Question: Did I solve this correctly? Problem 20-27 (LO. 2, 3) The Allwardt Trust is a simple trust that correctly uses the calendar year for tax

Did I solve this correctly?

Did I solve this correctly?

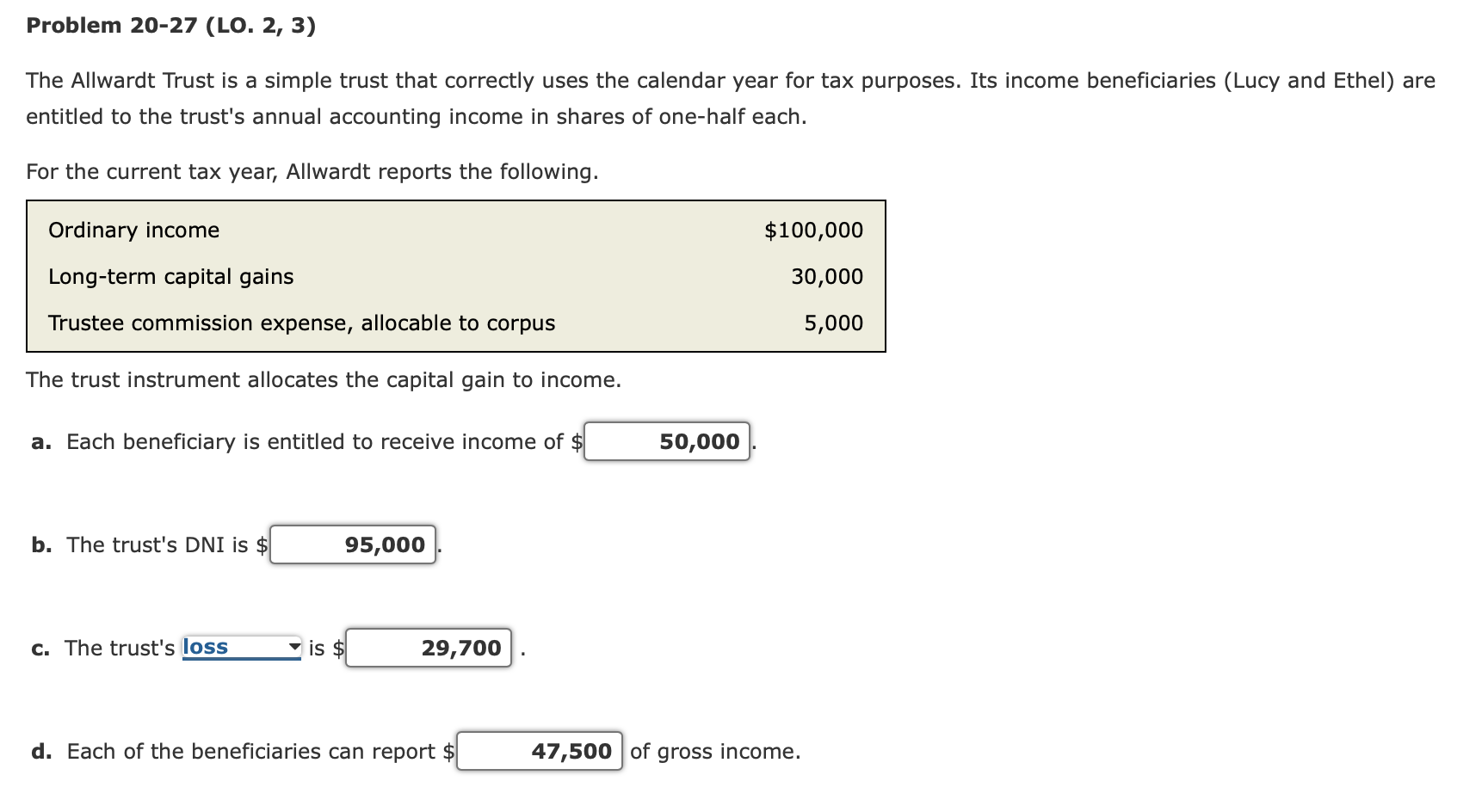

Problem 20-27 (LO. 2, 3) The Allwardt Trust is a simple trust that correctly uses the calendar year for tax purposes. Its income beneficiaries (Lucy and Ethel) are entitled to the trust's annual accounting income in shares of one-half each. For the current tax year, Allwardt reports the following. Ordinary income $100,000 Long-term capital gains 30,000 Trustee commission expense, allocable to corpus 5,000 The trust instrument allocates the capital gain to income. a. Each beneficiary is entitled to receive income of $ 50,000 b. The trust's DNI is $ 95,000 c. The trust's loss is $ 29,700 d. Each of the beneficiaries can report $ 47,500 of gross income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts