Question: Difficult problem This problem ties together almost everything you have learned in this unit. When you understand how to solve this problem, then you should

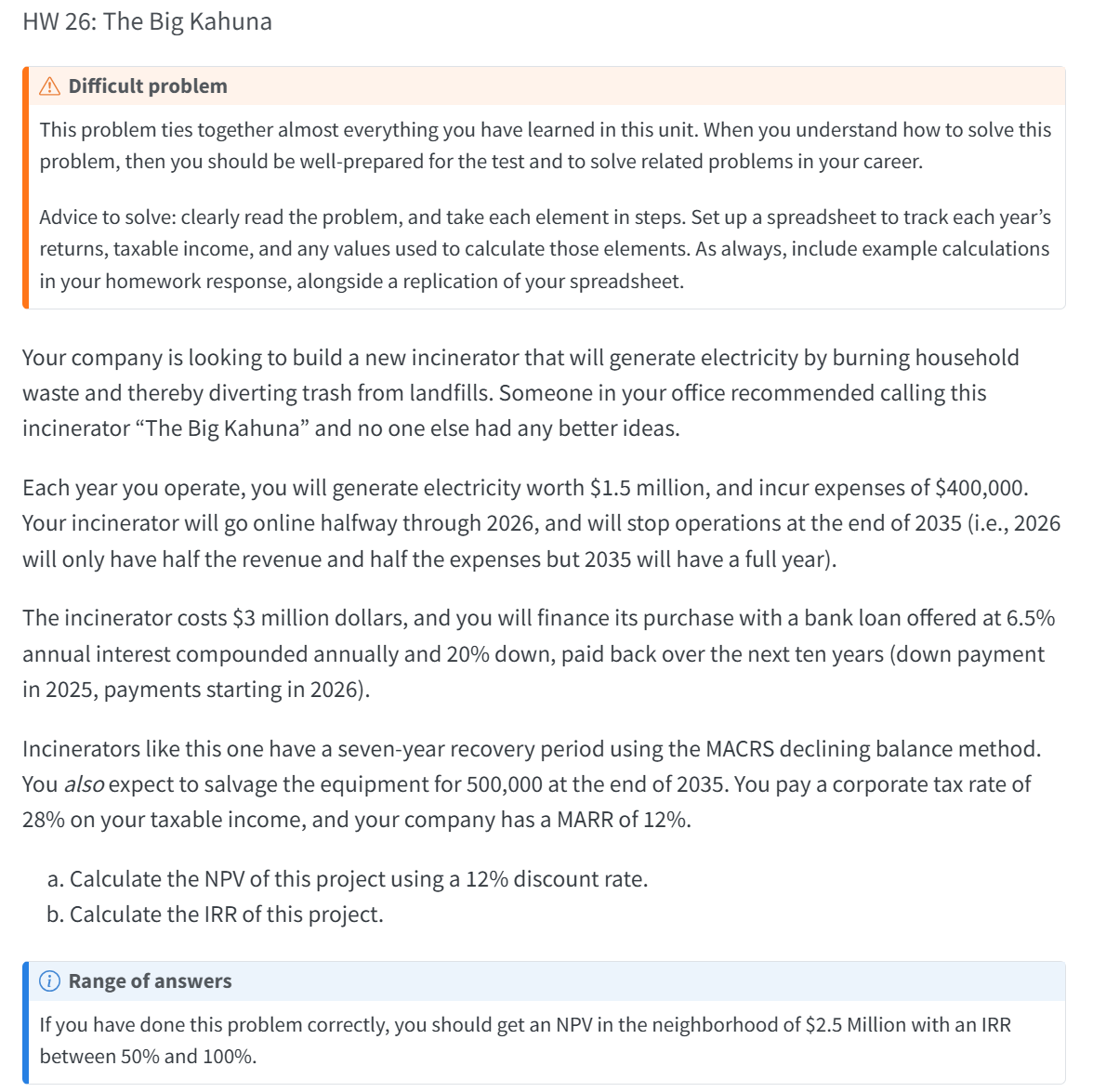

Difficult problem This problem ties together almost everything you have learned in this unit. When you understand how to solve this problem, then you should be wellprepared for the test and to solve related problems in your career. Advice to solve: clearly read the problem, and take each element in steps. Set up a spreadsheet to track each year's returns, taxable income, and any values used to calculate those elements. As always, include example calculations in your homework response, alongside a replication of your spreadsheet. Your company is looking to build a new incinerator that will generate electricity by burning household waste and thereby diverting trash from landfills. Someone in your office recommended calling this incinerator "The Big Kahuna" and no one else had any better ideas. Each year you operate, you will generate electricity worth $ million, and incur expenses of $ Your incinerator will go online halfway through and will stop operations at the end of ie will only have half the revenue and half the expenses but will have a full year The incinerator costs $ million dollars, and you will finance its purchase with a bank loan offered at annual interest compounded annually and down, paid back over the next ten years down payment in payments starting in Incinerators like this one have a sevenyear recovery period using the MACRS declining balance method. You also expect to salvage the equipment for at the end of You pay a corporate tax rate of on your taxable income, and your company has a MARR of a Calculate the NPV of this project using a discount rate. b Calculate the IRR of this project. i Range of answers If you have done this problem correctly, you should get an NPV in the neighborhood of $ Million with an IRR between and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock