Question: direct answer please All the following are correct except: OA Executory costs should not be excluded by the lessee in computing the present value of

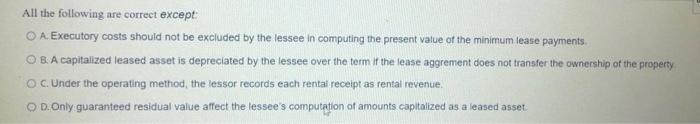

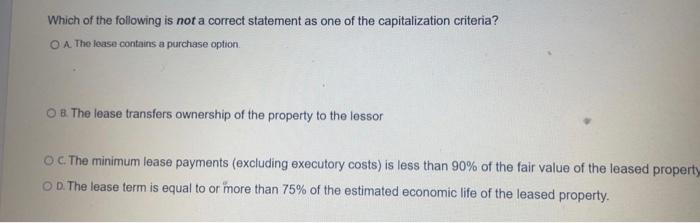

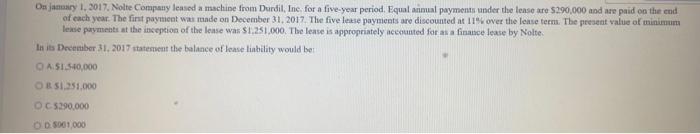

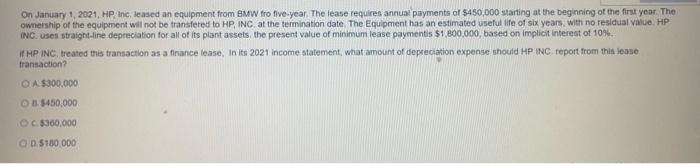

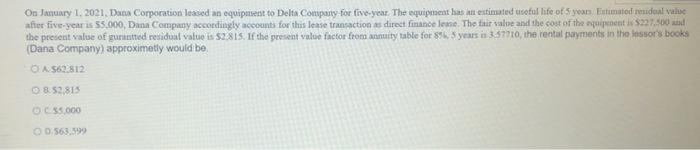

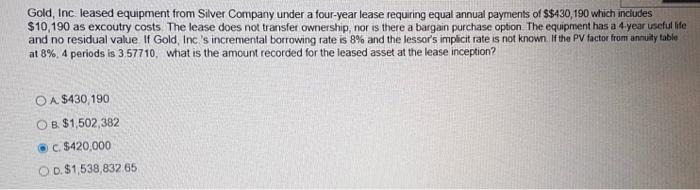

All the following are correct except: OA Executory costs should not be excluded by the lessee in computing the present value of the minimum lease payments. OB. A capitalized leased asset is depreciated by the lessee over the term if the lease aggrement does not transfer the ownership of the property O C. Under the operating method, the lessor records each rental receipt as rental revenue. O D.Only guaranteed residual value affect the lessee's computation of amounts capitalized as a leased asset. Which of the following is not a correct statement as one of the capitalization criteria? OA. The lease contains a purchase option. OB The lease transfers ownership of the property to the lessor OC. The minimum lease payments (excluding executory costs) is less than 90% of the fair value of the leased property OD. The lease term is equal to or more than 75% of the estimated economic life of the leased property. On january 1, 2017, Nolte Company leased a machine from Durdil, Inc. for a five-year period. Equal annual payments under the lease are $290,000 and are paid on the end of each year. The first payment was made on December 31, 2017. The five lease payments are discounted at 11% over the lease terms. The present value of minimum lease payments at the inception of the lease was $1,251,000. The lease is appropriately accounted for as a finance lease by Nolte. In its December 31, 2017 statement the balance of lease liability would be: QA $1.540,000 OR $1.251.000 OC$290,000 OD 5001,000 On January 1, 2021, HP, Inc. leased an equipment from BMW fro five-year. The lease requires annual payments of $450,000 starting at the beginning of the first year. The ownership of the equipment will not be transfered to HP, INC. at the termination date. The Equipment has an estimated useful life of six years, with no residual value. HP INC. uses straight-line depreciation for all of its plant assets, the present value of minimum lease paymentis $1,800,000, based on implicit interest of 10%. if HP INC. treated this transaction as a finance lease, In its 2021 income statement, what amount of depreciation expense should HP INC. report from this lease transaction? O A $300,000 OB$450,000. OC $360,000 OD$180,000 On January 1, 2021, Dana Corporation leased an equipment to Delta Company for five-year. The equipment has an estimated useful life of 5 years Estimated residual value after five-year is $5,000, Dana Company accordingly accounts for this lease transaction as direct finance lease. The fair value and the cost of the equipment is $227,500 and the present value of gurantted residual value is $2.815. If the present value factor from annuity table for 8%, 5 years is 3.57710, the rental payments in the lessor's books (Dana Company) approximetly would be A $62,812 08 $2,815 OC $5,000 O.0.563,599 Gold, Inc. leased equipment from Silver Company under a four-year lease requiring equal annual payments of $$430,190 which includes $10,190 as excoutry costs The lease does not transfer ownership, nor is there a bargain purchase option. The equipment has a 4-year useful life and no residual value. If Gold, Inc.'s incremental borrowing rate is 8% and the lessor's implicit rate is not known. If the PV factor from annuity table at 8%, 4 periods is 3.57710, what is the amount recorded for the leased asset at the lease inception? OA $430,190 OB $1,502,382 C. $420,000 D. $1,538,832.65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts