Question: Different types of assets will react differently to economic and market conditions. By purchasing a variety of assets in different categories, an investor aims to

Different types of assets will react differently to economic and market conditions. By purchasing a variety of assets in different categories, an investor aims to achieve a positive or negative average return while increasing or reducing the portfolios level of volatility and risk.

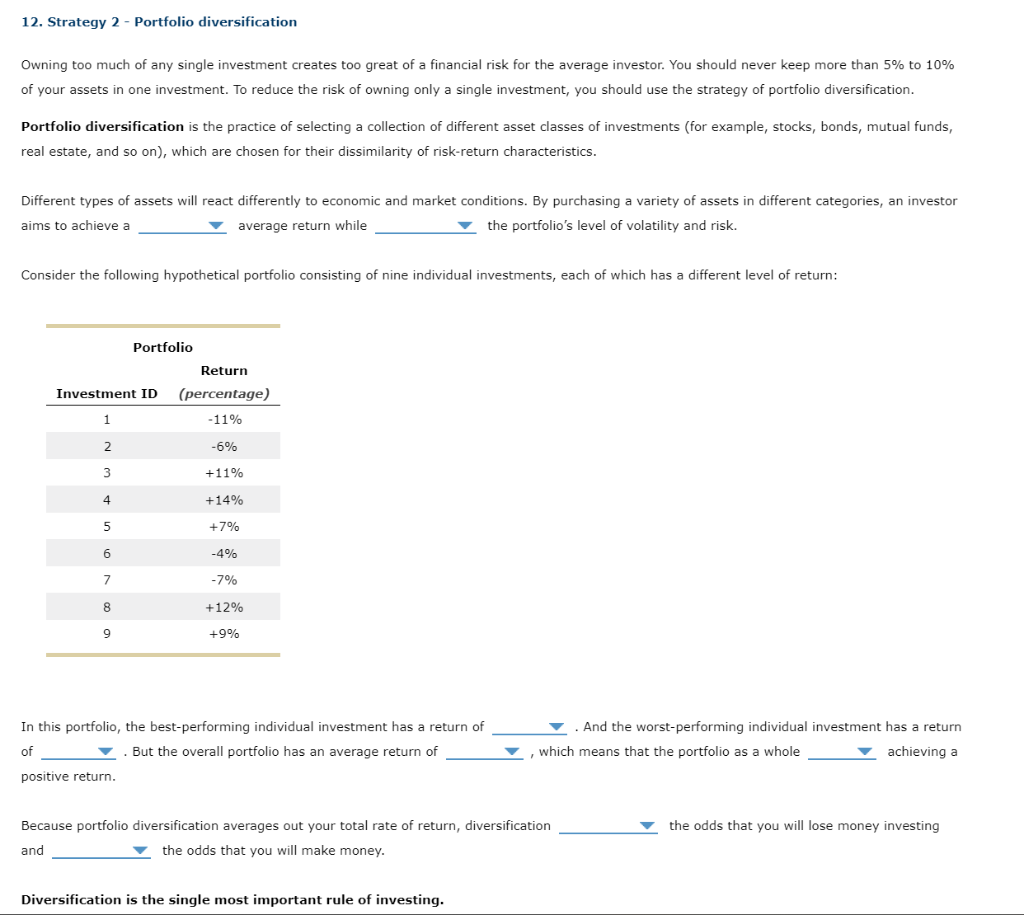

In this portfolio, the best-performing individual investment has a return of +7%, -8.2%, +12%, +14%. And the worst-performing individual investment has a return of +7%, -8.2%, -11%, +14%. But the overall portfolio has an average return of +2.8%, -6%, +8,2%, +14%, which means that the portfolio as a whole is or is not achieving a positive return.

Because portfolio diversification averages out your total rate of return, diversification increase or decrease the odds that you will lose money investing and increase or decrease the odds that you will make money.

12. Strategy 2 - Portfolio diversification Owning too much of any single investment creates too great of a financial risk for the average investor. You should never keep more than 5% to 10% of your assets in one investment. To reduce the risk of owning only a single investment, you should use the strategy of portfolio diversification. Portfolio diversification is the practice of selecting a collection of different asset classes of investments (for example, stocks, bonds, mutual funds, real estate, and so on), which are chosen for their dissimilarity of risk-return characteristics. Different types of assets will react differently to economic and market conditions. By purchasing a variety of assets in different categories, an investor aims to achieve a average return while the portfolio's level of volatility and risk. Consider the following hypothetical portfolio consisting of nine individual investments, each of which has a different level of return: In this portfolio, the best-performing individual investment has a return of . And the worst-performing individual investment has a return of . But the overall portfolio has an average return of , which means that the portfolio as a whole achieving a positive return. Because portfolio diversification averages out your total rate of return, diversification the odds that you will lose money investing and the odds that you will make money. Diversification is the single most important rule of investing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts