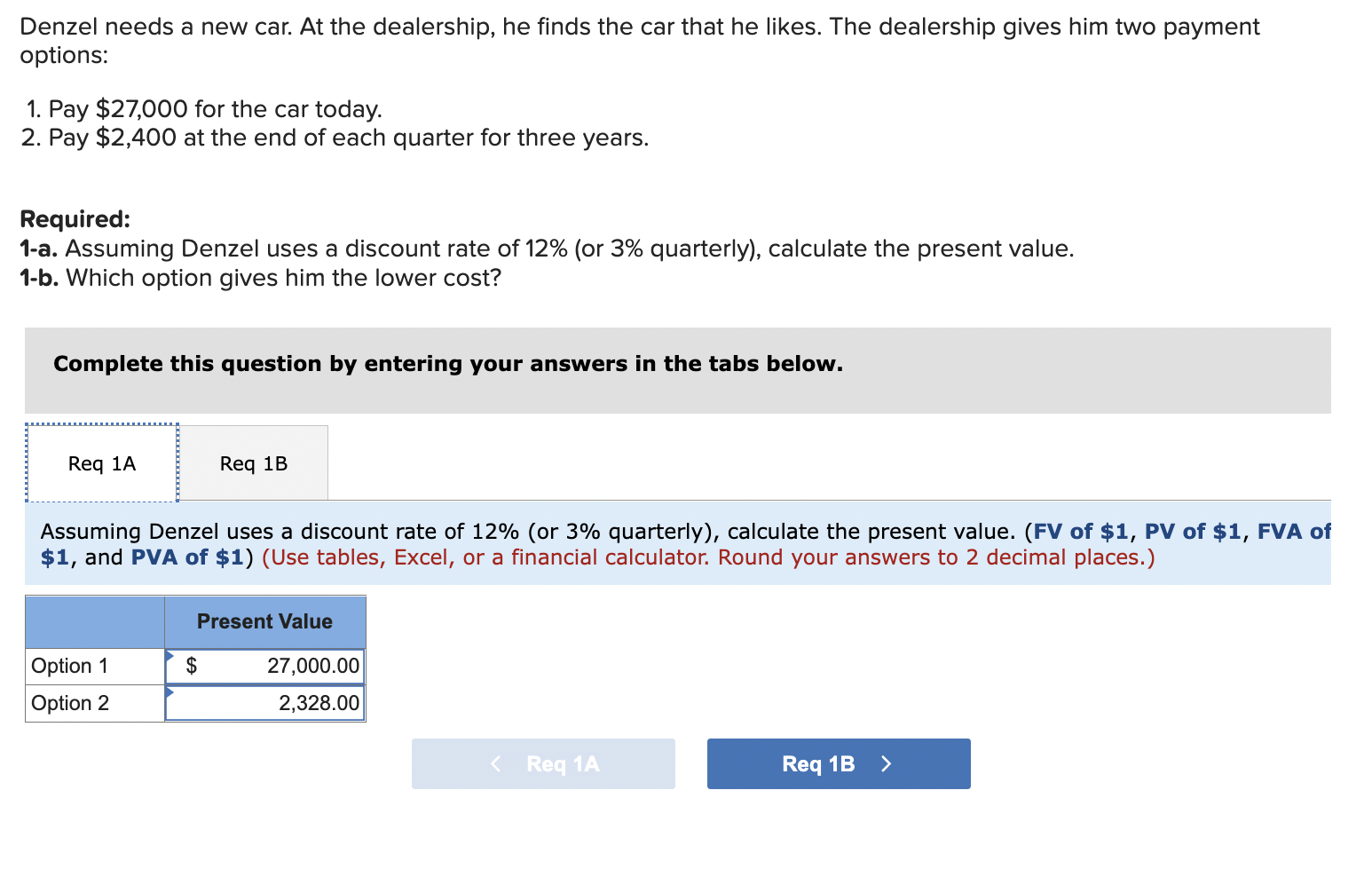

In January 1,2024 , White Water issues $580,000 of 5% bonds, due in 15 years, with interest payable semiannually n 9 \& Appendix C: Homework Annuities, Leases, and Bonds equired: ssuming the bonds issue for $580,000, record the bond issue on January 1,2024 , and the first two semiannual iterest payments on June 30, 2024, and December 31, 2024. (If no entry is required for a particular ansaction/event, select "No Journal Entry Required" in the first account field.) You would like to start saving for retirement. Assuming you are now 20 years old and you want to retire at age 60 , you have 40 years to watch your investment grow. You decide to invest in the stock market, which has earned about 12% per year over the past 80 years and is expected to continue at this rate. You decide to invest $2,000 at the end of each year for the next 40 years. Required: Calculate how much your accumulated investment is expected to be in 40 years. ( FV of $1, PV of $1,FVA of $1, and PVA of \$1) (Use tables, Excel, or a financial calculator. Round your answer to 2 decimal places.) Denzel needs a new car. At the dealership, he finds the car that he likes. The dealership gives him two payment options: 1. Pay $27,000 for the car today. 2. Pay $2,400 at the end of each quarter for three years. Required: 1-a. Assuming Denzel uses a discount rate of 12% (or 3% quarterly), calculate the present value. 1-b. Which option gives him the lower cost? Complete this question by entering your answers in the tabs below. Assuming Denzel uses a discount rate of 12% (or 3% quarterly), calculate the present value. (FV of $1, PV of $1, FVA $1, and PVA of \$1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts