Question: Did KPB finance its expansion program with internally generated funds (additions to retained earnings plus depreciation) or with external capital? How does the choice of

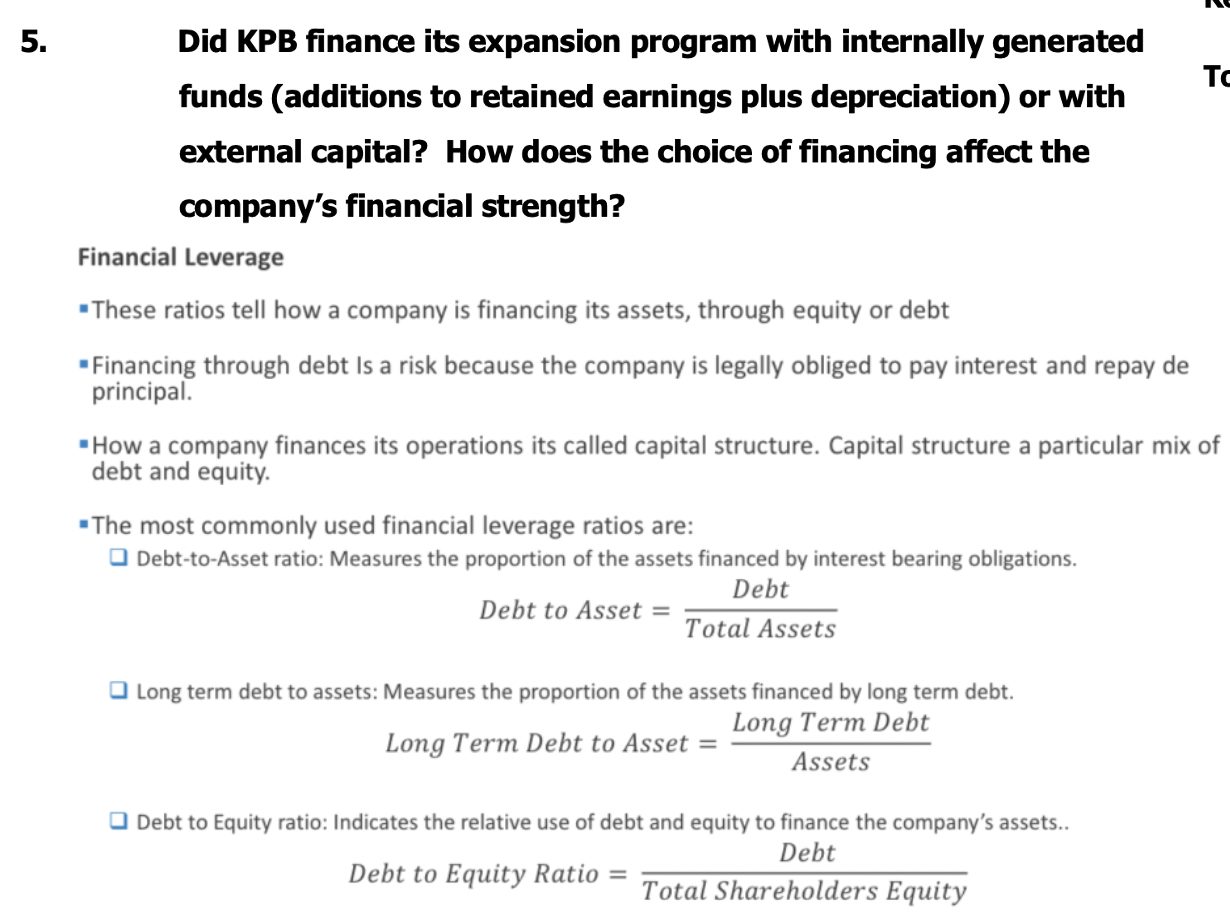

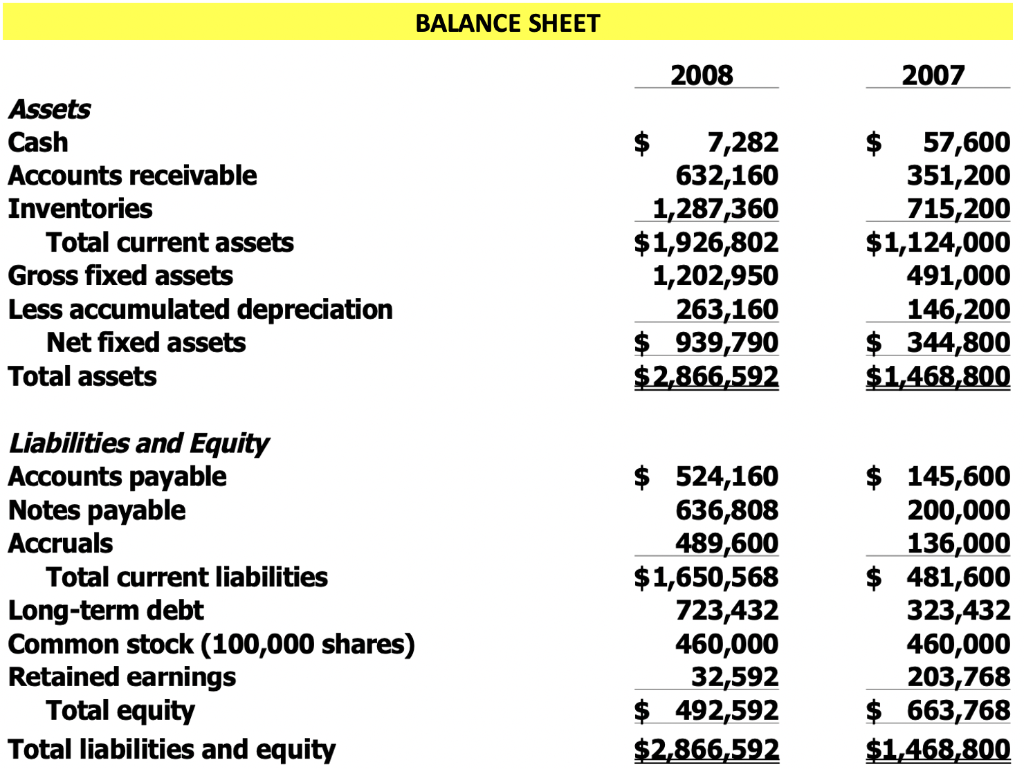

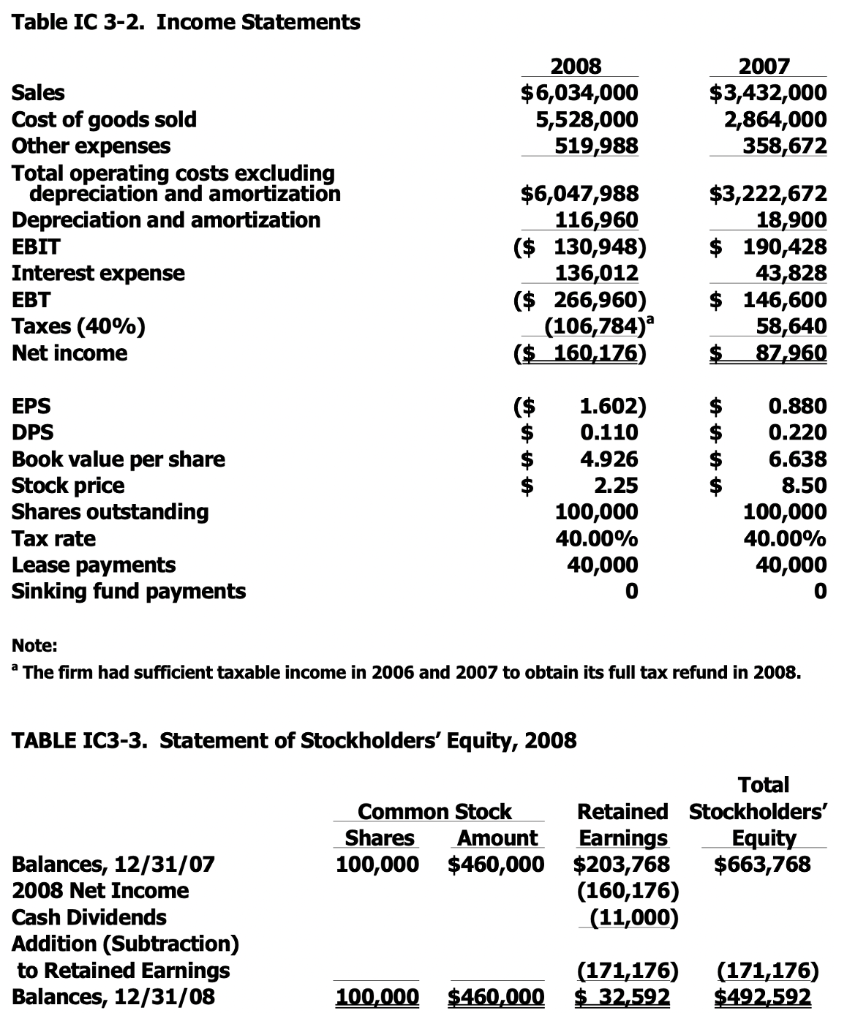

Did KPB finance its expansion program with internally generated funds (additions to retained earnings plus depreciation) or with external capital? How does the choice of financing affect the company's financial strength? Financial Leverage - These ratios tell how a company is financing its assets, through equity or debt - Financing through debt Is a risk because the company is legally obliged to pay interest and repay de principal. - How a company finances its operations its called capital structure. Capital structure a particular mix of debt and equity. - The most commonly used financial leverage ratios are: Debt-to-Asset ratio: Measures the proportion of the assets financed by interest bearing obligations. DebttoAsset=TotalAssetsDebt Long term debt to assets: Measures the proportion of the assets financed by long term debt. LongTermDebttoAsset=AssetsLongTermDebt Debt to Equity ratio: Indicates the relative use of debt and equity to finance the company's assets.. DebttoEquityRatio=TotalShareholdersEquityDebt BALANCE SHEET Table IC 3-2. Income Statements Note: a The firm had sufficient taxable income in 2006 and 2007 to obtain its full tax refund in 2008. TABLE IC3-3. Statement of Stockholders' Equity, 2008 Did KPB finance its expansion program with internally generated funds (additions to retained earnings plus depreciation) or with external capital? How does the choice of financing affect the company's financial strength? Financial Leverage - These ratios tell how a company is financing its assets, through equity or debt - Financing through debt Is a risk because the company is legally obliged to pay interest and repay de principal. - How a company finances its operations its called capital structure. Capital structure a particular mix of debt and equity. - The most commonly used financial leverage ratios are: Debt-to-Asset ratio: Measures the proportion of the assets financed by interest bearing obligations. DebttoAsset=TotalAssetsDebt Long term debt to assets: Measures the proportion of the assets financed by long term debt. LongTermDebttoAsset=AssetsLongTermDebt Debt to Equity ratio: Indicates the relative use of debt and equity to finance the company's assets.. DebttoEquityRatio=TotalShareholdersEquityDebt BALANCE SHEET Table IC 3-2. Income Statements Note: a The firm had sufficient taxable income in 2006 and 2007 to obtain its full tax refund in 2008. TABLE IC3-3. Statement of Stockholders' Equity, 2008

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts