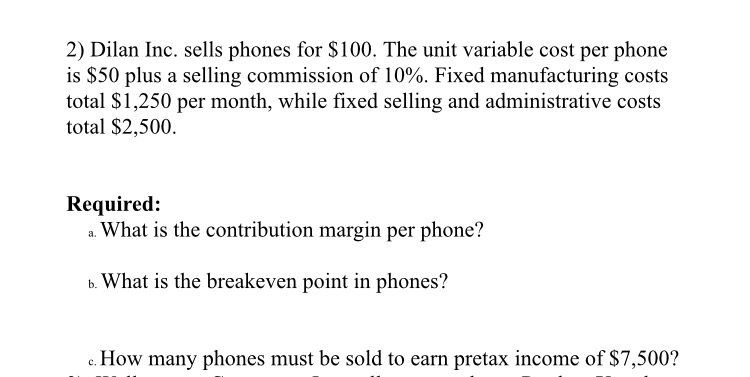

Question: Dilan Inc. sells phones for $100. The unit variable cost per phone is $50 plus a selling commission of 10%. Fixed manufacturing costs total $1,250

Dilan Inc. sells phones for $100. The unit variable cost per phone is $50 plus a selling commission of 10%. Fixed manufacturing costs total $1,250 per month, while fixed selling and administrative costs total $2,500. What is the contribution margin per phone? What is the breakeven point in phones? How many phones must be sold to earn pretax income of $7,500?\",, 11263247,Determine the force in member GJ of the truss and state if this member is in tension or compression. Take F = 1080 Lb Express your answer to three significant figures and include the appropriate units. Assume positive scalars for members in tension and negative scalars for members in compression ,, 11263249,Poisson Suppose that someone (unwisely) buys 100 lottery tickets every week. Assuming that only.01% of tickets win

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts