Question: Differences between hedge funds and mutual funds are that O a. hedge funds are typically open only to wealthy or institutional investors. O b. hedge

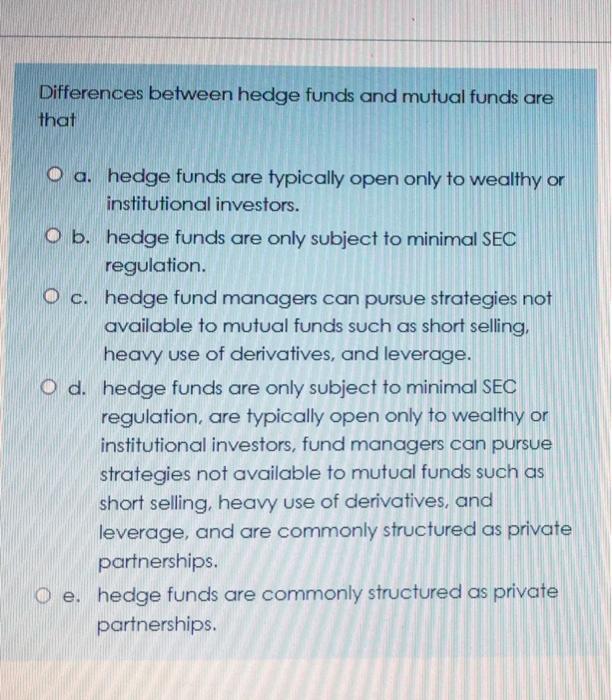

Differences between hedge funds and mutual funds are that O a. hedge funds are typically open only to wealthy or institutional investors. O b. hedge funds are only subject to minimal SEC regulation. O c. hedge fund managers can pursue strategies not available to mutual funds such as short selling, heavy use of derivatives, and leverage. O d. hedge funds are only subject to minimal SEC regulation, are typically open only to wealthy or institutional investors, fund managers can pursue strategies not available to mutual funds such as short selling, heavy use of derivatives, and leverage, and are commonly structured as private partnerships. O e. hedge funds are commonly structured as private partnerships

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts