Question: Based on the information shown below, calculate for the year ended December 31, 2019, (a) the total amount of expenditures that would be recognized

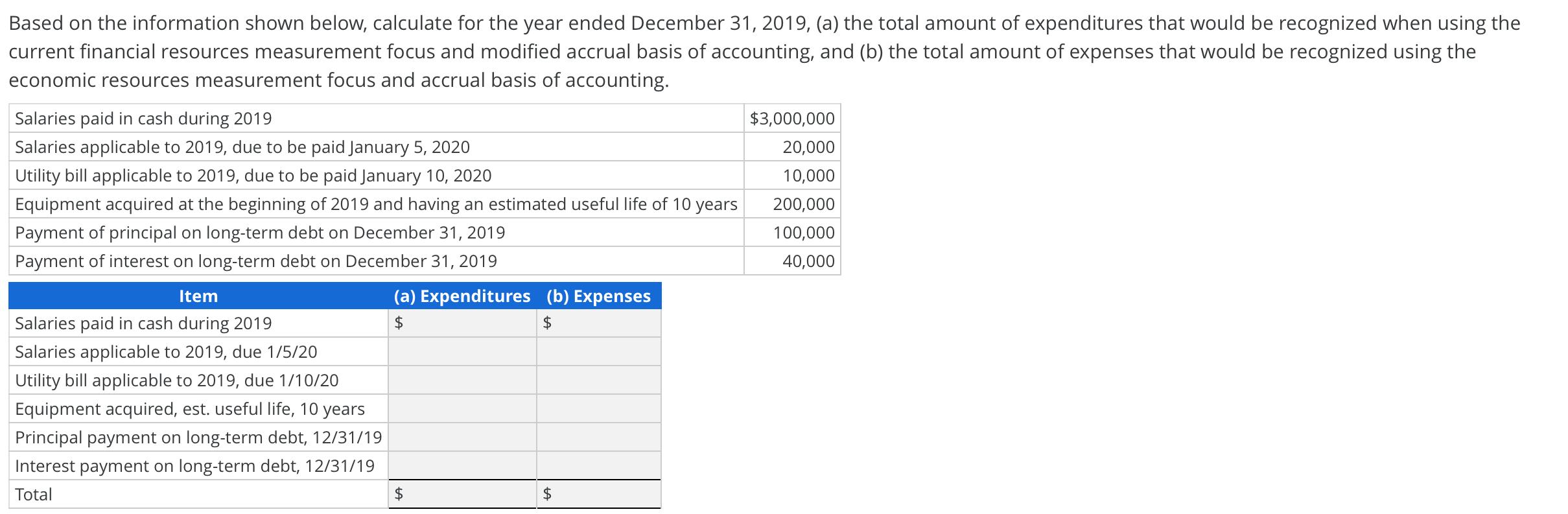

Based on the information shown below, calculate for the year ended December 31, 2019, (a) the total amount of expenditures that would be recognized when using the current financial resources measurement focus and modified accrual basis of accounting, and (b) the total amount of expenses that would be recognized using the economic resources measurement focus and accrual basis of accounting. Salaries paid in cash during 2019 $3,000,000 Salaries applicable to 2019, due to be paid January 5, 2020 20,000 Utility bill applicable to 2019, due to be paid January 10, 2020 10,000 Equipment acquired at the beginning of 2019 and having an estimated useful life of 10 years 200,000 Payment of principal on long-term debt on December 31, 2019 100,000 Payment of interest on long-term debt on December 31, 2019 40,000 Item (a) Expenditures (b) Expenses Salaries paid in cash during 2019 $4 Salaries applicable to 2019, due 1/5/20 Utility bill applicable to 2019, due 1/10/20 Equipment acquired, est. useful life, 10 years Principal payment on long-term debt, 12/31/19 Interest payment on long-term debt, 12/31/19 Total $4 $4

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Total amount of expenditures that would be recognized when using the current fi... View full answer

Get step-by-step solutions from verified subject matter experts