Question: Dinalive reen. If you do , you will receive a zero on the exam and be referred to the Office of Student Rights and esponsibilities.

"Dinalive reen. If you do you will receive a zero on the exam and be referred to the Office of Student Rights and esponsibilities.

Time Running: Hide Tin

Attempt due May at

Hour, Minutes,

Question

pts

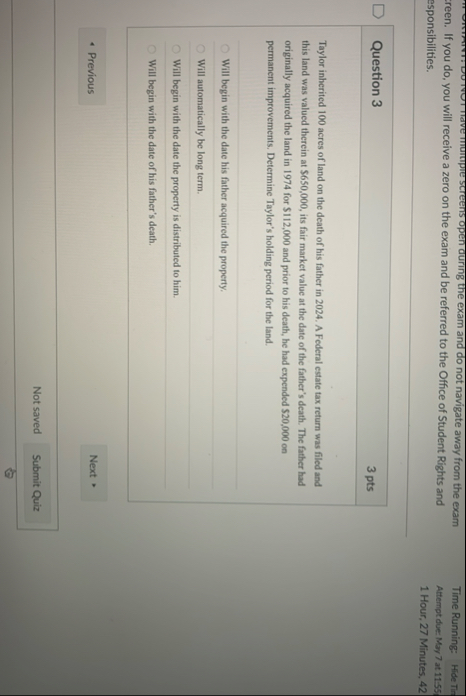

Taylor inherited acres of land on the death of his father in A Federal estate tax return was filed and this land was valued therein at $ its fair market value at the date of the father's death. The father had originally acquired the land in for $ and prior to his death, he had expended $ on permanent improvements. Determine Taylor's holding period for the land.

Will begin with the date his father acquired the property.

Will automatically be long term.

Will begin with the date the property is distributed to him.

Witl begin with the date of his father's death.

Not saved

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock