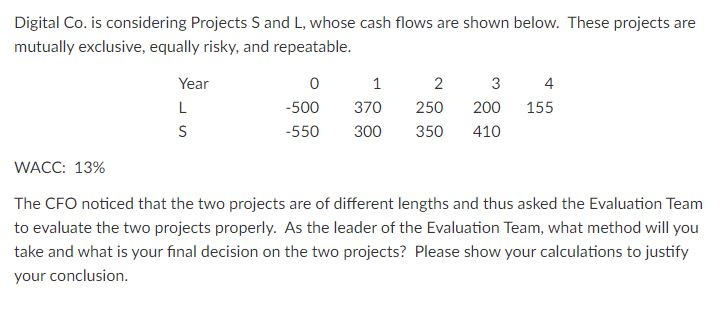

Question: Digital Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and repeatable. Year

Digital Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and repeatable. Year L S 0 -500 -550 1 2 3 370 250 200 300 350 410 4 155 WACC: 13% The CFO noticed that the two projects are of different lengths and thus asked the Evaluation Team to evaluate the two projects properly. As the leader of the Evaluation Team, what method will you take and what is your final decision on the two projects? Please show your calculations to justify your conclusion.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

To properly evaluate Projects S and L which have different lengths we will use the profitability ind... View full answer

Get step-by-step solutions from verified subject matter experts