Question: Differential Analysis for Machine Replacement Ridgeway Digital Components Company assembles circuit boards by using a manually operated machine to insert electronic components. The original cost

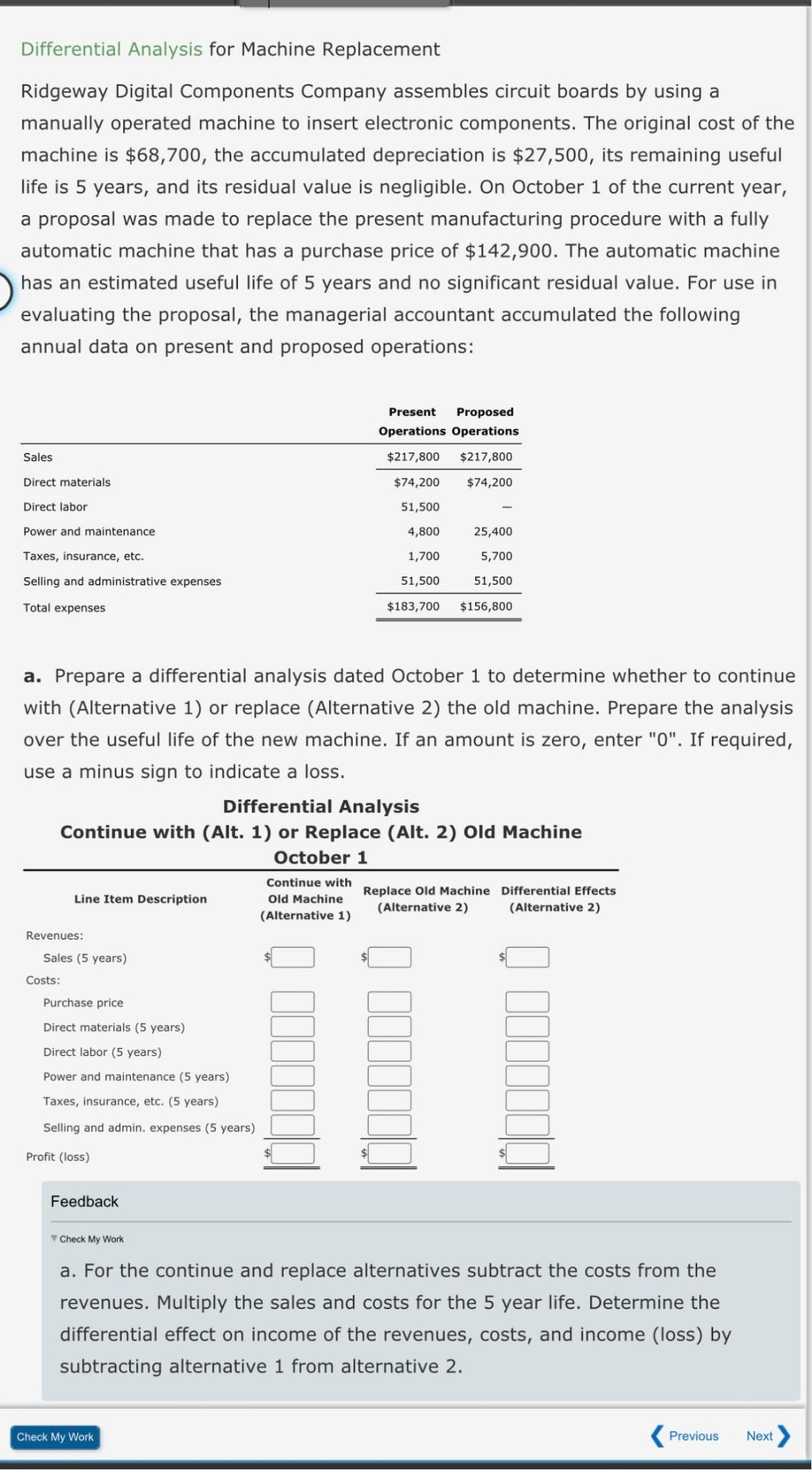

Differential Analysis for Machine Replacement Ridgeway Digital Components Company assembles circuit boards by using a manually operated machine to insert electronic components. The original cost of the machine is $68,700, the accumulated depreciation is $27,500, its remaining useful life is 5 years, and its residual value is negligible. On October 1 of the current year, a proposal was made to replace the present manufacturing procedure with a fully automatic machine that has a purchase price of $142,900. The automatic machine has an estimated useful life of 5 years and no significant residual value. For use in evaluating the proposal, the managerial accountant accumulated the following annual data on present and proposed operations: a. Prepare a differential analysis dated October 1 to determine whether to continue with (Alternative 1 ) or replace (Alternative 2) the old machine. Prepare the analysis over the useful life of the new machine. If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Feedback Check My Work a. For the continue and replace alternatives subtract the costs from the revenues. Multiply the sales and costs for the 5 year life. Determine the differential effect on income of the revenues, costs, and income (loss) by subtracting alternative 1 from alternative 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts