Question: Diderot Stores Inc., which uses the conventional retail inventory method, wishes to change to the LIFO retail method beginning with the accounting year ending December

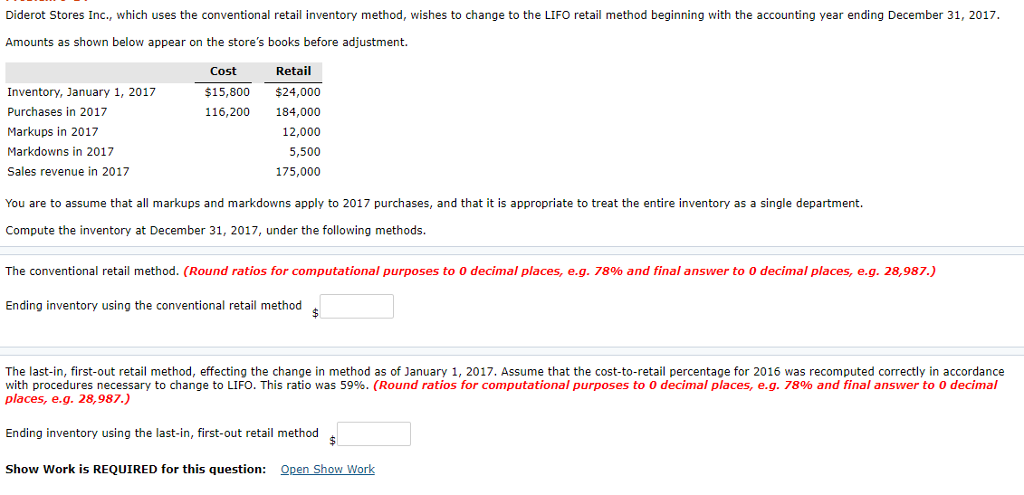

Diderot Stores Inc., which uses the conventional retail inventory method, wishes to change to the LIFO retail method beginning with the accounting year ending December 31, 2017. Amounts as shown below appear on the store's books before adjustment. Cost Retail Inventory, January 1, 2017 Purchases in 2017 Markups in 2017 Markdowns in 2017 Sales revenue in 2017 $15,800 $24,000 116,200 184,000 12,000 5,500 175,000 You are to assume that all markups and markdowns apply to 2017 purchases, and that it is appropriate to treat the entire inventory as a single department. Compute the inventory at December 31, 2017, under the following methods. The conventional retail method. (Round ratios for computational purposes to 0 decimal places, eg. 78% and final answer to 0 decimal places, eg. 28,987.) Ending inventory using the conventional retail method The last-in, first-out retail method, effecting the change in method as of January 1, 2017. Assume that the cost-to-retail percentage for 2016 was recomputed correctly in accordance with procedures necessary to change to LIFO This ratio was 59%. (Round ratios for computation a purposes to de m places, e.g 78% and 7 lansver to reima places, e.g. 28,987.) Ending inventory using the last-in, first-out retail method Show Work is REQUIRED for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts