Question: ---------------- different problem correct ? wrong Your answer is partially correct. Try again. Assume the partnership income-sharing agreement calls for income to be divided with

---------------- different problem

correct

?

wrong

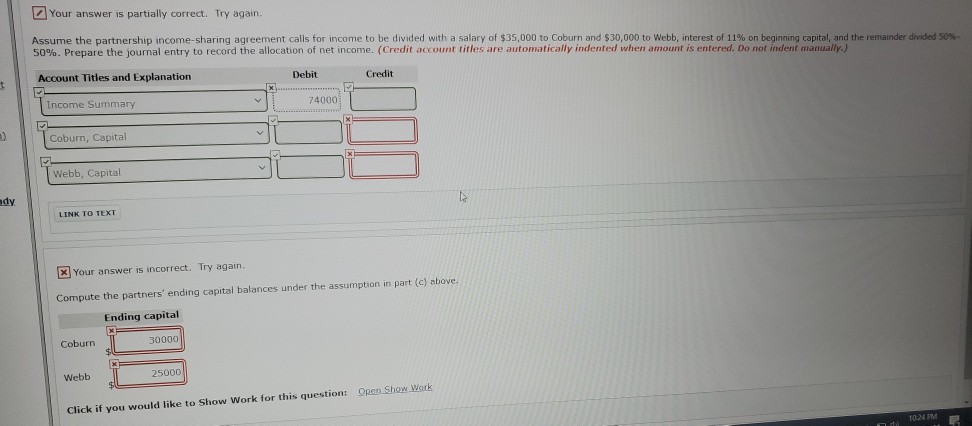

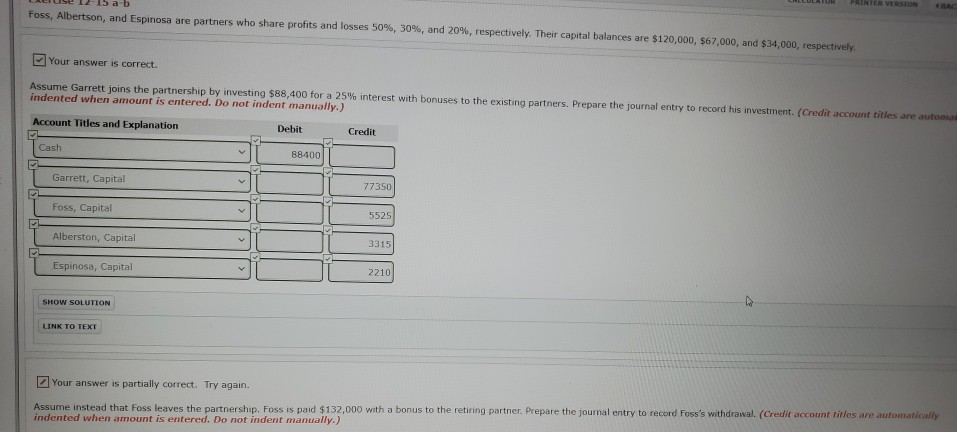

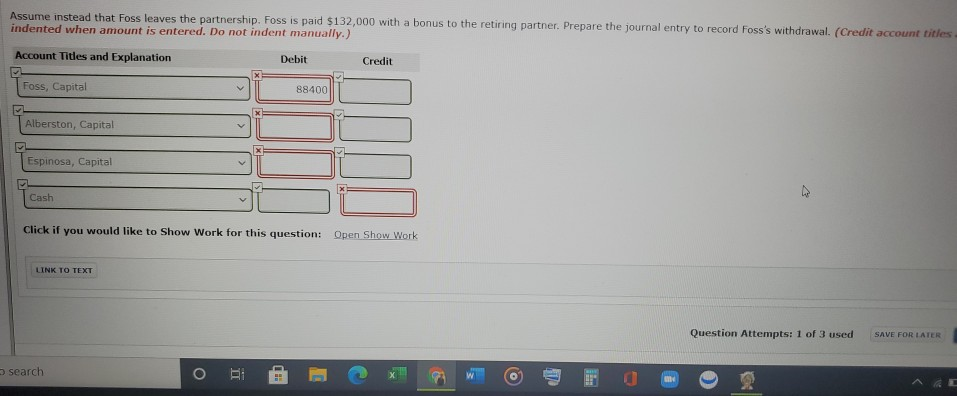

Your answer is partially correct. Try again. Assume the partnership income-sharing agreement calls for income to be divided with a salary of $35,000 to Coburn and $30,000 to Webb, interest of 11% on beginning capital, and the remainder divided 50% 50%. Prepare the journal entry to record the allocation of net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Account Titles and Explanation 74000 Income Summary Coburn, Capital XE Webb, Capital ady LINK TO TEXT x Your answer is incorrect. Try again. Compute the partners' ending capital balances under the assumption in part (c) above, Ending capital 30000 Coburn Webb 25000 Click if you would like to Show Work for this question: Open Show Work 10:24 PM RE Foss, Albertson, and Espinosa are partners who share profits and losses 50%, 30%, and 20%, respectively. Their capital balances are $120,000, $67,000, and $34,000, respectively. Your answer is correct. Assume Garrett joins the partnership by investing $88,400 for a 25% interest with bonuses to the existing partners. Prepare the journal entry to record his investment. (Credit account titles are automas indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Cash 88400 Garrett, Capital 77350 Foss, Capital 5525 Alberston, Capital 3315 > Espinosa, Capital 2210 SHOW SOLUTION LINK TO TEXT Your answer is partially correct. Try again. Assume instead that Foss leaves the partnership. Foss is paid $132,000 with a bonus to the retiring partner. Prepare the journal entry to record Foss's withdrawal. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Assume instead that Foss leaves the partnership. Foss is paid $132,000 with a bonus to the retiring partner. Prepare the journal entry to record Foss's withdrawal. (Credit account titles indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Foss, Capital 88400 Alberston, Capital LODI Espinosa, Capital Cash Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT Question Attempts: 1 of 3 used SAVE FOR LATER search o IT Your answer is partially correct. Try again. Assume the partnership income-sharing agreement calls for income to be divided with a salary of $35,000 to Coburn and $30,000 to Webb, interest of 11% on beginning capital, and the remainder divided 50% 50%. Prepare the journal entry to record the allocation of net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Account Titles and Explanation 74000 Income Summary Coburn, Capital XE Webb, Capital ady LINK TO TEXT x Your answer is incorrect. Try again. Compute the partners' ending capital balances under the assumption in part (c) above, Ending capital 30000 Coburn Webb 25000 Click if you would like to Show Work for this question: Open Show Work 10:24 PM RE Foss, Albertson, and Espinosa are partners who share profits and losses 50%, 30%, and 20%, respectively. Their capital balances are $120,000, $67,000, and $34,000, respectively. Your answer is correct. Assume Garrett joins the partnership by investing $88,400 for a 25% interest with bonuses to the existing partners. Prepare the journal entry to record his investment. (Credit account titles are automas indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Cash 88400 Garrett, Capital 77350 Foss, Capital 5525 Alberston, Capital 3315 > Espinosa, Capital 2210 SHOW SOLUTION LINK TO TEXT Your answer is partially correct. Try again. Assume instead that Foss leaves the partnership. Foss is paid $132,000 with a bonus to the retiring partner. Prepare the journal entry to record Foss's withdrawal. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Assume instead that Foss leaves the partnership. Foss is paid $132,000 with a bonus to the retiring partner. Prepare the journal entry to record Foss's withdrawal. (Credit account titles indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Foss, Capital 88400 Alberston, Capital LODI Espinosa, Capital Cash Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT Question Attempts: 1 of 3 used SAVE FOR LATER search o IT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts