Question: Dineo was impressed by your input concerning classifying the costs incurred to run her factory textile. As a result, she employed you to become

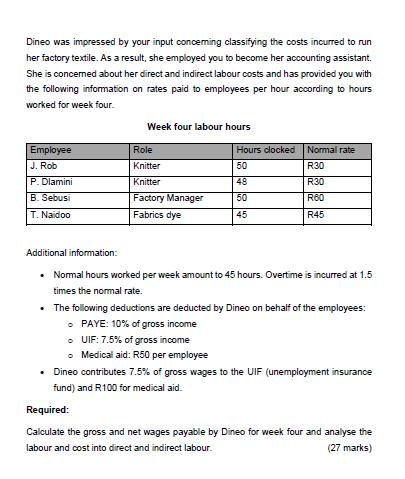

Dineo was impressed by your input concerning classifying the costs incurred to run her factory textile. As a result, she employed you to become her accounting assistant. She is concerned about her direct and indirect labour costs and has provided you with the following information on rates paid to employees per hour according to hours worked for week four. Employee J. Rob P. Dlamini B. Sebusi T. Naidoo Week four labour hours Role Knitter Knitter Factory Manager Fabrics dye Hours clocked Normal rate 50 R30 48 R30 50 R60 45 R45 Additional information: Normal hours worked per week amount to 45 hours. Overtime is incurred at 1.5 times the normal rate. The following deductions are deducted by Dineo on behalf of the employees: . PAYE: 10% of gross income UIF: 7.5% of gross income Medical aid: R50 per employee Dineo contributes 7.5% of gross wages to the UIF (unemployment insurance fund) and R100 for medical aid. Required: Calculate the gross and net wages payable by Dineo for week four and analyse the labour and cost into direct and indirect labour. (27 marks)

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

To calculate the gross and net wages payable by Dineo for week four and analyze the labor cost into direct and indirect labor well follow these steps ... View full answer

Get step-by-step solutions from verified subject matter experts