Question: Digicel LTE 3:06 PM 11% X Case Study Unit 2 Eindhoven T... excess of one ye 1.000 2001) 10,015 10.00 Share Capital and Reserves Ordinary

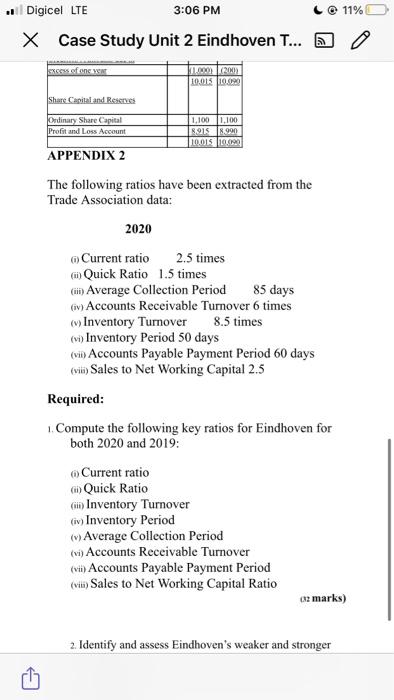

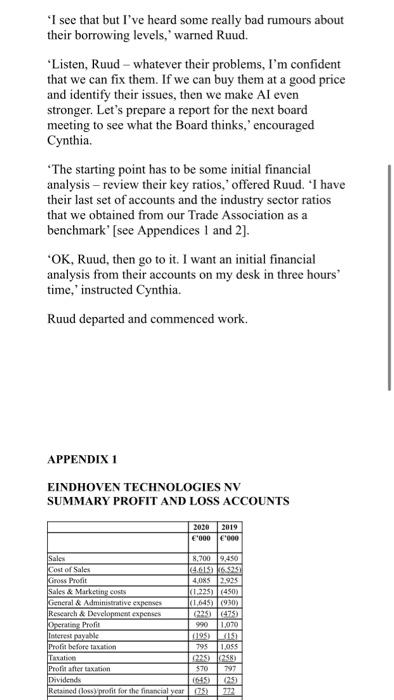

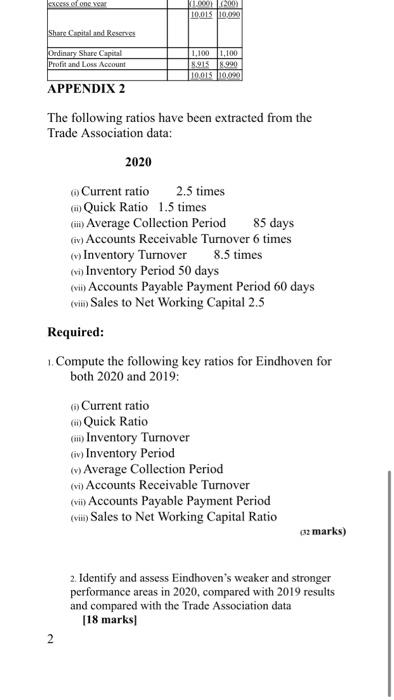

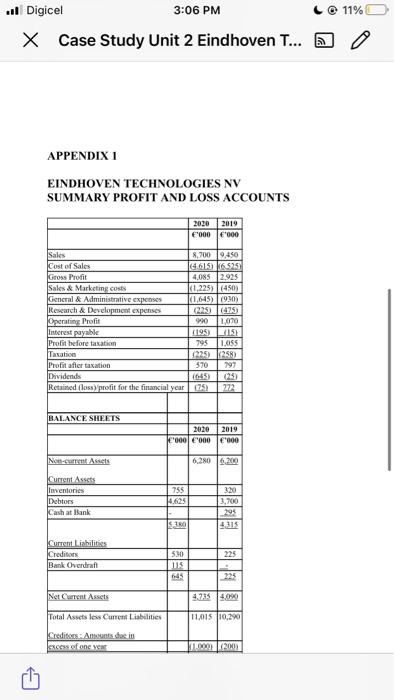

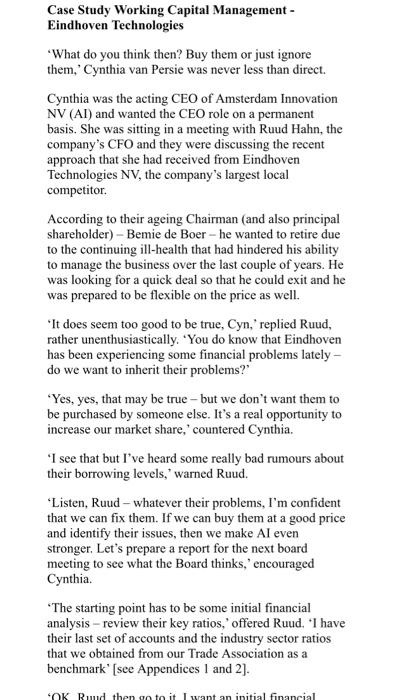

Digicel LTE 3:06 PM 11% X Case Study Unit 2 Eindhoven T... excess of one ye 1.000 2001) 10,015 10.00 Share Capital and Reserves Ordinary Share Capital Profit and Loss Account 1.100 1.100 8915 18.990 10,015 10.000 APPENDIX 2 The following ratios have been extracted from the Trade Association data: 2020 Current ratio 2.5 times m Quick Ratio 1.5 times (in) Average Collection Period 85 days (ov) Accounts Receivable Turnover 6 times c) Inventory Tumover 8.5 times (vi) Inventory Period 50 days (vii) Accounts Payable Payment Period 60 days (vi) Sales to Net Working Capital 2.5 Required: 1. Compute the following key ratios for Eindhoven for both 2020 and 2019: Current ratio m) Quick Ratio an Inventory Turnover (iv) Inventory Period (w) Average Collection Period (vi) Accounts Receivable Turnover (vii) Accounts Payable Payment Period (it) Sales to Net Working Capital Ratio 02 marks) 2. Identify and assess Eindhoven's weaker and stronger 'I see that but I've heard some really bad rumours about their borrowing levels,' warned Ruud. 'Listen, Ruud - whatever their problems, I'm confident that we can fix them. If we can buy them at a good price and identify their issues, then we make Al even stronger. Let's prepare a report for the next board meeting to see what the Board thinks,' encouraged Cynthia "The starting point has to be some initial financial analysis - review their key ratios,' offered Ruud. "I have their last set of accounts and the industry sector ratios that we obtained from our Trade Association as a benchmark' (see Appendices 1 and 2]. OK, Ruud, then go to it. I want an initial financial analysis from their accounts on my desk in three hours time,' instructed Cynthia. Ruud departed and commenced work. APPENDIX 1 EINDHOVEN TECHNOLOGIES NV SUMMARY PROFIT AND LOSS ACCOUNTS 2030 2019 000 600 Sales Cost of Sales Cimoss Profit Sales & Marketing costs General & Administrative expenses Research & Development expenses Dreating Profit Interest payable Profit before taxation Tanahon Profit after taxation Dividends Retaimed (loss profit for the financial year 8.700 9,450 (4.615) 6.525 4,085 2.925 (1.225 (450) (1.645) (930) (225) (475) 990 1.070 1959 795 10SS 2225 126 570 797 1645) (25) 175 222 excess of one year (1.000100 10,015 19.090 Share Capital and Rescue Ordinary Share Capital Profit and Loss Account APPENDIX 2 1.100 1.100 8.913 1990 10,015 19.099 The following ratios have been extracted from the Trade Association data: 2020 Current ratio 2.5 times m Quick Ratio 1.5 times Gi) Average Collection Period 85 days Civ) Accounts Receivable Turnover 6 times (w) Inventory Turnover 8.5 times (vi) Inventory Period 50 days (vi) Accounts Payable Payment Period 60 days (vin) Sales to Net Working Capital 2.5 Required: Compute the following key ratios for Eindhoven for both 2020 and 2019: Current ratio 6) Quick Ratio Inventory Turnover (iv) Inventory Period (w) Average Collection Period (vi) Accounts Receivable Turnover (vin Accounts Payable Payment Period (vin Sales to Net Working Capital Ratio 02 marks) 2. Identify and assess Eindhoven's weaker and stronger performance areas in 2020, compared with 2019 results and compared with the Trade Association data [18 marks 2 ..ll Digicel 3:06 PM 11% X Case Study Unit 2 Eindhoven T... APPENDIX 1 EINDHOVEN TECHNOLOGIES NV SUMMARY PROFIT AND LOSS ACCOUNTS 2020 2019 000 C'000 Sales 8,700 9,450 Cost of Sales 4.615 525 Gross Profit 4.085 2.925 Sales & Marketing costs (1,225) (450) General & Administrative expenses (1.645) 19.30 Research & Development expenses (225) (475) Operating profil 1,070 Interest payable (195) 119 Profit before taxation 795 105 Taxation 1225) 1 258) Profit after taxation 570 797 Dividends (25 Retaimed (lossy profit for the financial year (25) 272 BALANCE SHEETS 2020 2019 000 000 600 Non-current Assets 6.280 6.200 Current Assets Inventories Debtors Cash at Bank 755 14.625 3:20 3,700 295 4.315 IS20 Current Liabilities Creditors Bank Overdra 225 5.90 115 645 . Net Current Assets 4.335 40 Total Assets less Current Liabilities 11.2015 10:290 Credit Andorin excess of one ye 11.000 2001 Case Study Working Capital Management - Eindhoven Technologies What do you think then? Buy them or just ignore them,' Cynthia van Persie was never less than direct. Cynthia was the acting CEO of Amsterdam Innovation NV (AI) and wanted the CEO role on a permanent basis. She was sitting in a meeting with Ruud Hahn, the company's CFO and they were discussing the recent approach that she had received from Eindhoven Technologies NV, the company's largest local competitor. According to their ageing Chairman and also principal shareholder) - Bemie de Boer - he wanted to retire due to the continuing ill-health that had hindered his ability to manage the business over the last couple of years. He was looking for a quick deal so that he could exit and he was prepared to be flexible on the price as well. 'It does seem too good to be true, Cyn,' replied Ruud, rather unenthusiastically. You do know that Eindhoven has been experiencing some financial problems lately- do we want to inherit their problems? 'Yes, yes, that may be true - but we don't want them to be purchased by someone else. It's a real opportunity to increase our market share,' countered Cynthia. 'I see that but I've heard some really bad rumours about their borrowing levels,' warned Ruud. "Listen, Ruud - whatever their problems, I'm confident that we can fix them. If we can buy them at a good price and identify their issues, then we make Al even stronger. Let's prepare a report for the next board meeting to see what the Board thinks,' encouraged Cynthia. "The starting point has to be some initial financial analysis - review their key ratios,' offered Ruud. "I have their last set of accounts and the industry sector ratios that we obtained from our Trade Association as a benchmark' (see Appendices 1 and 2). OK Rud then go to it I want an initial financial

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts